Is it time to reverse the "gold frenzy"?

After reaching a historic high, gold plummeted over 2% in a single day on Friday. "Bond King" Gross warned that it has become a "meme asset." Technical indicators show that prices are severely deviating from moving averages, market sentiment is extremely exuberant, and institutional positions have reached extreme levels, indicating excessive trading. Additionally, gold prices are diverging from traditional driving factors such as real interest rates and the dollar. Bears believe that the frenzy cannot continue, while bulls insist that physical demand and the reconstruction of the political and economic order will support long-term increases

After reaching a historic high, gold has encountered a dramatic pullback, compounded by warnings from "bond king" Bill Gross, as well as technical indicators, market sentiment, and position allocations all signaling red lights, pointing to an increasingly urgent question: has this round of gold bull market, driven by both safe-haven demand and speculative frenzy, reached a critical turning point?

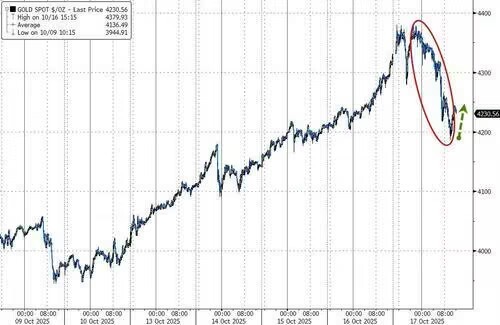

On Friday (October 17), spot gold approached $4,380 during the Asian trading session, setting a new historical record, but then turned to decline during the European trading session and accelerated its drop in the early hours of the U.S. stock market, ultimately closing with a drop of over 2%, marking the largest single-day decline since Thanksgiving 2024, after rising on 9 out of the previous 10 days. However, despite the sharp drop on Friday, gold prices still rose nearly 5% this week, marking the 10th consecutive week of gains and the best single-week increase since May, rebounding after testing $4,200.

The rare intraday reversal in gold prices on Friday coincided with warnings from Wall Street legend and "bond king" Bill Gross. According to a previous article by Jianwen, Gross stated on social media platform X that gold has become a "momentum/meme asset" and advised potential buyers to "wait a bit longer."

It is noteworthy that after the dramatic pullback in gold, Zerohedge pointed out that despite the long-term investment logic for gold remaining solid, technical indicators, market sentiment, and position allocations are all sounding alarms—this safe-haven asset sought after by global investors has entered an overcrowded state. Analysis shows that gold may still be the "right" asset, but its price is no longer "appropriate."

In addition to technical indicators flashing red lights, there has been a significant divergence from traditional fundamental drivers in this round of the gold bull market. As mentioned in a previous article by Jianwen, one of the most striking features of this gold bull market is its rise diverging from multiple traditional drivers, leading more analysts to believe that speculative forces may have surpassed the fundamentals.

Fundamental Support Remains, but Tactical Aspects Have Changed

Financial blog Zerohedge recently pointed out that the core investment logic for gold has not changed: inflation hedging, expectations of interest rate cuts, and the demand for central bank reserve diversification continue to provide long-term support. However, market sentiment, position structure, and volatility levels all indicate that current trading has become overcrowded. This means that even if the direction is correct, the timing and price for entry may no longer be appropriate.

1. Gold Price Trends Have Significantly Diverged from Technical Benchmarks

The current price has deviated significantly from short-term moving averages, with the 21-day moving average around $3,950 and the 50-day moving average at $3,675. Even if gold prices pull back to around the 21-day moving average of $3,950, its long-term upward trend may not necessarily be compromised The daily chart shows that a possible reversal pattern is forming. The current candlestick exhibits characteristics of a shooting star, which typically signals short-term peak risk and requires close attention to subsequent confirmation signals.

2. Market sentiment is extremely exuberant

The Gold Volatility Index (GVZ) has recently surged to extreme levels, reflecting that the market is being forced to chase bullish options on gold. This volatility spike driven by panic buying could exacerbate price corrections once sentiment reverses.

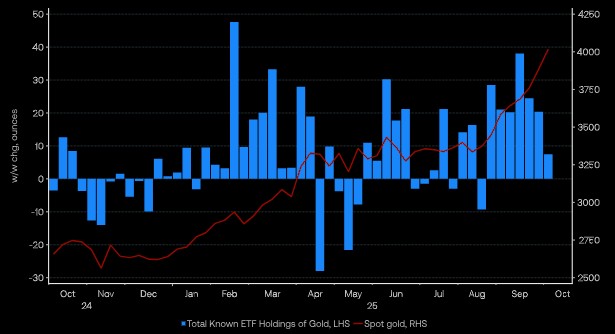

According to data observed by ANZ Bank, the "increment" of inflows into gold ETFs is actually slowing down, indicating that buying momentum is weakening.

