RoboTaxi, is DiDi the biggest winner?

摩根大通報告指出,實現自動駕駛後,佔總交易額 75%-80% 的司機成本被剔除,整個出行市場或能多出約 50% 的利潤空間。儘管消費者因更低價格成為最大受益者,但擁有穩固網絡效應與市場主導地位的出行平台——尤其是滴滴,憑藉其需求聚合能力和議價權,有望成為這場變革中的贏家。

隨着自動駕駛出租車(RoboTaxi)時代臨近,一場圍繞萬億級出行市場新增利潤的分配大戲即將上演。誰將成為最大贏家?

據追風交易台消息,10 月 19 日一份來自摩根大通的最新研究報告指出,雖然消費者將通過更低廉的 “打車費” 成為這場變革的最大受益者,但憑藉穩固網絡效應和市場主導地位的出行平台運營商,尤其是滴滴,最有可能在價值重構中分得巨大利潤蛋糕。

這份報告將自動駕駛出租車產業鏈的未來圖景描繪成一場圍繞 “成本節約” 這塊巨大蛋糕的分配博弈。

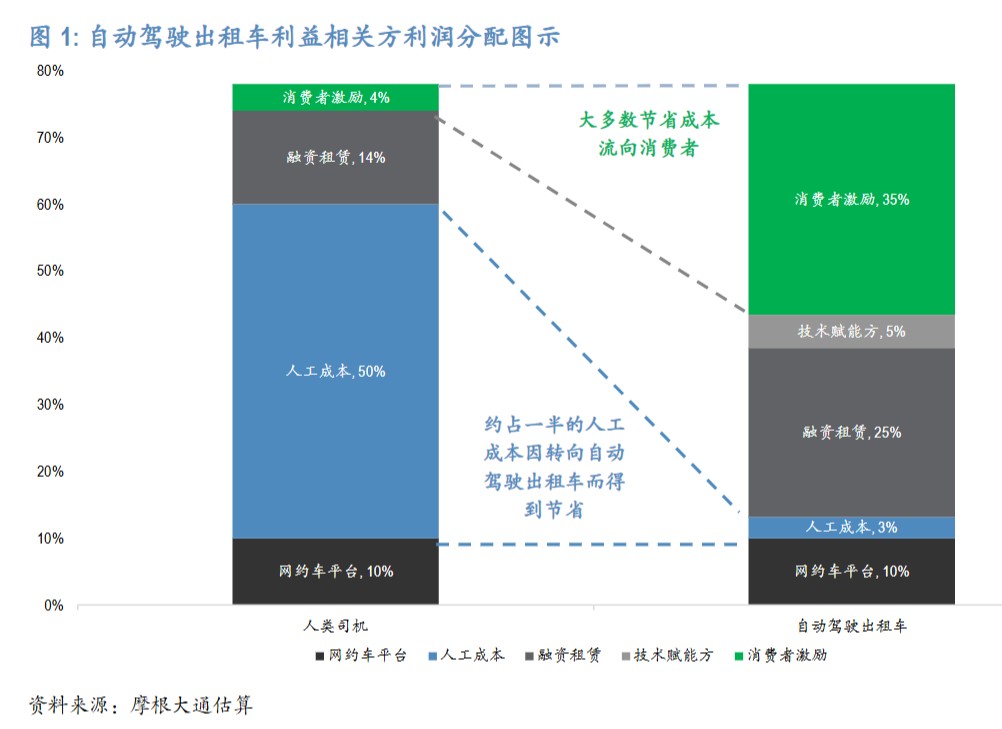

摩根大通明確指出,從傳統網約車轉向 RoboTaxi,核心變革在於取消了佔總交易額(GTV)高達 75-80% 的司機薪酬,即使扣除車輛折舊、技術和融資成本,仍能釋放出約 GTV 一半的經濟盈餘。

我們得出的結論是在共享出行中引進自動駕駛出租車可實現的成本節省將達到 GTV 的 50% 左右。

而從人工駕駛到自動駕駛的轉變所釋放的經濟盈餘,將在消費者、平台運營商、技術賦能方和出資方這四大關鍵利益相關者之間進行重新分配。

利益重構:誰在價值鏈中掌握話語權?

