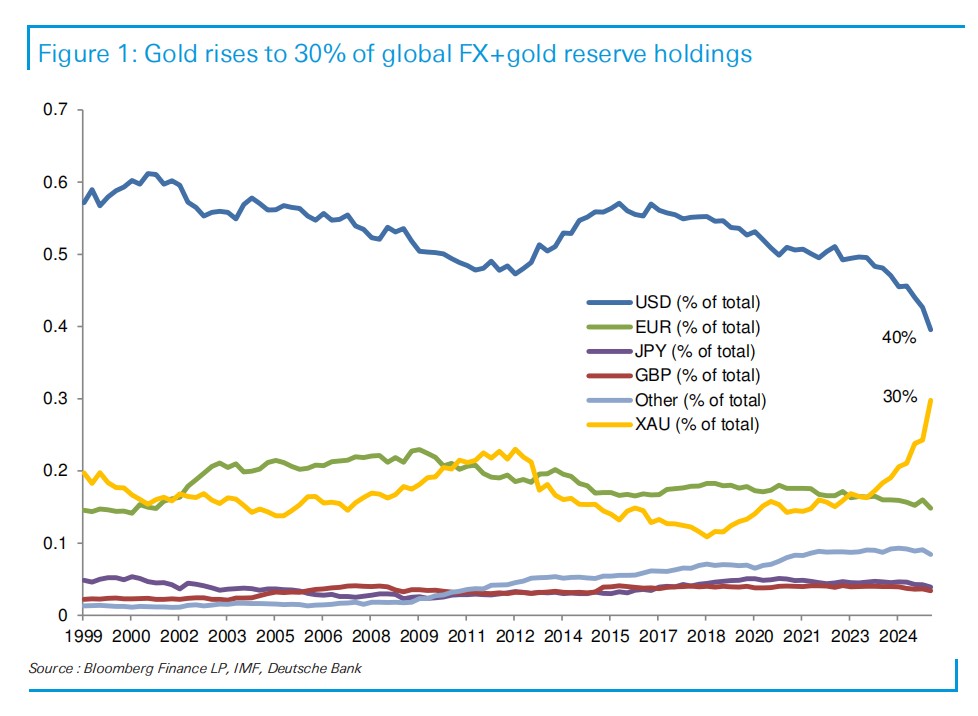

The proportion of gold in global "foreign exchange gold reserves" has risen to 30%. If it is to catch up with the US dollar, the gold price needs to rise to $5,790

According to Deutsche Bank, the share of gold in global central banks' "foreign exchange + gold" reserves has rapidly increased from 24% at the end of June this year to the current 30%. During the same period, the share of the US dollar has decreased from 43% to 40%. To match the dollar's share, the price of gold would need to rise to USD 5,790 per ounce, assuming the current holdings remain unchanged

In the landscape of global reserve assets, the status of gold is undergoing significant changes.

According to news from the Chasing Wind Trading Desk, Deutsche Bank's latest research shows that gold's share in global "foreign exchange + gold" reserves has risen to 30%. To match the dollar's share, the gold price would need to rise to $5,790 per ounce, assuming current holdings remain unchanged. This calculation provides a new theoretical perspective for the market to understand the long-term value of gold.

The core driving force behind the rise in gold reserves is the strong willingness of global central banks to increase their holdings. A previous survey by the World Gold Council indicated that the vast majority of reserve managers expect the global central bank's gold holdings to continue to increase. This trend has not only been a significant driver of rising gold prices in recent years but also suggests that future demand for gold will remain strong.

If it matches the dollar's share, gold price needs to rise to $5,790

According to a report released by Deutsche Bank analyst Michael Hsueh on October 17, the share of gold in global central bank "foreign exchange + gold" reserves has rapidly increased from 24% at the end of June this year to the current 30%. During the same period, the dollar's share has decreased from 43% to 40%. This dynamic reflects the increasing attractiveness of gold as a reserve asset, while the dollar's dominance has relatively weakened.

The report further proposes a price projection: if gold is to share equal footing with the dollar in the aforementioned reserve category, its price would need to reach $5,790 per ounce. In this scenario, assuming central bank gold holdings remain unchanged, gold and the dollar would each occupy 36% of global "foreign exchange + gold" reserves.

Deutsche Bank's analysis particularly emphasizes that its research focuses on gold's share in "foreign exchange plus gold" reserves, rather than its share in total central bank assets. The report argues that this is a more relevant analytical dimension, as "foreign exchange plus gold" reserves are the assets that central banks can utilize to defend their national currencies, denominated in foreign currencies.

The global central banks' preference for gold has not diminished due to rising prices; rather, it has become even stronger. Deutsche Bank cites a survey conducted by the World Gold Council from February 25 to May 20 this year, which found that the proportion of central banks planning to increase their gold reserves has risen from 29% last year to 43%.

More critically, market managers' judgments about the overall trend are also highly consistent. The survey found that as many as 95% of the reserve managers surveyed expect the total gold holdings of global central banks to increase in the next 12 months, a proportion significantly higher than last year's 81%