Fu Peng's Latest Market Observation: Observations and Strategic Thoughts on Stocks, Bonds, Gold, and VIX Against the Background of Upgraded Market Game Theory [Fu Peng's Article]

付鵬最新市場觀察指出,市場博弈升級,股債、黃金、VIX 的策略應對需關注。華爾街對美股 AI 泡沫的分歧加劇,市場情緒緊繃,波動受基本面與情緒因素影響。特朗普重啓對華貿易戰,關税大幅提高,全球經濟脆弱休戰狀態被打破。市場反應與 4 月有所不同,儘管廣度不及,但中美兩國的影響力深遠。

- 《付鵬説·第六季》全面升級!立即訂閲

今年是華爾街見聞《付鵬説》年度專欄的第十個年頭!

《付鵬説第六季》正式上新!第六季將會做全面升級,在日常視頻的基礎上,新增付鵬老師文章的筆記,圖表解讀。

除此之外,課代表也講給大家新建一個購買用户的專屬社羣,除了付鵬説日常內容,還會給大家發送每日交易關注早報,和值得關注的研究報告,推薦電子閲讀書單,延展閲讀資料,大家也可以社羣中多提問交流,一起共同進步。加入專欄的用户請掃碼下圖添加小助手進入《付鵬説》專屬交流羣。

市場博弈升級背景下,策略如何應對?

正如之前內容所述,當前華爾街對美股 AI 泡沫的分歧持續發酵,市場情緒自 9 月以來始終高度緊繃:無論人工智能板塊估值是否高企、基本面前景是否星辰大海,這些都不是核心矛盾——市場波動不僅源於基本面,更摻雜着濃厚情緒因素。任何風吹草動,無論是負面政策突襲、量化交易的過度抱團,還是擁擠頭寸的連鎖反應,都可能迅速引爆類似去年的美股 “爆金幣” 行情。

剛發出預警,誰料這隻黑天鵝來得如此之快:特朗普重啓對華貿易戰,宣佈大幅提高關税以報復中國限制關鍵礦產出口,終結了全球兩大經濟體間脆弱的休戰狀態。中國輸美商品將面臨 100% 關税,11 月 1 日起更將對 “任何關鍵軟件” 實施新出口管制——此時距離現有關税減免措施到期,僅剩九天。

4 月德州牌局開場後,隨着選手陸續棄牌,對手越來越少。眾人原以為只剩 9 天就能塵埃落定,將和牌希望寄託於中美,卻迅速崩塌。誠然,與 4 月相比其廣度或許不及,但中美皆為重量級玩家,手握重牌與巨量籌碼,其影響的深度更甚,垂直度更為集中。

市場的反應和 4 月份會有一定的差異性,這個差異性也是如此,廣泛度沒有 4 月份波及全球很多國家那樣的廣度,但是在中美掰手腕誰也不一定服輸的情況下,這個擔憂的時間維度和深度可能會更廣泛一些。

稀土在人工智能產業鏈中至關重要,支持 AI 硬件基礎設施構建,提升計算效率和數據處理能力。稀土元素的獨特特性(磁性、電學、光學和電化學)使其用於 AI 電子組件,實現小型化高性能設備,支持 AI 算法訓練、推理和部署。

市場的邏輯極為直接,因為稀土在人工智能產業鏈中至關重要,而中國則憑藉現有產業鏈優勢,強化從開採到分離的全鏈條主導權,短期一定是可以制約美國,勢必拖累美國 AI 發展進程——這一時機恰到好處,正值美國加速推進 AI 產業佈局的關鍵窗口期。巨大的資本投入與預期落差使市場異常敏感脆弱,此時的衝擊必然放大波動幅度。資本市場劇烈震盪的根源即在於此:投資者對供應鏈安全的憂慮急劇攀升,資本被迫重新評估技術迭代的時間表與成本邊界,地緣政治風險溢價被深度納入產業鏈定價邏輯之中。

稀土舉足輕重,卻非萬能鑰匙。此舉雖未直接阻斷美國 AI 發展路徑,卻能有效擾亂其發展節奏,迫使對手在成本攀升與供應鏈重構中消磨戰略定力,從而為中國贏得技術追趕與反制佈局的關鍵窗口期。這場博弈的核心價值在於贏得時間——為中國技術升級搶佔戰略機遇。通過精準佈局,中國在高端分離與材料製備領域構築壁壘,使外部勢力在高性能磁材、精密器件等環節短期內難以擺脱依賴困境。這場角逐本質上是時間的賽跑:一方着力延緩對手步伐,另一方則全力突破封鎖,此消彼長間競奪發展先機。

