Danger Signals for AI: Growth of ChatGPT's Paid Users in Europe May Have Stalled!

德銀研報顯示,ChatGPT 在歐洲市場消費支出自今年 5 月起停滯,付費用户增長或已觸頂。儘管每週活躍用户達 8 億,但僅 2000 萬付費用户,與 5000 億美元估值嚴重不符。德銀認為,若付費增長持續停滯,AI 行業的估值體系可能面臨修正壓力。

本文作者:董靜

來源:硬 AI

AI 行業的標杆產品 ChatGPT 面臨關鍵挑戰,歐洲付費用户增長或已停止,這揭示了一個重磅信號:AI 變現能力受到考驗。

10 月 17 日,據硬 AI 消息,德意志銀行在最新研報中稱,ChatGPT 在歐洲市場的消費者支出自今年 5 月以來幾乎陷入停滯,暗示這款 AI 浪潮的 “旗幟產品” 在吸引新付費用户方面或已觸頂。

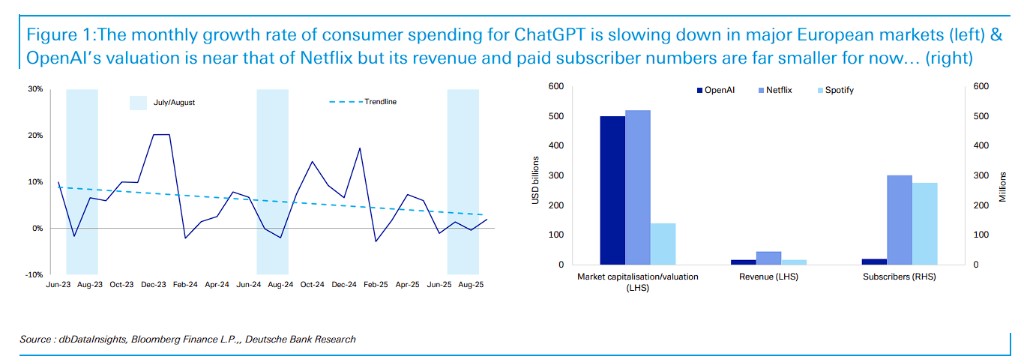

儘管 OpenAI 首席執行官 Sam Altman 上週宣佈,ChatGPT 每週活躍用户已突破 8 億人,但德銀指出,其付費用户增長明顯放緩,收入增長與 Spotify、Netflix 等流媒體平台相比仍存在巨大差距。

研報稱,在 OpenAI 估值高達 5000 億美元、接近 Netflix 市值的背景下,其收入規模和付費訂閲用户數量卻遠遠落後。這揭示了 AI 產業當前面臨的核心矛盾——技術影響力與商業盈利能力之間的巨大鴻溝。

德銀分析師 Jim Reid 表示:“AI 毫無疑問將改變世界、提升生產力,但盈利的路徑仍然模糊。真正的挑戰,不在算法,而在商業模式。”

歐洲市場增長信號轉弱

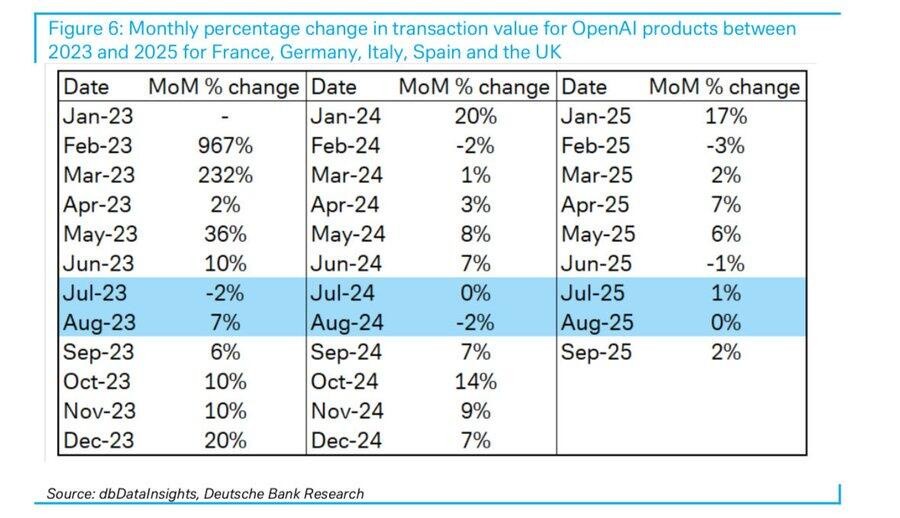

根據德意志銀行 dbDataInsights 團隊對法國、德國、意大利、西班牙和英國五大歐洲市場的追蹤數據,ChatGPT 的消費支出月度增長率自 2025 年 5 月起明顯放緩。

值得注意的是,雖然 2024 年 7 月和 8 月也曾出現類似的季節性放緩(當時歸因於學生用户暑期減少),但彼時 6 月增長強勁,9 月更出現顯著反彈。

相比之下,2025 年這兩個月的表現均顯平淡,未能重現去年的增長動能。

分析指出,這一差異暗示當前的增長停滯可能並非簡單的季節性波動。儘管數據僅覆蓋部分歐洲市場而非全球,且仍可能存在數據波動,但這一趨勢無疑值得密切關注。

估值與營收的巨大落差

德意志銀行的對比分析揭示了 OpenAI 估值與實際業務規模之間的顯著差距。報告稱,

- Netflix市值與 OpenAI 預期估值(5000 億美元)相當,但其擁有超過 3 億全球訂閲用户,2025 年預計年收入達 450 億美元,市銷率為 12.5 倍。

- 音樂流媒體平台 Spotify市值 1440 億美元,擁有 2.76 億訂閲用户,預計年收入超過 170 億美元,市銷率為 7.3 倍。

相比之下,根據 OpenAI 今年 4 月披露的數據,其全球付費訂閲用户僅約 2000 萬——這一數字與估值之間的落差極大。

德銀指出,OpenAI 的用户增長雖驚人(每週活躍用户已從 3 月底的 5 億人升至 8 億人),但 “如何將龐大流量轉化為持續付費訂閲者” 仍是商業化的最大挑戰。

研報指出,AI 工具在最初階段的增長往往依賴好奇心與免費用户的擴散效應,但進入付費階段後,留存率和持續價值將決定平台的商業上限。

投資者正高度關注 OpenAI 即將到來的收入披露週期。德銀認為,若付費增長持續停滯,AI 行業的估值體系可能面臨修正壓力。