From the cryptocurrency world to Wall Street, is "prediction markets" becoming mainstream?

随着纽交所母公司等华尔街巨头携巨资入局,以及芝加哥商品交易所(CME)等传统金融基础设施计划亲自下场,曾被视为加密货币圈内小众实验的预测市场,正以前所未有的速度迈向主流金融世界。

曾被视为加密货币圈内小众实验的预测市场,正以前所未有的速度迈向主流金融世界。

最新的动作来自全球最大的衍生品交易所。据彭博报道,芝加哥商品交易所(CME Group Inc.)正计划在今年年底前,推出与体育赛事和经济指标挂钩的金融合约。此举将使 CME 与 Polymarket 和 Kalshi 等新兴预测市场平台展开直接竞争。

这一举动引发了市场的直接反应。消息披露后,与 CME 合作的体育预测公司 FanDuel 的竞争对手 DraftKings Inc.股价在盘后交易中一度下跌 3.8%,而 CME 股价则应声上涨。此前,加密预测市场平台 Polymarket 刚刚获得了纽交所母公司洲际交易所(Intercontinental Exchange Inc.)20 亿美元的投资。

从亚文化动画片《南方公园》的调侃,到纽约街头的实时赔率大屏,再到华尔街顶级机构的战略布局,预测市场正从一个边缘化的金融工具,迅速演变为一个融合了文化、金融和信息的新兴赛道。其能否真正成为第一个被大规模采用的去中心化金融(DeFi)应用,正成为市场关注的焦点。

“正规军” 入场,传统交易所布局

传统金融巨头的入场,是预测市场走向主流化的最明确指标。

根据媒体报道,CME 计划通过其期货佣金商(FCM)向公众发布其新的预测合约产品,其中包括与体育预测平台 FanDuel 合作设立的机构。

CME 与 FanDuel 的合作于今年早些时候宣布,当时主要聚焦于与经济指标挂钩的产品。但 CME 首席执行官 Terry Duffy 在 8 月接受彭博采访时曾明确表示,他对上线体育类合约持开放态度,并称 “在运营上第一天就准备好了”。

CME 的优势在于其监管地位。作为受美国商品期货交易委员会(CFTC)监管的交易所,CME 有权在未经监管机构明确批准的情况下 “自我认证” 新合约,这可能使其能够迅速推进新产品的上线。这一系列举动表明,传统交易所不再仅仅是旁观者,而是准备成为这个新兴市场中的核心玩家。

新兴平台崛起,数据彰显热度

在传统巨头入局之前,以 Polymarket 和 Kalshi 为代表的新兴平台早已凭借其创新模式和市场热点,积累了可观的用户基础和交易量。

Polymarket 是一个基于加密货币的平台,允许用户使用稳定币对选举、体育赛事等真实世界事件的结果进行押注。该平台在 2024 年美国总统大选期间声名鹊起,活跃度和交易量均创下历史新高。