長期去看其他國家一定加速出於國家安全的目的尋求關鍵礦產自主可控的路徑,推動本土開採與回收技術突破,同時重構全球供應鏈佈局。這種戰略調整不僅限於美國,歐洲、日韓亦將加快建立稀土儲備體系與替代渠道,促使資源民族主義進一步抬頭。全球供應鏈的裂隙正加速演變為結構性重組。

從稀土牌到 AI 產業鏈以及 AI 相關的所有資產,就是最最直接的市場博弈出牌影響的關鍵,當然這張牌對於美國 AI 產業構成顯著短期壓制,尤其在高性能計算芯片與智能終端製造環節的原材料供給上形成制約,從而影響 AI 硬件升級節奏。

但這並不是直接摧毀美國人工智能產業鏈,這樣的摧毀用詞可能並不準確,應該説這張牌會影響的是 “時間 - 延後了” 和 “節奏 - 沒那麼快了”,而不是 “他不能了,被摧毀了”。

但這足夠讓美國的金融市場反應非常劇烈了,因為市場對不確定性的定價從來都是放大恐懼而非理性評估。並且由於前面 AI 投資狂熱的浪潮背景下資本已提前透支未來數年的增長預期,任何技術推進的遲滯都會被視作信任危機的導火索,這讓市場波動率足夠的放大的;

以前我講過在我的體系中 BTC 我是當做 AI 綜合指數來使用的,隨美股的 AI 股大幅受到了衝擊,BTC 亦未能倖免於這場系統性調整,價格也大幅度下挫,其實 12000 的價格已經如同大家形容美股 AI 的估值貴一樣,都處在那個臨界點的邊緣,市場的脆弱度很高,一旦預期逆轉,流動性便迅速撤離,風險資產首當其衝。BTC 的下跌並非孤立事件,而是 AI 產業鏈信心鬆動在金融端的映射。市場從追逐增長轉向規避不確定性,高估值資產集體承壓。這種聯動性凸顯了當前科技與資本深度綁定下的脆弱平衡。

並且我們看到隨着 NEW MONEY 資產中的錨 BTC 和 ETH 的波動率飆升,更為廣泛金融化槓桿程度更高的其他各種 “幣”,其本質就是更為高的 new money 人羣的 50 倍,100 倍的波動率,甚至過高的槓桿在極端行情中瞬間爆破,NEW MONEY 出現了巨大的流動性問題,連鎖清算與流動性枯竭,這種高槓杆的脆弱性在波動加劇的環境下被無限放大;

澳元和原油的下跌肯定是反應這種激烈的背景下可能會帶來的需求的衝擊,市場對全球供應鏈重構的隱憂正迅速轉化為對增長前景的悲觀預期。

但這次和 4 月份不同的是,隔壁的日本,歐洲都已經下桌子,站在後面看,當然這場博弈的輸贏或許真的非常的重要了,因為這些下了桌子的,要麼看到川普贏了,那就為自己的棄牌竊竊自喜,要麼看到川普輸了,那有可能這些棄牌的會迅速的轉為牆頭草。

匯率上其實目前反映的還並不劇烈的原因也是如此,之前講過,中美的市場博弈是兩者之間的絕對最直接的(美國股市,中國需求)反映,而匯率則是對歐元對日元的相對,這兩個下了桌子的,雖然日元有避險的推動,但同樣高市的不確定性(自民黨的聯盟夥伴公明黨退出與自民黨的聯盟)也使得日元在 155 需要時間,而歐元目前受到其所在地區政治和財政的影響,最終還是使得美元指數還是實現了 1.66% 的周漲幅,這是自 2024 年 9 月以來的最大周線漲幅,這就是相對的資產,而不是絕對的資產。

