The "ultimate solution" for powering AI? A detailed explanation of SMR (Small Modular Reactor technology)

摩根大通認為,為滿足 AI 和數據中心激增的電力需求,SMR(小型模塊化核反應堆)被視為關鍵解決方案。其核心優勢在於小型化、模塊化設計,可靈活部署等。儘管部分項目已獲許可,但商業化仍面臨技術路線競爭激烈、供應鏈瓶頸(尤其是 HALEU 燃料)、監管及經濟性待驗證等多重挑戰。

本文作者:董靜

來源:硬 AI

在全球電力需求加速增長的背景下,小型模塊化核反應堆(SMR)正成為滿足數據中心、工業製造和電氣化需求的關鍵解決方案。

10 月 18 日,摩根大通在最新研報中認為,這項技術通過設計簡化、標準化和工廠製造,試圖突破傳統大型核電站的經濟和建設瓶頸,為清潔基荷電力供應開闢新路徑。

摩根大通稱,全球目前有 99 座 SMR 處於積極開發階段,但僅有 7 座在建或運營。氣冷和水冷 SMR 概念在近期部署中處於領先地位。國際能源署(IEA)預計,若部署順利,到 2040 年 SMR 可佔全球核電裝機的 10%,美國將貢獻其中 20% 的增長。

研報指出,特朗普政府的行政命令為 SMR 發展注入強勁動力。新政策將民用核能列為國家和經濟安全優先事項,要求聯邦機構加速先進反應堆部署,簡化監管審查,並開放政府燃料儲備。監管改革將許可審查時間壓縮至 18 個月,目標在 2026 年 7 月前實現三座先進反應堆投運,同時擴大投資和生產税收抵免,顯著改善項目經濟性並降低許可風險。

然而,摩根大通認為,SMR 的成功部署仍依賴政府支持、技術迭代、供應鏈建設和監管許可等多重因素。接下來,我們通過摩根大通研報,詳細解析下可能成為 AI 電力供應終極方案的 SMR 技術。

SMR 技術核心優勢與市場定位

研報稱,SMR 通過五大核心特徵重新定義核能應用場景:

小型化設計使其可靈活部署在多種場所;模塊化建造支持現場組裝以降低成本;可實現離網和併網雙重安裝模式;燃料循環週期長達 30 年;內置被動冷卻機制以簡化設計並降低成本。

據核能署(NEA)數據,SMR 開發商總部主要集中在美國、加拿大和歐洲地區。按反應堆概念分類,近期市場以水冷反應堆為主導,佔據最大份額,其次是氣冷和熔鹽冷卻設計。從場地所有者角度看,公用事業公司、工業用户和政府機構是主要客户羣體,數據中心需求正快速增長。

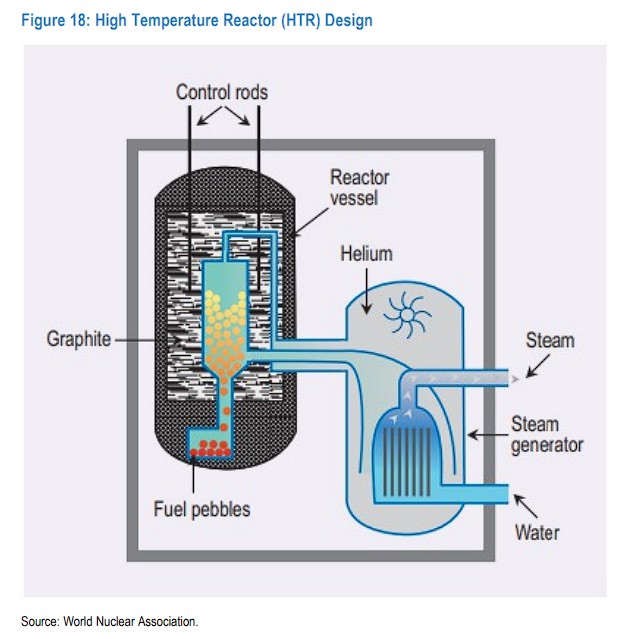

SMR 的獨特價值在於滿足多元化能源需求。高温氣冷堆可提供 750 攝氏度以上的工藝熱,適用於氫氣生產、區域供暖和工業應用等傳統大型反應堆難以覆蓋的市場。快中子譜 SMR 設計雖然許可進展有限,但在燃料效率和成本控制方面具有顯著技術優勢,涵蓋氣冷、熱管、金屬冷卻和熔鹽冷卻等多種概念。

