Both assets and liabilities stabilize, China Life's net profit in a single quarter exceeds last year's total

China Life Insurance expects a net profit attributable to shareholders of RMB 156.785-177.689 billion for the first three quarters, with a year-on-year growth rate of 50-70%, setting a new historical high. The net profit for the third quarter alone is projected to be RMB 115.854-136.758 billion, surpassing last year's total profit. The company focuses on value creation and efficiency improvement, with strong performance on the asset side, benefiting from the stabilization of the stock market and a significant increase in investment income. NCI and PICC P&C also released performance forecasts, indicating an overall improvement in the industry

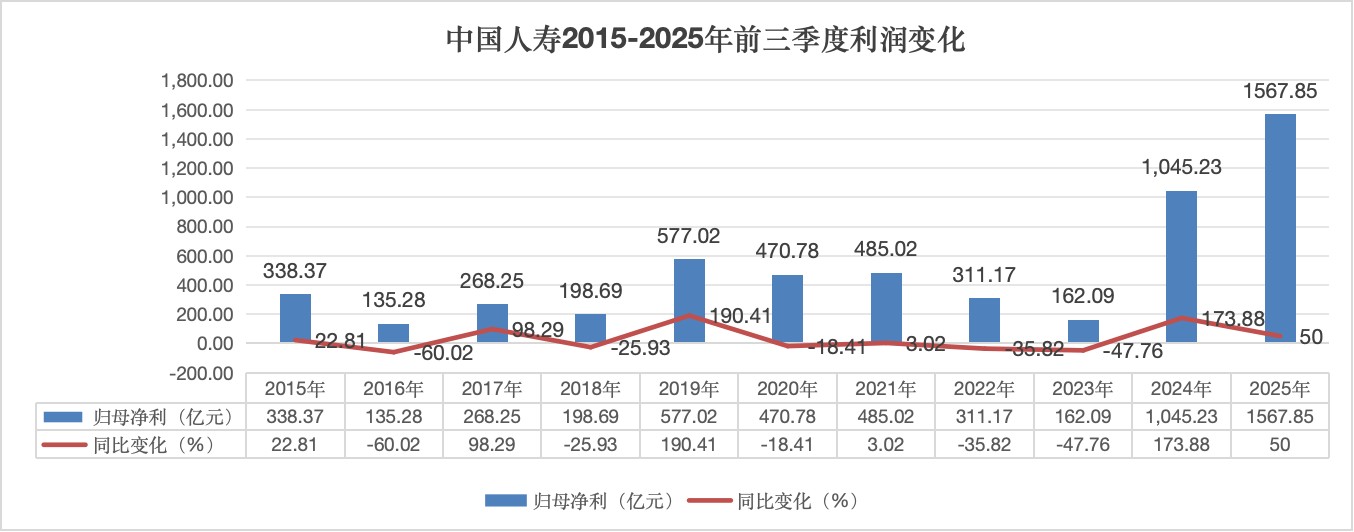

On October 19, China Life announced that it expects to achieve a net profit attributable to shareholders of RMB 156.785-177.689 billion for the first three quarters, with a year-on-year growth rate of 50-70%, achieving high growth on a high base.

Based on the performance over the past 10 years, China Life's net profit attributable to shareholders for the first three quarters is expected to set a historical record.

According to calculations by Xinfeng, in the third quarter alone, China Life's net profit attributable to shareholders should be in the range of RMB 115.854-136.758 billion;

Even at the lowest estimate of the profit range, China Life's profit for the third quarter this year has already surpassed the total profit for the entire last year.

In response to the high growth in performance, China Life stated that the company focuses on value creation and efficiency improvement, continuously deepening the linkage between assets and liabilities, and advancing product and business diversification, further enhancing sustainable development capabilities.

Breaking down the performance on both the asset and liability sides, it is expected that China Life's profit "surge" is mainly driven by the asset side:

On the liability side, China Life's total premium in the first half of the year reached the best level for the same period in history, but the year-on-year growth rate was only 7.3%;

The overall premium growth rate for the life insurance industry in the first eight months was only around 11%. Although it maintained rapid growth, there is still a significant gap compared to the more than 50% profit change.

On the asset side, China Life pointed out that since the beginning of this year, the stock market has stabilized and improved, and the company has seized market opportunities to decisively increase equity investments, proactively laying out in new productivity-related fields, and continuously optimizing the asset allocation structure, resulting in a significant year-on-year increase in investment income.

In the third quarter alone, the A-share ChiNext Index, STAR 50, Shenzhen Component Index, and Shanghai Composite Index rose by 50.4%, 49.02%, 29.25%, and 12.73%, respectively. It is expected that China Life's profit in the third quarter will largely depend on the stock market performance.

Data from peers further corroborate this speculation.

Not long ago, Xinhua Insurance and PICC Property and Casualty also released performance forecasts, with Xinhua Insurance expecting a year-on-year increase in net profit of 45-65% to RMB 29.986-34.122 billion, while PICC Property and Casualty's growth rate is expected to be between 40-60%.

Xinhua Insurance stated that the stabilization and improvement of China's capital market in the first three quarters allowed the company's investment income for the first three quarters of 2025 to continue to grow significantly year-on-year based on last year's high growth, resulting in a substantial increase in profit;

PICC Property and Casualty also stated that benefiting from the rise in the capital market in the first three quarters, the optimization of the allocation structure amplified the positive effects of the market rise, leading to a significant year-on-year increase in total investment income.

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk