"Bond King" Gross: Gold has become a meme asset, the impact of the regional bank crisis will continue

I'm PortAI, I can summarize articles.

格羅斯建議,買黃金再等等,稱由於供應過剩和財政赤字問題,10 年期美國國債收益率不會低於 4%,應該接近 4.5%。

“老債王” 比爾·格羅斯發出警告,稱黃金已成為 “動量/迷因(Meme)資產”,建議潛在買家 “再等一等”。他同時指出,地區銀行的信用問題可能繼續影響股票和債券市場,並認為 10 年期美債不可能低於 4%。

10 月 17 日,據媒體報道,格羅斯在社交媒體平台 X 上的一篇文章中警告,

“地區銀行的 ‘蟑螂’ 可能會繼續影響股票和債券。”

近日,兩家美國區域性銀行披露的貸款欺詐案引發市場恐慌。Zions 週四披露,對兩筆貸款計提 6000 萬美元撥備並核銷 5000 萬美元,這筆損失相當於其 2025 年市場預期盈利的 5%。

法庭文件顯示,這是繼 First Brands 和 Tricolor 之後,一個半月內曝光的第三起疑似欺詐案件,印證了摩根大通 CEO 戴蒙最近的警告。戴蒙説:“當你看到一隻蟑螂時,可能還有更多。”

格羅斯週五還表示,美國經濟正在放緩,很快就會增速就會回落到 1%,但由於美債供應過剩和政府的財政赤字問題,10 年期美國國債收益率不會低於 4%,應該接近 4.5%。

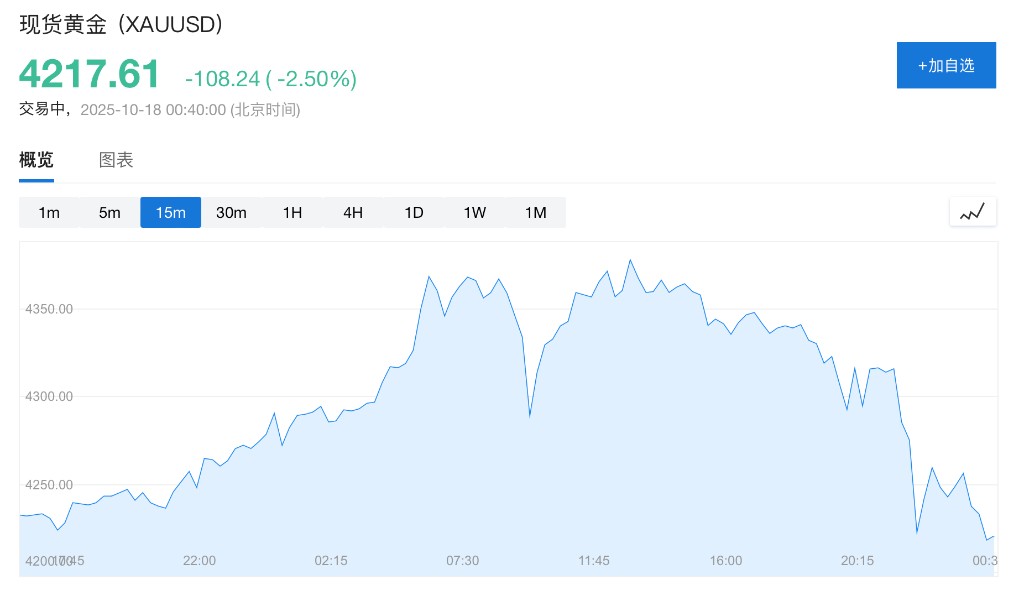

格羅斯發表言論當天,週五亞市盤中,黃金繼續創歷史新高,現貨黃金逼近 4380 美元,但歐股盤中轉跌,美股早盤刷新日低,格羅斯講話後,現貨黃金盤中保持 2% 以上的跌幅,處於 4250 美元下方。