The UK economy relies on manufacturing for "single-engine" flight, barely achieving growth in August

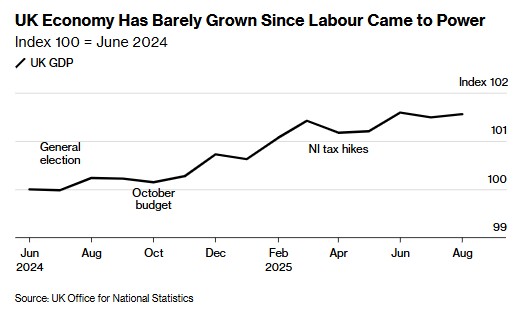

英國經濟在 8 月小幅增長 0.1%,主要得益於製造業反彈,抵消了服務業增長停滯的影響。儘管建築業萎縮,工廠產出增長 0.7% 超出預期,顯示出第三季度有望實現增長。財政大臣裏夫斯面臨挑戰,需通過經濟增長穩定公共財政。專家指出,恢復企業信心和減少不確定性是重振經濟的關鍵。儘管 GDP 數據略有改善,但市場反應平淡,英鎊兑美元匯率持平。

智通財經 APP 獲悉,英國經濟於 8 月恢復小幅增長,主要得益於製造業的反彈抵消了占主導地位的服務業當月增長停滯的影響。

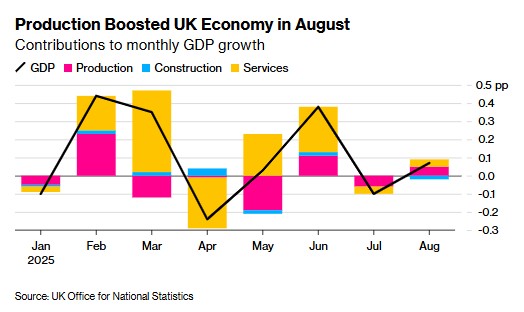

英國國家統計局週四公佈的數據顯示,在 7 月國內生產總值 (GDP) 下降 0.1% 後,8 月該指標回升 0.1%。這一增幅與經濟學家的中位預期一致。其中,工廠產出增長 0.7%,超出預期;服務業則連續兩個月持平;建築業出現萎縮。

這些數據表明,英國經濟第三季度有望實現一定程度的增長。這對財政大臣蕾切爾·裏夫斯而言是一個温和的利好——11 月 26 日她將公佈一份預計頗具挑戰性的預算案,企業和消費者正為進一步加税做準備。英國國家統計局指出,除非 9 月 GDP 下降 0.5% 或更多,否則本季度經濟將實現擴張。

不過,這些數據或許難以緩解外界對經濟已迴歸低速增長的擔憂——儘管英國上半年表現曾優於七國集團其他所有成員國。裏夫斯需要通過經濟增長來穩定公共財政,進而兑現其競選承諾——加大公共服務投入並提高民眾生活水平。

智庫英國國家經濟社會研究院 (NIESR) 的副經濟學家 Fergus Jimenez-England 表示:“要重振經濟動能,關鍵在於恢復企業信心並減少不確定性。政府可通過在即將出台的預算案中預留更充裕的財政緩衝資金來提供支持。”

在截至 8 月的三個月裏,英國 GDP 增長了 0.3%。該數據對市場影響甚微,週四英鎊兑美元匯率基本持平。

此番 GDP 數據為財政大臣裏夫斯持續一週的黯淡經濟消息畫上了句號。

週二,國際貨幣基金組織 (IMF) 預測,未來兩年英國的通脹率將在主要經濟體中處於最高水平。而幾小時前,英國公佈失業率意外上升,這使得英國央行行長貝利對經濟潛力未能充分釋放表示擔憂。與此同時,英國央行外部利率制定者艾倫・泰勒警告稱,英國面臨 “硬着陸” 的風險正在上升。

儘管交易員預計今年內再次降息的可能性低於 40%,但他們已完全消化明年 3 月前降息、以及明年年底前再次降息 25 個基點的預期。英國國債近日已出現上漲。

英國國家統計局稱,在 7 月製造業產出下降 1.1% 後,8 月該行業迎來增長,13 個細分行業中有 8 個實現產出上升。

其中,基礎藥品及藥物製劑製造業增長 3%,對製造業整體增長的貢獻最大。機械裝備、金屬和化工行業的產出也有所上升。

儘管 8 月零售銷售額有所增長,但服務業再次未能實現擴張。批發、娛樂休閒以及運輸倉儲行業均出現下滑。服務業的增長主要來自租賃業務,其次是醫療保健行業。8 月面向消費者的服務業增長 0.1%,而 7 月該領域零增長。

另一項數據顯示,8 月英國商品進口持平,出口則出現下降,對歐盟和非歐盟國家的出貨量均有所減少。其中,對美國的出口 (包括貴金屬) 下降了約 7 億英鎊。