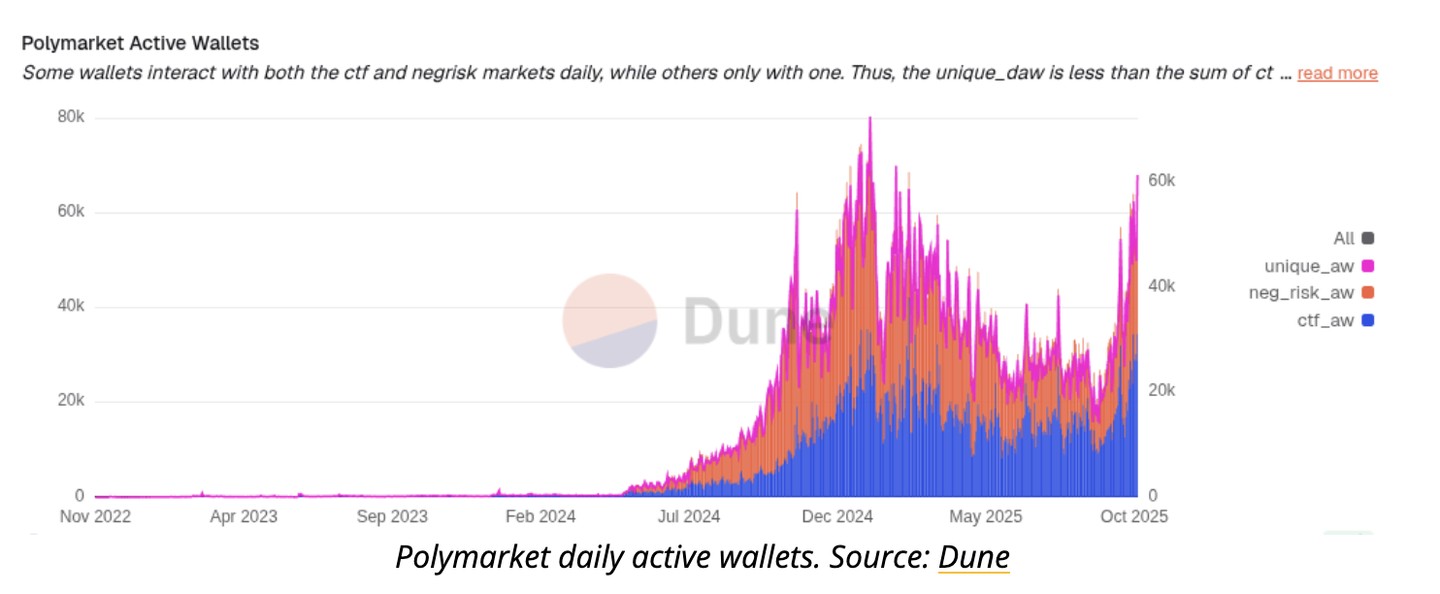

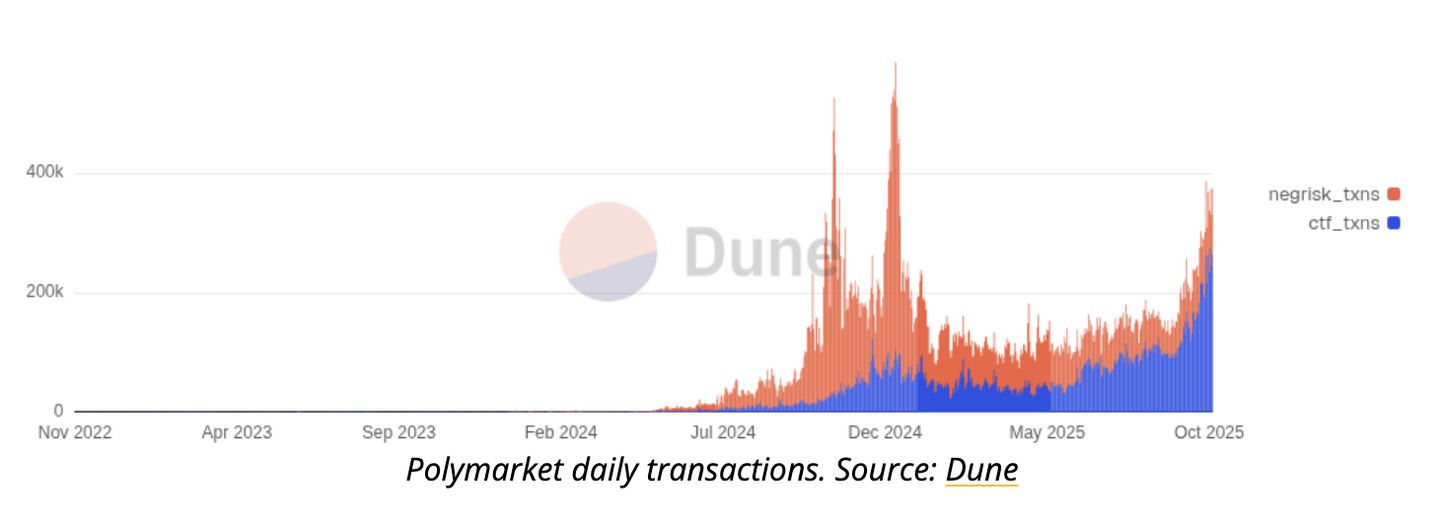

Dune 数据显示,其日活跃钱包数在 2025 年 1 月 19 日达到超过 72600 个的峰值。尽管此后有所回落,平台活跃度依然强劲,本月处理的交易量已超过 10 亿美元,累计交易总额突破 157 亿美元。

另一家平台 Kalshi 则走了合规路线,是美国首家受 CFTC 联邦监管的事件合约交易所。

近期,Kalshi 因其在纽约市展示的市长选举赔率实时屏幕而在社交媒体上走红,相关视频在 X 平台上的观看量接近 1300 万次。该平台甚至出现在了知名动画片《南方公园》中,其文化影响力可见一斑。这些平台通过捕捉公众对热点事件的关注,成功将预测市场推向了更广泛的视野。

资本加持与监管博弈

资本的涌入与监管的突破,共同为预测市场的主流化铺平了道路。最引人注目的交易之一是,纽交所母公司洲际交易所宣布斥资 20 亿美元,收购加密预测市场 Polymarket 25% 的股份。尽管 Polymarket 目前尚未对美国用户开放,但它在今年早些时候收购了一家受 CFTC 监管的交易所,并计划在美国推出业务,其估值可能高达 100 亿美元。

监管方面,Kalshi 去年在与 CFTC 的法庭诉讼中获胜,为其在美国境内提供总统大选相关的投注合约扫清了障碍。此后,Kalshi 等公司开始利用其联邦金融牌照在全美范围内提供体育博彩相关服务,尽管此举仍面临部分州博彩监管机构的阻力和关于市场操纵等问题的法律不确定性。

然而,监管环境依然复杂。例如,一些州的博彩监管机构已表示,不允许其监管下的博彩公司同时提供受联邦监管的事件合约。FanDuel 的发言人也谨慎表态,称公司在与 CME 合作开发产品的过程中,正 “与包括州监管机构在内的各方利益相关者保持积极对话”。

“简洁性” 或成大规模采用关键

预测市场为何能在此刻吸引如此多的关注?Azuro 的基础设施研究员 Mike Rychko 认为,关键在于其无与伦比的 “简洁性”。他指出,预测市场将复杂的概率预测转化为简单直观的数据点,例如 “某候选人有 87% 的获胜机会”,这种语言是任何人都能理解的。

“大多数人永远不会去开一个衍生品交易所的账户,” Rychko 写道,“但他们渴望一个干净、易于理解的信号。” 他认为,正是这种直观性,使得预测市场相比其他复杂的 DeFi 产品,更有可能率先实现大规模采用。

从数据来看,这种吸引力显而易见。根据 DefiLlama 的数据,尽管 Polymarket 的总锁仓价值(TVL)已从美国大选期间近 5.12 亿美元的高点回落至约 1.94 亿美元,但与一年前的 800 万美元相比,仍增长了 2325%。这种将文化相关性与真实世界金融参与相结合的模式,正在证明其强大的市场生命力,并可能最终引领一波新的金融产品浪潮。