摩根大通的報告將 RoboTaxi 生態系統劃分為四個核心角色:

- 出行運營商(如滴滴): 負責聚合需求與網絡管理,掌握需求、品牌和網絡效應,擁有最強的議價能力。

- 消費者: 價格彈性的最終決定者,他們的接受度決定了市場擴張的速度。

- 技術賦能方(如百度、文遠知行): 提供自動駕駛軟硬件,但面臨 3-5 家主要供應商的激烈競爭,產品趨向商品化。

- 出資方(金融機構): 為昂貴的 RoboTaxi 車隊提供資金,其回報率受無風險利率和風險溢價影響。

報告認為,節省的成本中的大多數將用於降低費率,以激活消費者滲透率和出行頻率。“預計出行運營商將會把節約的絕大部分成本轉移給消費者,以提高滲透率。”

• 消費者剩餘:在達到 GTV 一半左右的節省成本中,我們預計大多數將用於降低費率,以激活滲透率和出行頻率。

• 出行運營商:通過業務量規模(更高的 GTV)、更好的利用率和增量變現(廣告、訂閲、優先匹配)捕獲價值。我們預測,即使最初幾年每單的單位利潤率處於保守水平,運營商的絕對利潤也將增長。

• 技術賦能方:約 5% 的穩態 GTV 份額;如果和車隊運營或專有邊緣硬件綁定則更高。

• 出資方:按當前利率,基於 9% 的內部回報率其租賃/資產證券化經濟效益相當於 GTV 的 25% 左右;隨着融資成本降低,資產週轉率提高以及殘值改善,其份額將縮小。

同時,報告認為,運營商的優勢源於其掌握的需求、品牌和由高利用率驅動的 “飛輪效應”。相比之下,技術和資本投入則趨向於商品化,多家合格的供應商將在價格、可靠性和安全性等指標上展開競爭。