主要技術路線與開發進展

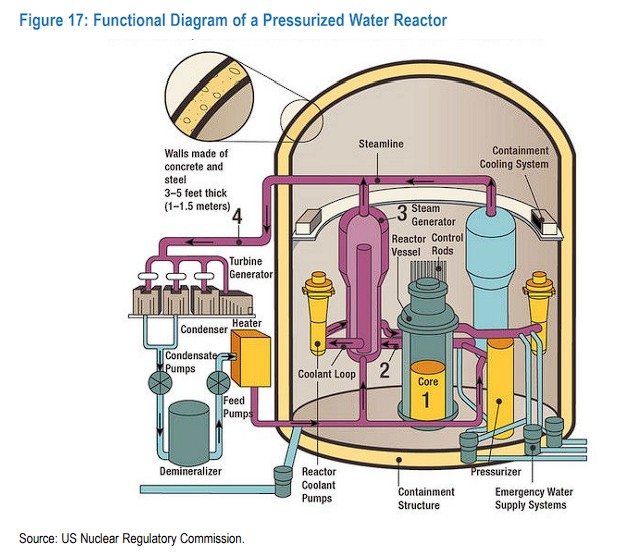

SMR 技術按冷卻劑類型分為五大概念:水冷、熔鹽冷卻、氣冷、熱管冷卻和金屬冷卻。水冷反應堆代表大多數近期概念,其中輕水堆(LWR)最接近近期部署。熱管和金屬冷卻反應堆代表更前沿的技術發展方向。

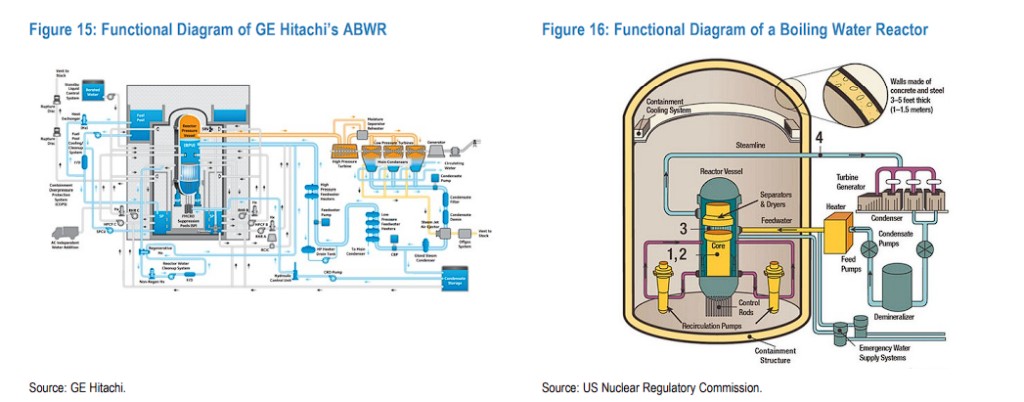

輕水反應堆採用成熟技術,包括沸水堆(BWR)和壓水堆(PWR)兩種類型。NuScale 的 50 兆瓦和 77 兆瓦壓水堆設計是唯一獲得美國核管理委員會(NRC)標準設計批准的 SMR,在監管進程中處於領先地位。GE 日立核能的 BWRX-300 沸水堆已獲田納西河谷管理局(TVA)提交建造許可申請,成為美國首個提交 SMR 建造許可的公用事業公司。

高温氣冷堆(HTGR)使用氦氣作為冷卻劑,陶瓷塗層燃料可產生約 750 攝氏度的高温。X-Energy 的 Xe-100(80 兆瓦)、Ultra Safe Nuclear 的 MMR(5 兆瓦)和 Radiant 的 1 兆瓦設計代表該領域主要開發商。這類反應堆在工業應用中表現出色,但受限於高丰度低濃鈾(HALEU)燃料供應短缺。

