汽车产业链的未来在 “3A”:自动驾驶、人形机器人和 AI 数据中心

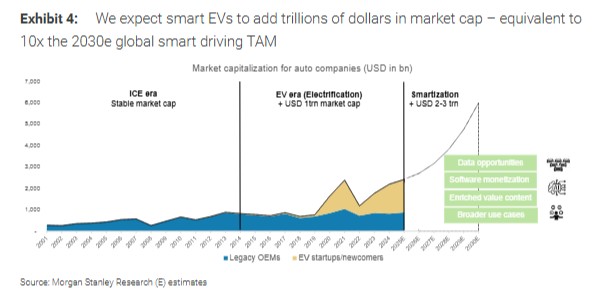

大摩認為單純關注汽車銷量數據的時代即將過去,未來汽車產業鏈的投資價值將錨定在擁有 “第二增長曲線” 的企業。若傳統車輛銷售公司能在 “3A” 領域取得實質性突破,屆時將有望撬動一個高達 2-3 萬億美元的新增市值空間。

本文作者:鮑奕龍

來源:硬 AI

單純關注汽車銷量數據的時代即將過去,未來汽車產業鏈的投資價值將錨定在擁有 “第二增長曲線” 的企業。

10 月 12 日,摩根士丹利發表研報指出,如今高質量電動車已成為行業標配,汽車產業鏈真正的創新機會在於 AI 生態系統的突破。報告提出了決定未來的 “3A” 機遇,即自動駕駛 (Autonomous Driving)、AI 具身智能 (AI embodiment) 和 AI 數據中心 (AIDC)。

若傳統車輛銷售公司能在 “3A” 領域取得實質性突破,屆時將有望撬動一個高達 2-3 萬億美元的新增市值空間。報告明確看好在 AI 領域有具體突破的小鵬汽車和激光雷達供應商禾賽科技。

市場環境改善但週期性壓力猶存

報告指出由於刺激政策到期前的 “搶購潮” 和大量新車型上市,2025 年第四季度銷量將被拉動,環比增長 19%。

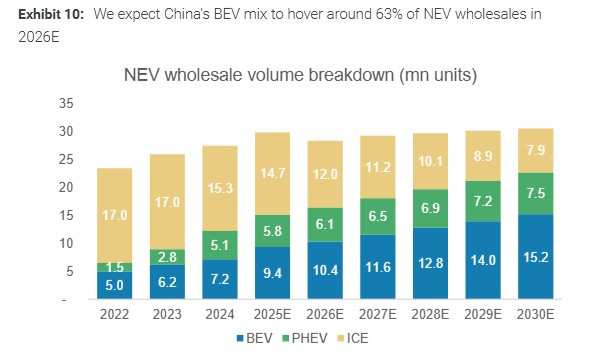

因此,報告將 2025 年中國汽車總銷量預測上調 6% 至 2990 萬輛,同比增長 9%。其中,新能源汽車(NEV)銷量預測上調 2% 至 1520 萬輛,同比增長 24%,滲透率預計達 51%。

(預計 2026 年中國純電動汽車在新能源汽車總銷量中的佔比將維持在 63% 左右)

(預計 2026 年中國純電動汽車在新能源汽車總銷量中的佔比將維持在 63% 左右)

不過報告維持 2026 年預測不變,預計汽車銷量將同比下降 5%。主要原因有二:

- 一是 2025 年銷量預支了部分需求。

- 二是 2026 年新能源車購置税將上調至 5%。

報告指出,政府的補貼政策在明年仍具有不確定性。不過,新能源汽車銷量有望同比增長 8%,出口銷量也預計將同比增長 4%。

(預計到 2026 年中國新能源汽車的批發銷量將同比增長 8%,達到 1650 萬輛)

(預計到 2026 年中國新能源汽車的批發銷量將同比增長 8%,達到 1650 萬輛)

分析師強調,刺激政策停止的擔憂可能會促使投資者忽略汽車行業第四季度的強勁表現,轉而尋找新的投資機會,以對沖 2026 年上半年汽車行業的週期性風險。

汽車公司的下一站是 “3A”

