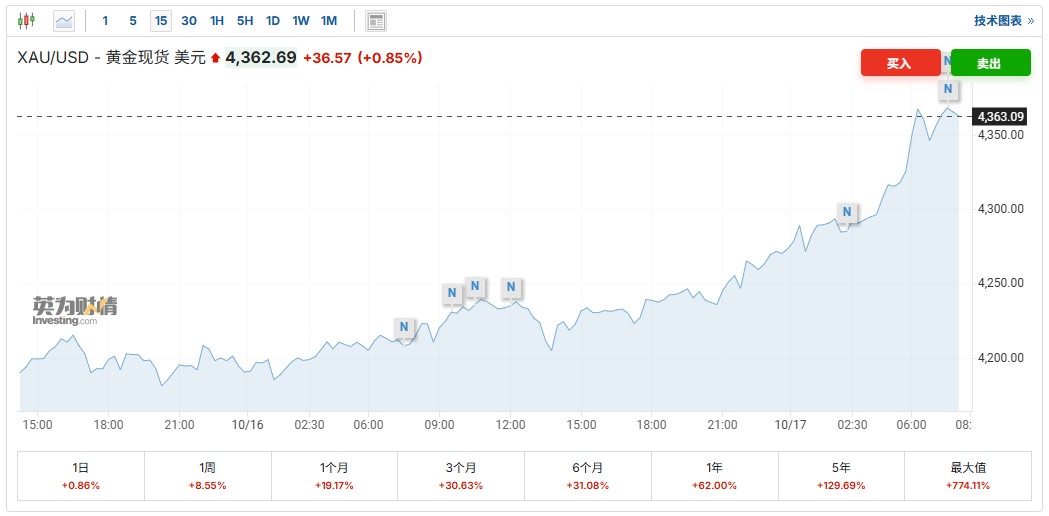

After a surge of 65%, there is still room! Gold breaks through $4,370, HSBC urgently raises the target price for 2026 by nearly 30%

Due to increasing concerns about credit quality in the economy and geopolitical tensions, gold and silver prices have reached historical highs. Spot gold once rose to $4,379.96 per ounce, marking the largest weekly gain since 2020. Investors are betting that the Federal Reserve will cut interest rates by the end of the year, which is expected to further drive up precious metal prices. So far this year, gold prices have surged over 65%

According to Zhitong Finance APP, due to increasing concerns about credit quality in the economy and rising safe-haven demand driven by geopolitical tensions, along with investors betting that the Federal Reserve may implement a significant rate cut this year, both gold and silver prices have reached historic highs. Data shows that during the early Asian trading session on Friday, spot gold rose by 1.2% to $4,379.96 per ounce, setting a new historical high and is expected to achieve the largest weekly gain since 2020. Spot silver also saw a slight increase, reaching a historical high of $54.3775 per ounce before giving back some gains.

It is reported that the bankruptcy of U.S. subprime auto loan company Tricolor Holdings and auto parts manufacturer First Brands has raised investor concerns that the credit market may face tougher times ahead. The bankruptcy events of these two automotive companies have triggered a chain reaction, bringing the quality of bank loans back into focus. JP Morgan CEO Jamie Dimon mentioned this week regarding the bankruptcies of these two companies, "When you see one cockroach, there are likely more behind it." Additionally, geopolitical tensions have also driven an increase in safe-haven demand.

Meanwhile, traders are actively betting that the Federal Reserve will implement at least one significant rate cut before the end of this year. Federal Reserve Chairman Jerome Powell hinted this week that the Fed plans to cut rates by 25 basis points later this month. Although the ongoing U.S. federal government shutdown has delayed the release of September non-farm payroll and CPI data, once the government resumes operations, a large amount of economic data is expected to be released, which may reveal signs of economic weakness and support further rate cuts by the Fed. Lower borrowing costs typically benefit precious metals, as assets like gold do not generate interest income.

Since the beginning of this year, gold prices have surged over 65%, primarily supported by continued purchases by central banks, inflows into gold exchange-traded funds (ETFs), and a surge in safe-haven demand amid geopolitical and trade tensions, rising fiscal and debt levels, and threats to the independence of the Federal Reserve. Meanwhile, the silver market has faced tight liquidity in London, leading to a global rush to buy silver and pushing the London benchmark price significantly above New York futures prices.

As gold prices continue to soar, several Wall Street giants have raised their gold price outlooks. UBS predicts that gold prices will rise to $4,200 per ounce in the coming months. Morgan Stanley forecasts that gold prices will reach $4,500 per ounce in the second half of 2026. Goldman Sachs has raised its gold price forecast for December 2026 from $4,300 per ounce to $4,900 per ounce. Bank of America has increased its 2026 gold target price to $5,000 per ounce, noting that policy uncertainty driving safe-haven demand will support gold prices to reach the $5,000 level. Veteran in the precious metals market, Ed Yardeni, president of Yardeni Research, reiterated his previous bullish forecast for gold, stating, "Our current gold target is to reach $5,000 per ounce by 2026." "If the current upward trend continues, it may break through the $10,000 mark before 2030."

HSBC is the latest major bank to raise its gold price target. HSBC has increased its expectation for the average gold price in 2025 from $3,215 per ounce to $3,355 per ounce, citing geopolitical tensions, economic uncertainty, and a weakening dollar. The bank also raised its expectation for the average gold price in 2026 from $3,125 per ounce to $3,950 per ounce, an increase of 26%. In a report on October 15, HSBC stated, "Market sentiment remains bullish, and gold prices are expected to continue rising in 2026."

HSBC pointed out that the expanding fiscal deficits in the U.S. and other major economies are driving up demand for gold. The bank stated, "Supported by geopolitical risks and the trend of de-dollarization, the demand for gold purchases by central banks may remain high, but will be below the peak levels of 2022 to 2023."

However, HSBC also warned that if the Federal Reserve lowers interest rates fewer times than the current market expectations this year and next, it may suppress the upward momentum of gold prices. Additionally, HSBC noted that the gradual decline in global inflation may weaken the demand for gold jewelry that was previously driven by inflation concerns