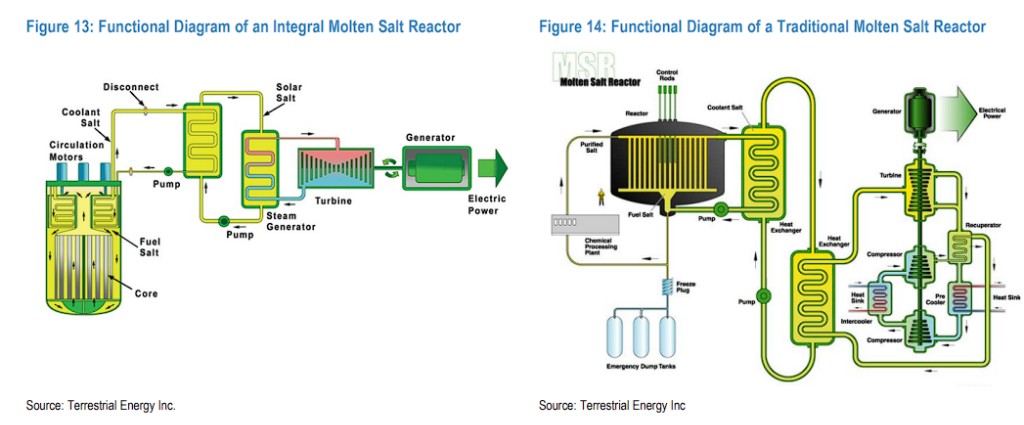

熔鹽反應堆(MSR)使用氟化鹽混合物作為燃料和冷卻劑,可在高温下運行並實現高效傳熱。Kairos Power 的 140 兆瓦 FHR、Natura Resources 的 MSR-100、Terrestrial Energy 的 195 兆瓦整體熔鹽堆和 TerraPower 的 345 兆瓦熱功率反應堆代表該技術方向。Kairos 已獲得 NRC 建造許可,成為美國首家獲得第四代 SMR 建造許可的公司。

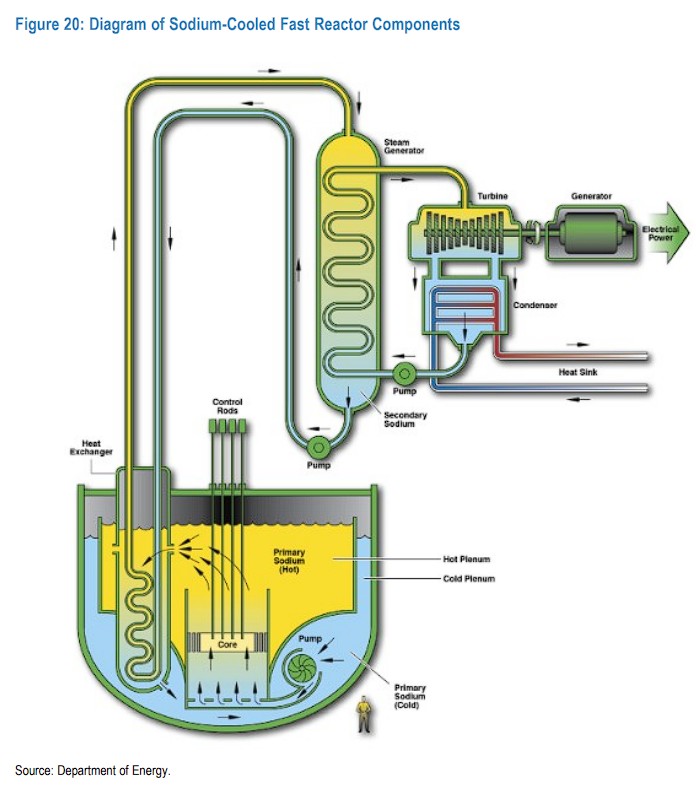

鈉冷快堆(SFR)使用液態鈉作為冷卻劑,在快中子譜下運行,可實現燃料再利用並減少核廢料。Arc 的 ARC-100(100 兆瓦)、Oklo 的 Aurora-INL(75 兆瓦)和 TerraPower 的 Natrium(345 兆瓦)是主要開發項目。TerraPower 的 Natrium 項目預計 2032 年投運。

