Silver is running out! Investors are frantically buying tax-exempt gold and silver coins, the Royal Mint's production capacity is in crisis, and the London precious metals market is caught in a "perfect storm."

The rush of retail investors has forced the Royal Mint to ramp up production, but it still has to warn customers that silver deliveries may be delayed. Meanwhile, gold and silver traders on the streets of London are busy dealing with the influx of retail investors and have even had to enhance security measures

The British Royal Mint, with a history of 1,100 years, is facing an unprecedented capacity crisis.

According to media reports on Thursday, a surge in retail investor purchases has forced this ancient institution to ramp up production, but it still has to warn customers that silver deliveries may be delayed. Meanwhile, gold and silver traders on the streets of London are busy dealing with the influx of crowds and have even had to enhance security measures.

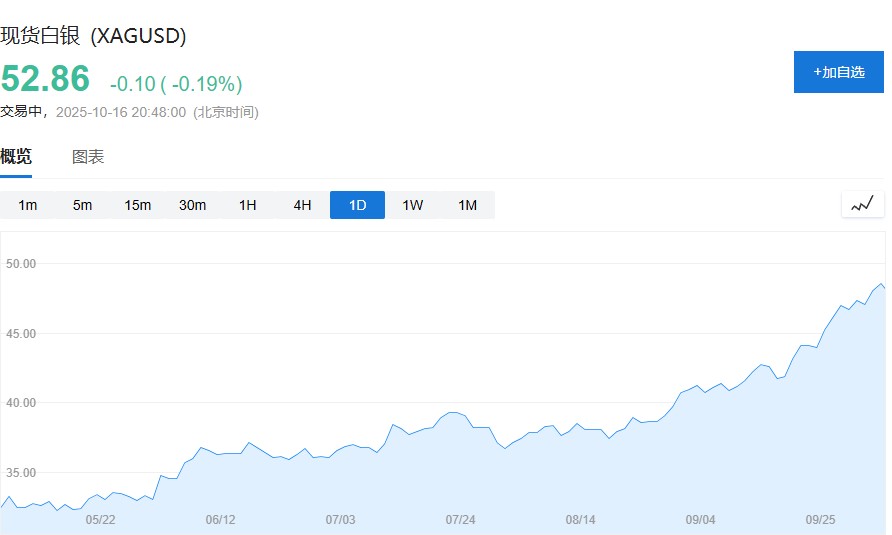

This year, the wholesale silver price in London has soared over 80%, and a new round of orders from institutional buyers this week has triggered a historic market squeeze. This retail buying frenzy is driving up global physical demand, providing additional momentum for gold and silver prices, which are already at historical highs.

The Royal Mint has increased production of gold coins and is working to replenish its silver inventory, but some customers may still face longer delivery times.

The inventory in London vaults is at extremely low levels, with new supplies being airlifted from places like New York. This demand storm is not only impacting the institutional market but is also causing a flurry of activity in London's jewelry district.

Tax-Free Coins Become the Focus of Buying Frenzy

Rising prices have prompted investors to flock to the gold, silver, and platinum markets, with Britannia coins and Sovereign coins being particularly sought after due to their exemption from capital gains tax, a tax advantage that is heightening retail investor enthusiasm.

Carly O'Donnell, a spokesperson for the Royal Mint, stated that demand for physical precious metals in the UK and international markets has been "exceptionally strong" in recent weeks.

"Silver Sprint" on the Streets of London

In the jewelry district of Hatton Garden in London, traders are experiencing an unusually busy scene. Lines stretch outside the stores as customers crowd the counters to sell gold bracelets, rings, and necklaces.

"We are currently in a perfect storm," said Emma Siebenborn, operator of Hatton Garden Metals, who, along with her sister Zoe Lyons, comes from a family of jewelers and now has to swap her high heels for sneakers to cope with the workload.

A long-time customer who purchased silver coins worth £20,000 a few years ago has now made a profit of £19,000. Their mother compared this moment to the silver rush she experienced decades ago and advised her daughters to cherish this ongoing period.

Rational Voices Amid Market Frenzy

In the face of continuously rising prices, traders are also reminding investors to stay grounded. "Not all markets will keep rising; that's not how the world works," Lyons said. "Not all markets can go to heaven. But where are we on this journey? Are we halfway? Or are we already in heaven?"

The London institutional silver market, as the global center for gold and silver trading, faced a squeeze this week, pushing prices to unprecedented levels and raising concerns about liquidity. This wave of demand sweeping through both wholesale and retail sectors is testing every link in the global precious metals supply chain