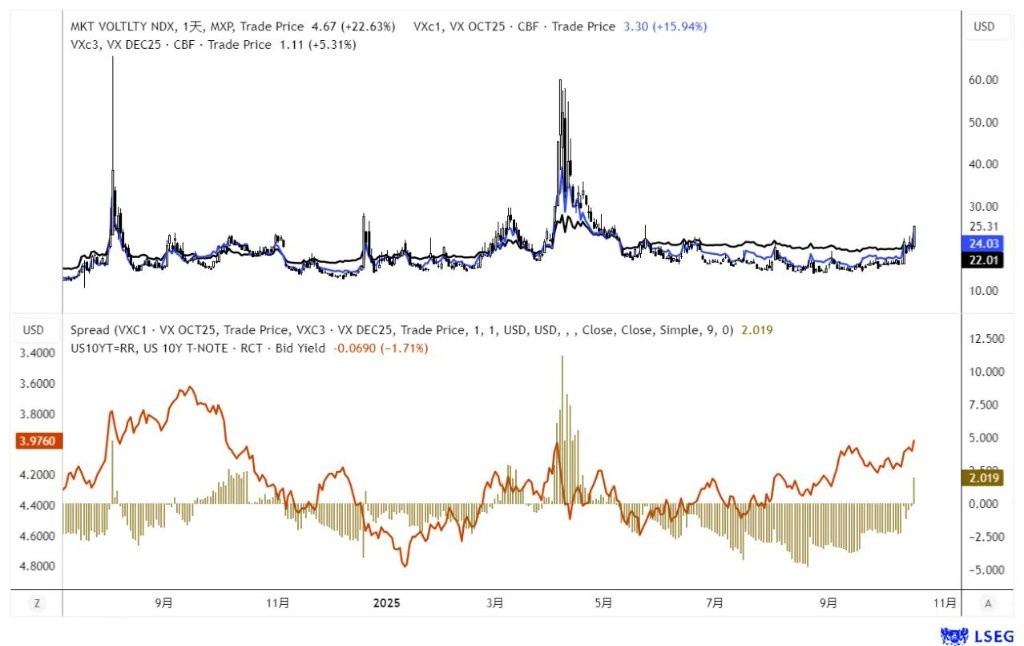

中美最深層次的市場博弈的我們沒法第一時間得知任何進度,這就會缺乏很多作為交易的依據,只能依靠市場的情緒來抓,過度悲觀可以嘗試,過度樂觀需要謹慎,這就可以依舊用我們的老辦法,可以參考去年英偉達爆金幣前我們的警惕,以及爆金幣時我是如何用 VIX 的結構來判斷情緒的高潮,現在看美股的波動率才剛剛的轉為 back,前 VIX 曲線的近月溢價尚未達到極端水平,這意味着目前的情緒或許還沒有完全釋放出來,情緒宣泄仍處中段,市場並未真正定價最壞情形,現在動手跟賭沒啥區別,安全邊際還不夠。

VIX 的信號

更新一下 VIX(10 月 17 日),VIX 的 Back 結構加大了,這隱含的市場風險在加劇,再起的 CNUS 的關税(稀土),在這兩天本森特 “脱鈎” 的言論讓市場更為擔心,原本就緊繃的市場神經(各方對高估值的擔憂) 雪上加霜,而美債收益率跌破 4%,也在指向對於風險可能造成衰退的擔憂,確實是時間臨近月底(能否見面能否談)這將是關鍵的時刻,如果中美繼續這樣下去,預期則可能會變成事實。

兩年形成的巨大的 BTC 的收斂三角形,每一次的支撐點都是一次 VIX 波動率的驟起,從英偉達去年 7 月份的爆金幣到 4 月份的關税再到最近的 G2 關税稀土,恐慌其實並不會推動 BTC,這更是反應了 BTC 和 AI 產業之間的高度關聯(畢竟現在 VIX 的對標市場的主要資產權重就是 AI 資產),現在非常的關鍵時刻,技術分析的支撐下線,如果衰退風險進一步加大,美債收益率已經 4% 了,也在關鍵的位置,坐實衰退,需求的預期坍塌對於巨大的 AI 資本支出將會是沉重的打擊,這波動率進一步提高的話,BTC 還有可能會加速閃崩,現在還有幾天就看中美到底是談判前的籌碼遊戲,還是真的 “決裂脱鈎” 了。

高波動下的黃金怎麼看?

黃金之前的低波動率,橫盤震盪收斂三角形末端,我們採用了 “夾板” 的 staddle 策略來獲取波動率的放大,普通投資者當時也可以通過多空雙開(破位平一腿)的方式來獲取對應的收益,價格的加速上行的背後也是波動率持續的擴大走高。

現在其實應該考慮高波下應該怎麼做,高波意味着成本增加,落袋為先,然後觀察市場,如果繼續橫盤波動率下降,那則還是上行趨勢的特徵,有可能還有繼續下一次低波再啓動的機會,如果波動率很高調整劇烈且波動率並不降低的話,要注意是否轉向的波動率特徵會出現。

《付鵬説 第六季》全面升級!重磅上新!

風險提示及免責條款

市場有風險,投資需謹慎。本文不構成個人投資建議,也未考慮到個別用户特殊的投資目標、財務狀況或需要。用户應考慮本文中的任何意見、觀點或結論是否符合其特定狀況。據此投資,責任自負。