摩根士丹利指出,隨着電動汽車的同質化加速,高品質的電動車已成為標配,真正的創新和估值差異將體現在 AI 的應用上。

汽車公司必須開啓 “第二幕”,將自己重塑為更廣泛的 AI 生態系統參與者。報告將這些機會概括為 “3A”:

自動駕駛(Autonomous Driving):

- 生成式 AI 在模擬訓練、東西方協作帶來的技術成本下降,以及漸進的法規支持,正在共同加速 L2+ 級智能駕駛和自動駕駛出租車(Robotaxi)的普及。

- 主流應用將於 2026 年在發達市場開始。

AI 具身智能機器人(AI Embodiment):

- 汽車供應鏈在發展人形機器人方面具備天然優勢。自動駕駛車輛與人形機器人在算力、算法和物料清單(BoM)成本上存在巨大重疊。

- 部分中國車企的目標是從 2026 年開始商業化和量產人形機器人,這可能成為繼電動汽車和飛行汽車(eVTOL)之後,車企的下一個 “必選項”。

AI 數據中心生態系統(AIDC):

- 人形機器人和自動駕駛的龐大算力需求,將帶動對 AI 數據中心的需求。

- 汽車零部件製造商,尤其是那些在冷卻系統和高速連接器等領域有技術積累的公司,正穩步進入 AIDC 生態系統。

(汽車 OEM 廠商接下來的發展方向)

AI 驅動萬億市值增量,估值體系面臨重塑

報告預計,到 2030 年智能電動車將為汽車公司增加 2-3 萬億美元市值,相當於 2030 年全球智能駕駛總體市場 (TAM) 的 10 倍。

(智能電動汽車將為市場帶來數萬億美元的市值增長,這一規模相當於 2030 年智能駕駛市場總規模的 10 倍)

(智能電動汽車將為市場帶來數萬億美元的市值增長,這一規模相當於 2030 年智能駕駛市場總規模的 10 倍)

雖然車輛銷售可能仍是主要收入來源,但非車輛業務包括自動駕駛出租車、飛行汽車、人形機器人等收入增長,以及授權和服務帶來的潛在經常性收入,將為車企帶來新的盈利機會。

隨着行業進入新一輪技術變革,股票估值將越來越多地以 “分部估值法”(SOTP)來重新評估公司價值,並將吸引科技、媒體和電信(TMT)等領域的投資者。擁有先發優勢的初創公司和科技企業,將有望獲得遠高於傳統車企的估值倍數。

此外報告指出,自 2024 年底以來,10 年期國債收益率已降至 2% 以下,而 2017 年時這一收益率約為 4%。因此摩根士丹利策略團隊將用於中國汽車行業估值的無風險利率從 4% 下調至 3%。

基於這些因素,分析師預計在未來 6 到 12 個月內,除了盈利預期會被上調外,中國汽車整車製造商和零部件企業的估值也將獲得有利支撐。

精選跨界與復甦標的

基於 “3A” 框架,報告給出了明確的投資偏好順序:

- 首選跨界 AI 公司。強烈看好在非汽車領域(特別是 AI、人形機器人)取得具體有效突破的公司。點名小鵬汽車和禾賽科技。

- 看好領先的造車新勢力。報告對小鵬、理想、蔚來等新勢力保持樂觀,認為其更快的車型迭代、領先的智能駕駛技術和潛在的 “3A” 機遇將支持長期增長。

(摩根士丹利關於電動汽車評級排序,左高右低)

- 關注延遲復甦的國企。對於側重汽車本身的投資者,上汽集團和東風汽車等延遲復甦的國有車企,因其在 2026 年提供了更好的安全邊際而被看好。

(摩根士丹利關於國企 OEM 公司的評級排序,左高右低)

報告指出,雖然新技術普及需要時間,但影響將很快體現在投資者認知、戰略行動 (併購、戰略合作等) 以及最重要的股票估值中。

此外摩根士丹利強調,並非所有公司都能順利實現轉型,因為這需要產能重新定位、技術再利用、組織再發展以及在分銷和可持續性方面的再投資,能夠在 AI 顛覆中冒險尋找制勝方案的公司並不多。投資者還需警惕 2026 年初需求疲軟的可能性,以及價格戰可能損害年終銷量反彈的質量。