滴滴的 “飛 - 輪”:降價換取 2 萬億 GTV 市場

面對 RoboTaxi 帶來的成本節約,滴滴站在了一個決定長期增長軌跡的十字路口。摩根大通在報告中提出了兩種截然不同的發展路徑。

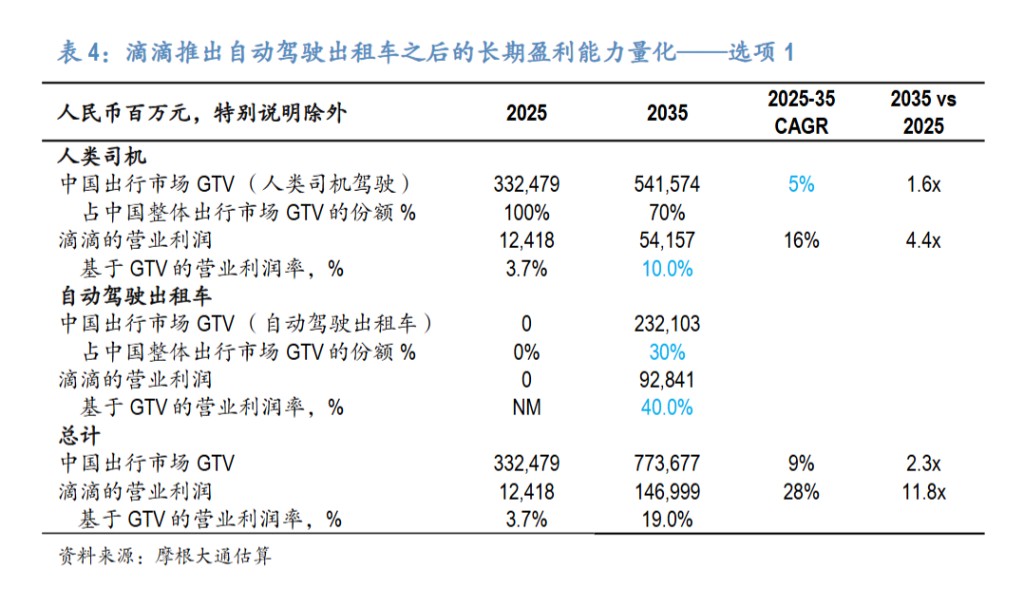

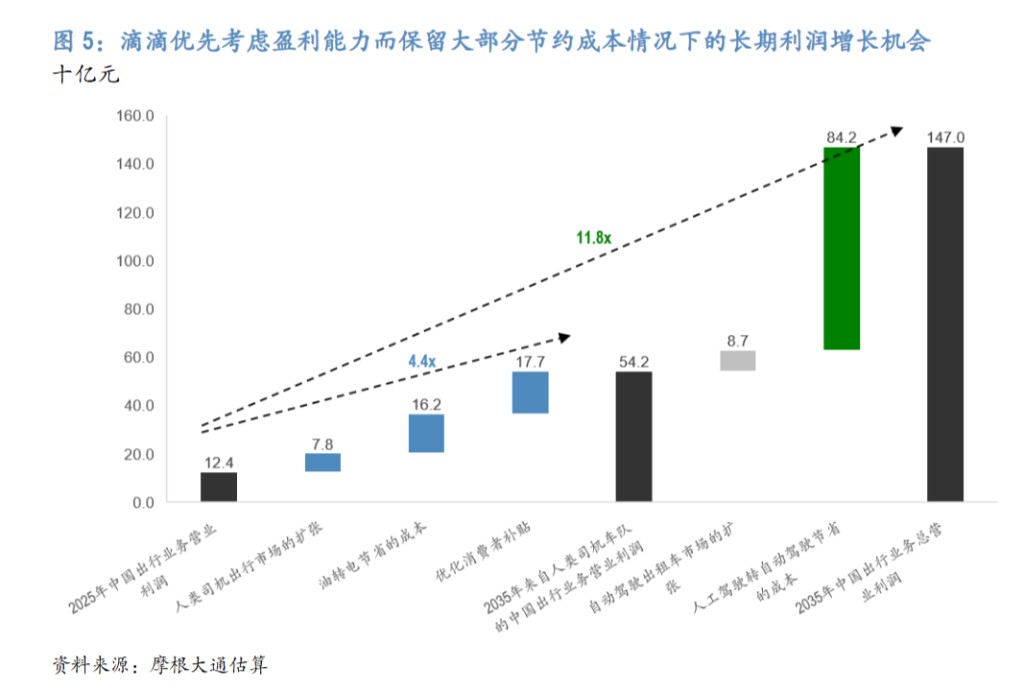

第一種是優先提升盈利能力,即將大部分節約的成本保留在公司內部。報告估算,在此情景下,滴滴的 GTV 利潤率可大幅提升,但市場只能實現約 9% 的年均複合增長,到 2035 年其中國出行 GTV 約為 7737 億元。

