"Subprime Crisis" or "Overreaction"? Small Banks in the U.S. "Blow Up," Market "Sell First, Talk Later"

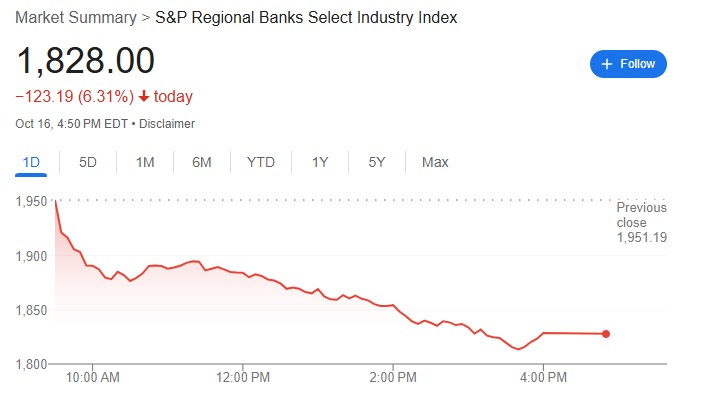

The loan fraud cases disclosed by two regional banks in the United States have triggered market panic, with the S&P Regional Banking Select Industry Index plummeting 6.3% on Thursday, marking its worst single-day performance in months. Investors are concerned that this is just the tip of the iceberg. JPMorgan analysts indicate that the banking sector is an area where investors tend to "sell first, ask questions later," and the rapid deterioration of market sentiment is becoming a greater concern than the banks' balance sheets themselves

The loan fraud cases disclosed by two regional banks in the United States have triggered market panic, leading to a sell-off wave against regional banks spreading across Wall Street, with investors adopting a "sell first, ask questions later" strategy amid concerns over credit risk.

Zions Bancorp and Western Alliance Bancorp, the two regional banks, disclosed on Thursday that they suffered losses due to fraud involving bad commercial mortgage investment funds. Although the scale of their losses is relatively small compared to recent other credit blow-up events, involving only tens of millions of dollars, the market's reaction has been exceptionally severe.

Affected by this news, the S&P Regional Banks Select Industry Index plummeted 6.3% on Thursday, marking its worst single-day performance in months. Zions' stock price fell sharply by 13%, while Western Alliance dropped by 11%. Panic quickly spread, dragging down the entire banking sector, with the total market capitalization of 74 large U.S. banks erasing over $100 billion in just one day.

This chain reaction highlights the fragile nerves of the market, with investors worried that this is just the tip of the iceberg.

JPMorgan Chase CEO Jamie Dimon's recent "cockroach" warning—"When you see one cockroach, there may be more"—is still fresh in mind. JPMorgan analysts stated that the banking sector is an area where investors tend to "sell first, ask questions later," and the rapid deterioration of market sentiment is becoming a greater concern than the banks' balance sheets themselves.

Trigger: Two Banks Claim to Have Encountered Loan Fraud

The direct cause of this market turmoil is two related loan fraud allegations.

According to disclosures from Zions and Western Alliance, they provided loans to investment funds associated with individuals such as Andrew Stupin and Gerald Marcil for the acquisition of bad commercial mortgages.

Zions disclosed that its wholly-owned subsidiary California Bank & Trust provided a $60 million loan to the borrower and consequently made a $50 million provision for bad debts. A lawsuit document from the bank revealed that an investigation found many notes and related mortgaged properties had been transferred to other entities. Western Alliance also stated that it issued loans to the same group of borrowers.

In response, Brandon Tran, the attorney representing Andrew Stupin and Gerald Marcil, stated in an email that the allegations against his clients are "baseless" and distort the facts. He said, "We believe that once all the evidence is presented, our clients will be completely exonerated."

Market Panic: "Sell First, Talk Later" Becomes Consensus

Although the loss amounts disclosed by the two banks are not significant, the market has been shaken by a recent series of "explosive" events in the credit market.

Last month, the subprime auto loan company Tricolor Holdings filed for bankruptcy; shortly thereafter, the auto parts supplier First Brands Group, which owed over $10 billion to Wall Street giants, also declared bankruptcy. Amid a series of negative news, the fraud allegations against Zions and Western Alliance became the last straw that broke the camel's back.

The potential anxiety of investors was instantly ignited, even as the S&P 500 index hovered near historical highs. Mike Mayo, Managing Director at Wells Fargo, stated, "When the credit market is so prosperous, there is little room for error—good times are precisely when bad debts breed. Therefore, I believe that today, cautious sentiment has triumphed over optimism."

This "sell first, talk later" mentality has spread rapidly. JPMorgan analysts Anthony Elian and Michael Pietrini pointed out in a report that they are also questioning "why all these credit 'isolated cases' seem to be happening in such a short time."

Thursday's sell-off did not spare large bank stocks, with shares of Citigroup and Bank of America both falling over 3%.

Several large banks reported being impacted by the recent high-profile bankruptcies—JPMorgan and Fifth Third Bancorp disclosed combined losses related to Tricolor amounting to hundreds of millions, while Jefferies Financial Group revealed its exposure to First Brands. JPMorgan incurred a loss of $170 million due to Tricolor.

History Repeating? Shadows of the 2023 Banking Crisis

The market's severe reaction is largely rooted in the painful memories of the 2023 banking crisis. That crisis, which began with the collapse of Silicon Valley Bank (SVB), once swept through the entire U.S. banking industry.

Matt Maley, Chief Market Strategist at Miller Tabak & Co LLC, stated, "The bank run that occurred two and a half years ago at regional banks is still fresh in investors' minds. Therefore, after this week's news regarding Zions and Western Alliance, credit quality issues will be the top concern for this group."

The root of the 2023 crisis lay in the Federal Reserve's interest rate hikes, which pressured banks' bond investment portfolios, leading to depositor runs that forced banks to sell assets at a loss, ultimately triggering bankruptcies and a chain reaction.

However, some analysts believe it is too early to assert that history is repeating itself. Steve Sosnick, Chief Strategist at Charles Schwab, pointed out: "It is still too early to conclude that this is another SVB moment. However, given the severity of that disaster, it is entirely understandable that bank stock investors remain vigilant about any situation that carries a similar scent."The differences in risk resilience between large banks and regional banks are becoming increasingly pronounced.

Wells Fargo Managing Director Mayo stated, "The largest banks have strong diversification capabilities to absorb such issues, while smaller banks have less room for error." In the coming weeks, as regional banks release their financial reports one after another, investors will conduct a "carpet-style" examination of their credit quality and provisioning data, and any surprises could trigger significant market volatility once again