U.S. regional banks are in crisis again, and Goldman Sachs calls it "too crazy." Here are the three questions most concerning clients!

Investors are focusing on how these loans are processed through the approval process, why three unrelated suspected fraud cases were exposed within a month and a half, and whether small banks have relaxed underwriting standards to stimulate loan growth. The market is closely watching the upcoming earnings season to determine whether credit issues are isolated incidents or a broader systemic risk. Goldman Sachs stated that the market is maintaining a high level of vigilance regarding regional banks' NDFI (non-depository financial institution) loan exposure until answers are obtained

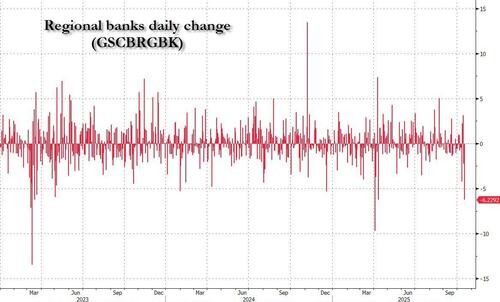

U.S. regional bank stocks experienced a sharp decline on Thursday, marking the second worst trading day since the collapse of Silicon Valley Bank in March 2023. Following this, the volume of client inquiries to Goldman Sachs traders "surged," with investors focusing on three core questions.

The crisis stemmed from Zions Bancorporation disclosing a $60 million provision for two loans and writing off $50 million, a loss equivalent to 5% of its expected earnings for 2025. Court documents revealed this to be the third suspected fraud case exposed within a month and a half, following First Brands and Tricolor, confirming JPMorgan CEO Jamie Dimon's warning of "more than one cockroach."

Goldman Sachs trader Mike Washington noted in the latest daily market summary that the number of clients calling the trading desk to ask "what exactly happened" was at a high level. Investors are focused on how these loans passed the approval process, why three unrelated suspected fraud cases have been exposed in a month and a half, and whether small banks have relaxed underwriting standards to stimulate loan growth.

Market anxiety is also spreading from the private credit sector to regional banks, with investors selling off financial stocks. U.S. regional banks collectively fell 7%, money center banks dropped 3.9%, Zions' stock plummeted 13%, Jefferies fell 10.6%, Capital One dropped 6% due to credit exposure, and alternative asset management companies fell 5%.

Goldman pointed out that such a severe market reaction triggered by the disclosure of a single borrower "seems a bit crazy," but clients are now saying "it's already three cases." Many regional banks have yet to release their earnings reports, and Goldman financial expert Christian DeGrasse noted that the market is maintaining a high level of vigilance regarding the NDFI (non-depository financial institution) loan exposure of regional banks until answers are obtained.

Single Loss Triggers Chain Reaction

Zions Bancorporation disclosed through an 8-K filing that its California Bank & Trust division had defaulted on commercial loans issued to two borrowers. Goldman’s analysis indicated that the $50 million write-off was equivalent to 7 basis points of the bank's core Tier 1 capital, about 5% of its expected earnings for 2025.

Documents showed that the bank found "obvious false statements and contract breaches" as well as "other violations" by the borrower and guarantor during an internal review. The default notices and acceleration demands issued by the bank went unanswered. Zions has filed a lawsuit in California against the guarantor seeking full recovery and plans to hire external lawyers for an independent review.

Court documents revealed that Western Alliance Bank is also involved in litigation against the same borrower, seeking to recover $100 million. This discovery prompted investors to quickly assess the NDFI loan exposure of other regional banks, spreading concern within the sector

The Three Core Issues Most Concerned by Investors

Feedback from Goldman Sachs' trading desk indicates that the market is not worried about the contagion risk of a single credit event, but rather focuses on three deeper issues.

First, how did these loans pass through the approval process? This question targets not only regional banks and commercial banks but also major investment banks like Jefferies. The firm held an investor day that day, and some investors expressed dissatisfaction with the management's handling of the risk exposures related to First Brands and Point Bonita, leading to a 10.6% drop in Jefferies' stock price.

Second, why have three unrelated suspected fraud cases emerged within a month and a half? Goldman Sachs pointed out that this is a "very important question" that makes investors feel "something is off." The three cases—Tricolor, First Brands, and the recently disclosed Zions borrower—each involve different borrowing entities.

Third, have small banks relaxed underwriting standards to stimulate loan growth? This concern is particularly unsettling as it aligns with investors' narrative of a deteriorating overall credit environment. These problematic loans mainly come from NDFI loans, which have increasingly become a source of loan growth for regional banks, typically accounting for about 15% of total loans.

NDFI Loans Become the Focus of Attention

Goldman Sachs' Ryan Nash noted in the Q2 2025 handbook that NDFI loans account for about 15% of regional banks, but the situation varies significantly among banks. These loans cover various financing to non-depository financial institutions, including private credit funds and consumer credit intermediaries.

The trading performance that day showed significant differences in the underwriting quality of NDFI loans among different banks. Large banks outperformed small and regional banks by about 300 basis points, with some cases showing a gap of up to 1000 basis points. Investors emphasized that not all NDFI loans are the same, and underwriting standards vary among different banks.

Currently, the market's focus is on private credit exposure within NDFI loans, followed by exposure to consumer credit intermediaries. Goldman Sachs pointed out that the market seems to be in a "discovery phase," with no one clear on what exactly is happening, but the tone of investor conversations has clearly shifted to "something seems to be happening."

More Risks May Be Exposed During Earnings Season

Goldman Sachs noted that although the new disclosures involve only one borrower (despite clients stating "now it's three"), market sentiment has significantly shifted, with the general view moving from wait-and-see to "there seems to be a real problem."

Goldman Sachs trader DeGrasse stated, "Everything seems a bit crazy after the new disclosure of a single borrower," but the tone of client conversations has clearly changed. ZION has indicated that while it believes this is an isolated incident, it plans to hire external lawyers for an independent review.

Many regional banks have yet to release their earnings reports, and Goldman Sachs expects NDFI loan exposure to become a key focus area during earnings calls and disclosures. Goldman Sachs emphasized that not all NDFI loans are the same, and underwriting standards for NDFI loans vary among different banks, as evidenced by the significant differences in stock performance among banks today The market is closely watching the upcoming earnings season to determine whether this credit issue is an isolated incident or a broader systemic risk