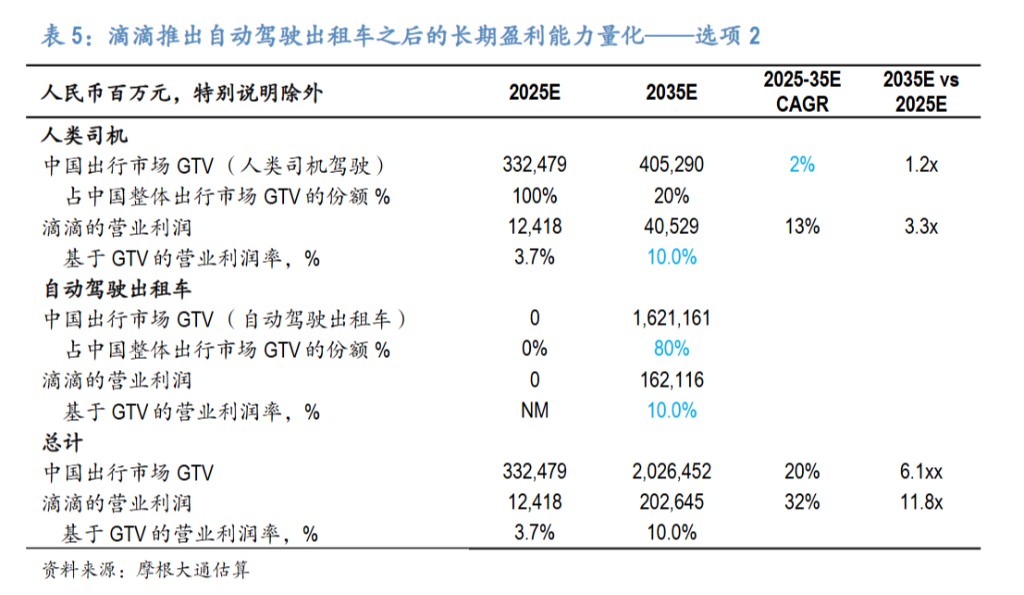

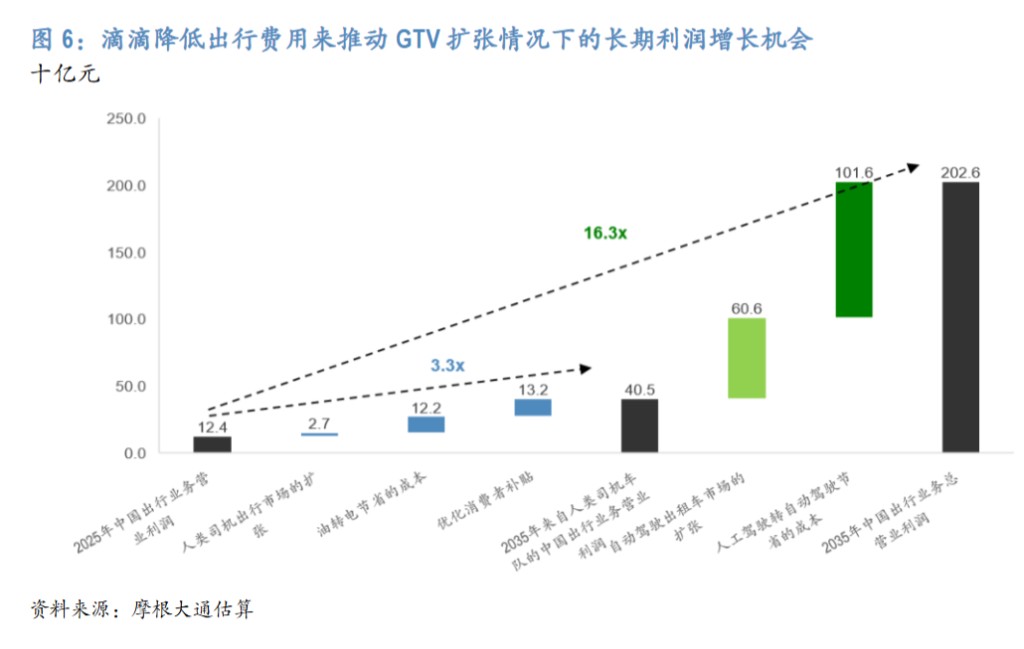

然而,報告更傾向於第二種選擇:將大部分成本節約轉移給消費者,通過降低出行費用來推動 GTV 的爆發式增長。報告將此與電信行業的發展類比:數據流量資費的下降曾引爆了互聯網使用量的激增。同樣,按需出行成本的降低也可能極大刺激網約車需求。

根據報告測算,若採取該策略,共享出行市場的年均複合增長率有望達到20%。

這將創造一個強大的 “飛輪效應”:價格下降驅動需求上升,從而改善車輛匹配效率和利用率,進而支持更密集的供應網絡,最終結構性地降低服務成本。在此路徑下,滴滴的中國出行 GTV 有望在 2035 年達到約 2.03 萬億元人民幣。儘管單均利潤率較低,但總量的巨大增長將帶來更為可觀的絕對利潤。

技術與資本:分食蛋糕的配角

雖然運營商是主角,但技術賦能方和出資方同樣是產業鏈中不可或缺的環節,他們也將分享 RoboTaxi 帶來的經濟紅利,但所佔份額相對有限。

對於技術賦能方,報告預計其在穩態下將獲得約 5% 的 GTV 份額。中國的自動駕駛技術領域競爭激烈,預計將形成 3-5 家主要供應商(如百度、小馬智行、文遠知行等)就成本和可靠性展開競爭的格局。

報告指出,由於作為純技術供應商的經濟效益有限,大多數技術公司預計將通過垂直整合進入運營商角色,以獲取更高的分成。百度的 “蘿蔔快跑” 業務便是這一策略的例證。

對於出資方,由於 RoboTaxi 屬於資本密集型業務,多數運營商將依賴第三方融資租賃或資產證券化。

報告基於中國當前的利率環境估算,出資方為達到約 9% 的內部回報率(IRR)目標,可能要求獲得相當於 GTV 約 25% 的份額。隨着未來融資成本降低和資產週轉率提高,這一比例預計將會縮小。

風險與變數:通往未來的顛簸之路

儘管前景廣闊,但通往 RoboTaxi 大規模商業化的道路並非坦途。摩根大通的報告也指出了幾個關鍵的風險和不確定性因素,這些因素將直接影響行業發展的節奏和最終格局。

首先是監管節奏。服務區域擴大的速度是影響車輛利用率和投資回報的最大單一變量。各城市商業化運營政策的推進速度,將是決定 RoboTaxi 能否快速規模化的關鍵。

其次是成本曲線與安全性。將 RoboTaxi 車輛的製造成本控制在 25 萬元人民幣及以下,對實現可觀的總擁有成本至關重要。同時,任何安全方面的挫折都可能延緩技術的普及和滲透。

最後是競爭行為。隨着技術供應商紛紛進行垂直整合,出行市場的競爭格局可能被重塑。運營商之間的整合或合作(報告中以 Waymo 與優步的合作為例)將值得密切關注,這可能會改變未來的議價能力平衡。

~~~~~~~~~~~~~~~~~~~~~~~~

以上精彩內容來自追風交易台。

更詳細的解讀,包括實時解讀、一線研究等內容,請加入【追風交易台▪年度會員】