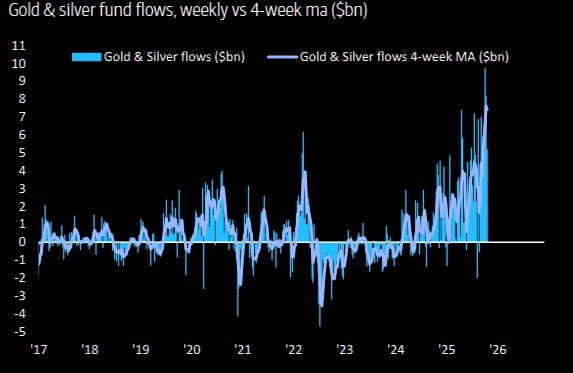

However, according to Bank of America data, net inflows into gold ETFs over the past 10 weeks have reached $34.2 billion, setting a historical record.

3. Institutional positions have reached extremes

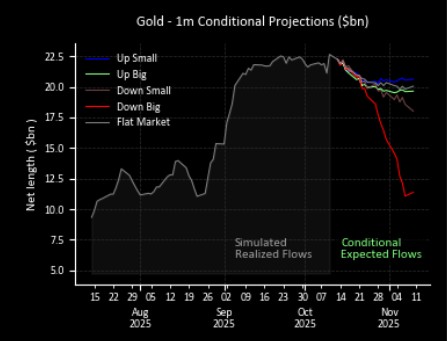

Quantitative strategies show extreme conditions. Citigroup points out that Commodity Trading Advisors (CTAs) are maintaining their highest long exposure to gold. This means that once prices reverse, programmatic selling could amplify the declines.

The extremity of institutional positions indicates a lack of incremental buying in the market, and any negative factors could trigger concentrated liquidations, exacerbating price volatility.

Disconnect from traditional fundamental drivers?

As noted in previous articles, one of the most striking features of this gold bull market is its divergence from several traditional driving factors. Theoretically, gold, as a zero-yield asset, becomes more attractive when real interest rates decline, the dollar weakens, or risk aversion increases. However, recent market performance has frequently broken these conventional logics.

First, gold prices and risk assets are showing a rare pattern of rising together. According to Reuters columnist Mike Dolan, despite the continuous rise in gold prices, global stock markets have also rebounded significantly since April, while market uncertainty indicators have actually declined.

Second, gold prices have diverged from the trend of real interest rates. JPMorgan points out that the recent surge in gold has far exceeded what can be explained by the concurrent decline in real interest rates.

Additionally, since mid-September, the U.S. dollar index has continued to rise, but gold seems to be "unfazed" by this. This disconnect has left many investors who rely on traditional model analysis feeling perplexed.

As zerohedge recently pointed out, several factors that previously drove gold prices higher are undergoing changes

- Although the VIX index has surged recently, it experienced a significant intraday pullback, weakening the short-term appeal of gold as a "panic hedge" tool.

- The volatility in the Japanese government bond market was once an important reason supporting gold buying. However, the yield on Japan's 30-year government bonds has stabilized since gold prices began a new round of increases, diminishing the effectiveness of this logic.

- The movement of the dollar also poses potential pressure on gold prices. Since mid-September, the DXY dollar index has continued to rise, and analysts are questioning whether gold can continue to ignore this traditional negative correlation factor.

Bull vs Bear: Bubble or New Paradigm?

In the face of an increasingly complex market landscape, the views of Wall Street investment banks and analysts have diverged significantly, leading to a heated debate about whether gold is in a "bubble" or represents a "new paradigm."

Bears believe that the current frenzy is at its peak. In addition to Gross's warning about "meme assets," both JP Morgan and HSBC have warned that if market expectations for the Federal Reserve's terminal rate in this cycle are raised again, gold will face challenges.

However, bulls remain steadfast. JP Morgan believes that the "decoupling" of prices and interest rates can be explained by strong physical demand and advises investors to buy on dips during short-term pullbacks.

Bank of America points out that the White House's "non-traditional policy framework," including expanding fiscal deficits and rising debt, will continue to be favorable for gold.

Meanwhile, HuaChuang Securities analyst Zhang Yu suggests that the core driving force behind this round of increases is no longer traditional interest rates, but rather the market's expectations for a "reconstruction of global political and economic order," indicating that gold should be approached with strategic caution, as its upward trend may be far from over