台积电 (TSM.US) 为 “AI 信仰” 添把火!Q3 业绩超预期后上调 2025 年指引

台積電 (TSM.US) 在第三季度業績超預期後,將 2025 年營收增長預期上調至 30% 中段區間,顯示出對英偉達等 AI 組件需求的強烈信心。第三季度營收為 331 億美元,同比增長 40.8%,每股收益為 2.92 美元,超出市場預期。台積電還提高了資本支出目標,預計 2025 年將投入至少 400 億美元用於產能擴張。作為全球領先的半導體制造商,台積電在 AI 基礎設施支出中扮演着重要角色。

智通財經 APP 獲悉,台積電 (TSM.US) 將 2025 年營收增長預期上調至 30% 中段區間,此舉釋放出對英偉達公司芯片等人工智能組件需求的強烈信心。財報顯示,台積電三季度營收為 331 億美元,同比增長 40.8%,遠超市場預期;每股收益為 2.92 美元,高於市場的預期 2.60 美元。

在三季度利潤超預期躍升 39% 至新台幣 4523 億元(合 148 億美元)後,台積電同時提高了今年資本支出目標的下限。該公司現在撥出至少 400 億美元用於 2025 年的產能擴張和升級,高於此前 380 億美元的下限。

第三季度,台積電 3 納米出貨量佔晶圓總收入的 23%;5 納米佔 37%;7 納米佔 14%。先進技術(定義為 7 納米及更先進的技術)佔晶圓總收入的 74%。

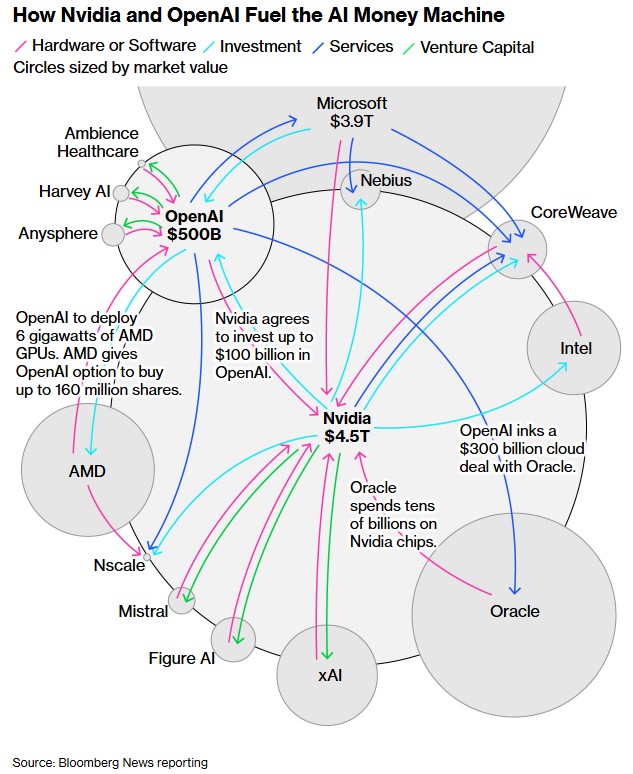

這些業績凸顯出,作為蘋果 (AAPL.US) 及全球多數最大半導體設計商的首選芯片製造商,台積電如何依然是 AI 基礎設施支出狂潮的主要受益者之一——預計未來幾年這類支出將突破 1 萬億美元大關。從 OpenAI 到甲骨文公司,科技企業正競相建設支撐後 ChatGPT 時代這項技術的數據中心。

在主流 AI 應用和服務持續缺位的背景下,這場投資熱潮加之科技股估值快速攀升,不禁讓人將其與互聯網泡沫相比較。

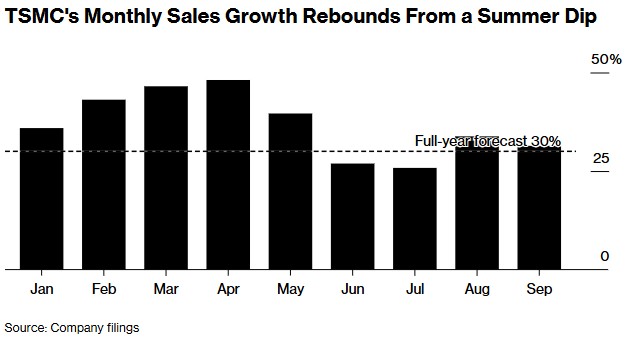

台積電上調展望頗為引人注目,因其在去年 7 月剛剛上調過營收指引。當時公司表示預計增長"約為"30%,而週四管理層預計增幅將達到 30% 的中段區間。

作為全球最先進的半導體制造商,台積電在以英偉達為核心的 AI 投資熱潮中扮演着主導角色。公司生產對 ChatGPT 和谷歌 Gemini 等 AI 服務訓練和運行至關重要的強大加速器。

它還是 iPhone 及眾多其他設備處理器的獨家制造商,而當前在中美貿易摩擦針鋒相對的背景下,消費電子需求仍存不確定性。

在中國對稀土礦物出口實施限制、美國隨之對軟件銷售至中國施加額外關税和限制後,全球半導體供應鏈企業正為可能出現的中斷做準備。

不過,台積電的主要設備供應商阿斯麥控股週三表示,得益於人工智能熱潮,對其最先進芯片製造設備的需求正在激增。

分析師 Charles Shum 表示,台積電第三季度初步銷售額達新台幣 9900 億元 (合 330.5 億美元),超出指引預期,反映出 AI 和 iPhone 芯片需求的強勁態勢,暗示其毛利率將處於 55.5%-57.5% 預測區間的高端。這一增長勢頭有望延續至第四季度,屆時蘋果 A19 和英偉達 Blackwell 芯片的強勁訂單應能大體抵消典型的季節性影響及關税相關阻力。這可能導致環比第三季度小幅下滑,但跌幅將小於 11% 的全年指引增速。

台積電月度銷售額增長從夏季低迷中反彈

台積電首席執行官魏哲家多次重申對 AI 需求可持續性的信心。然而在 7 月,他曾對特朗普政府關税及整體地緣政治緊張局勢帶來的不確定性發出警告。

公司正在美國擴張部分是為緩解此類風險。它已承諾投資 1650 億美元擴大亞利桑那州製造業務,這是其全球擴張計劃 (也涵蓋歐洲和日本) 的一部分。