熱管微堆使用熱管實現高導熱率,有效傳熱率在 5000 至 200000 瓦/米之間。Westinghouse 的 eVinci 微堆(5MW)、Oklo 的 Aurora Powerhouse、Antares Nuclear 的 R1 微堆和 Radiant Industries 的 Kaleidos 微堆(1.2MW)正在開發中。

監管環境與部署時間表

摩根大通稱,美國核電站必須經過 NRC 的安全、環境和反壟斷審查,獲得早期場地許可、設計許可、建造許可和運營許可。傳統的 Part 50 路徑採用分步許可流程,先獲建造許可再申請運營許可。1989 年引入的 Part 52 路徑允許申請人在滿足特定條件時獲得建造和運營的聯合許可(COL),降低違約風險並提高確定性。

特朗普政府的監管改革顯著加速審批流程。行政命令要求能源部和 NRC 設定 18 個月的審查窗口,並在成功完成預申請階段後,部分新設計可能在 12 個月內完成審批。NRC 的聯合許可方式通過僅審查新提交與已批准設計之間的"增量",進一步縮短審批時間。

據摩根大通研報稱,目前,NuScale 的 50MW 和 77MW 輕水壓水堆是唯一獲得 NRC 標準設計認證的 SMR 設計。

Kairos Power 於 2023 年 12 月獲得第四代 SMR 建造許可,2024 年 7 月開工,目標 2027 年投運。

TVA 成為首家提交 GE Vernova 日立 BWRX-300 SMR 技術建造許可申請的美國公用事業公司。

大多數競爭對手仍處於預申請或預設計許可申請階段。

數據中心電力需求激增創造市場機遇

摩根大通認為,超大規模雲服務商(亞馬遜、谷歌、Meta)可能為 SMR 項目提供直接支持,以滿足清潔能源數據中心需求。谷歌已與 Kairos Power 簽約,確保 2030 年前實現 SMR 上線,到 2035 年達到 500 兆瓦裝機。

能源部將鈉冷快堆、高温反應堆和熔鹽反應堆列入 2030 年部署觀察名單。世界核協會追蹤的 25 個 SMR 項目處於預投資、合作協議、項目關聯、最終投資決定或在建階段。Kairos Power 的 Hermes 熔鹽冷卻反應堆是唯一處於"在建"階段的項目。

NuScale、Oklo、Westinghouse、TerraPower 和 X-Energy 是最活躍的開發商。這些公司通過與大型公用事業公司、工業用户和政府機構合作,推進項目融資和場地選擇。部分項目已獲得美國能源部的貸款批准和技術投資協議支持。

商業化仍面臨多重挑戰

摩根大通指出,技術路線眾多導致競爭激烈,可能阻礙任何單一技術達到商業臨界規模。監管框架雖在演進,但往往滯後於 SMR 技術的多樣性和新穎性,特別是非水冷和先進設計面臨許可不確定性和延遲。

供應鏈準備不均衡構成重大瓶頸。許多新型燃料形式和反應堆部件尚未實現商業規模生產。HALEU 燃料供應有限對許多先進 SMR 概念構成重大障礙。據核能研究所(NEI)預測,北美 HALEU 需求將快速增長,但供應能力建設需要時間。

經濟可行性仍待驗證。儘管 SMR 通過工廠製造和模塊化設計尋求經濟優勢,但首堆成本和規模經濟效應仍是關鍵考驗。BloombergNEF 的分析顯示,不同開發商在融資、監管、項目和時間表四個維度的進展差異顯著。NuScale 在監管批准方面領先,X-Energy 和 Oklo 在項目管道和客户數量上表現突出。

國際合作對加速 SMR 採用和可擴展性至關重要。目前全球 SMR 項目主要集中在北美,加拿大和美國共有超過 30 個處於不同開發階段的項目。安大略電力公司與 GE 日立合作的達靈頓核設施 1.2 吉瓦項目計劃 2029 年投運,將成為西方世界首個落地的 SMR 項目。