Is the market facing another liquidity crisis? SRF usage surges, and the Federal Reserve may be forced to ease earlier

在美聯儲準備金跌破 3 萬億美元、逆回購工具用量接近四年來新低之際,金融體系正顯現出從 “流動性充裕” 向 “緊張” 轉變的信號。本週三,美聯儲常備回購便利工具(SRF)突然被動用 67.5 億美元,為疫情以來非季末最高水平,市場資金缺口迅速暴露。SOFR 利差抬升疊加財政發債壓力回流市場,引發對下一輪流動性危機的擔憂。高盛與巴克萊已同步下調縮表結束時間預期,但有分析指出,美聯儲恐怕不僅需要 “急剎車”,還將很快被迫重啓流動性注入操作。

美聯儲尚未決定下一步的降息節奏,市場卻已率先敲響流動性警鐘。

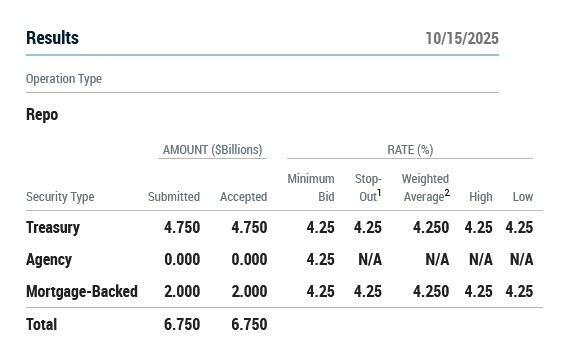

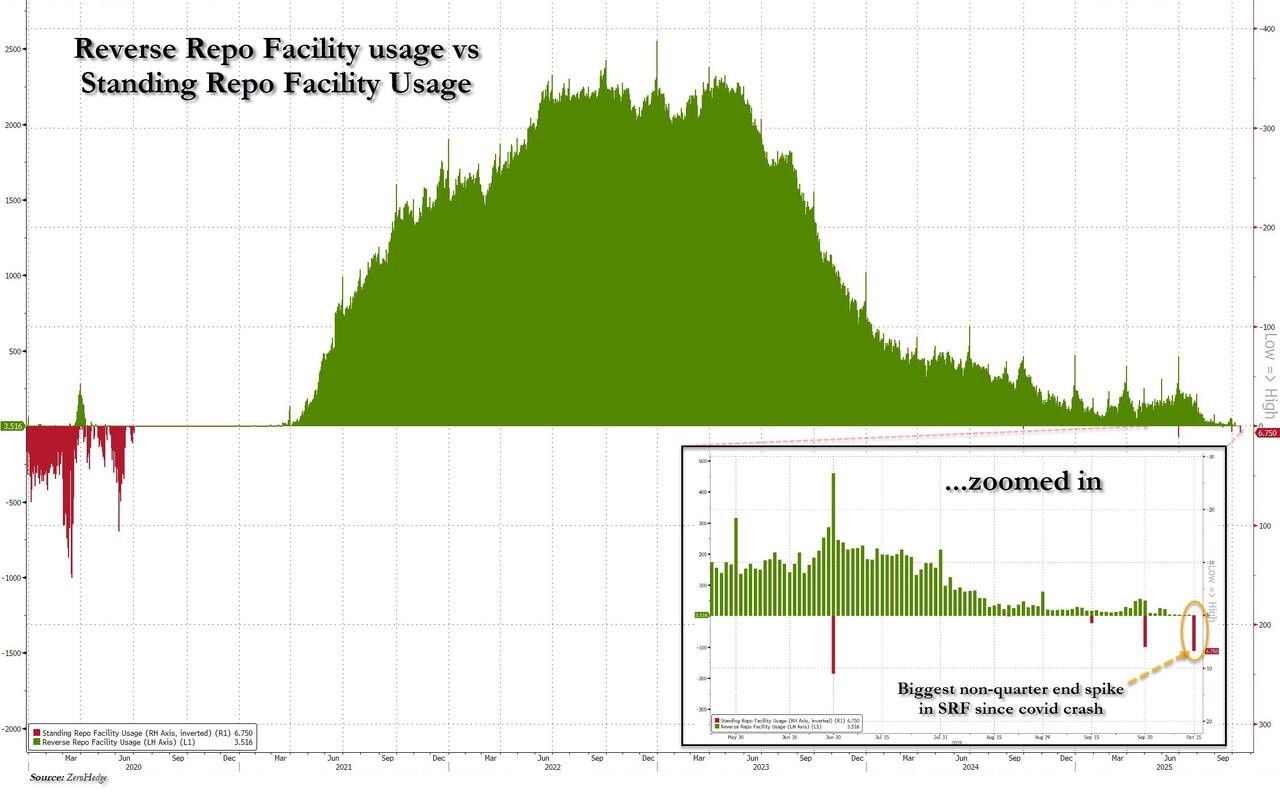

就在本週三早晨,美聯儲的常備回購便利工具(SRF)突然被大規模啓用,單日操作規模達 67.5 億美元,為今年二季度末以來最高,也是在非季末環境下自疫情以來的最大規模。

分析稱,種種跡象顯示,金融體系正從 “流動性充裕” 邁入 “流動性緊張” 區間,下一場資金危機或許比想象中更近。

銀行準備金跌破 3 萬億,美聯儲被迫 “放水” 預期升温

美聯儲在 9 月的聯邦公開市場委員會(FOMC)會議上決定降息,但主席鮑威爾並未給出未來寬鬆路徑的明確承諾,導致市場部分解讀為 “鷹派降息”。

但就在這之後幾天,更重要的一件事發生了:聯儲體系中的銀行準備金總額首次跌破 3 萬億美元。這一關口被多位聯儲官員視為 “充裕準備金” 與 “緊張準備金” 的分水嶺。

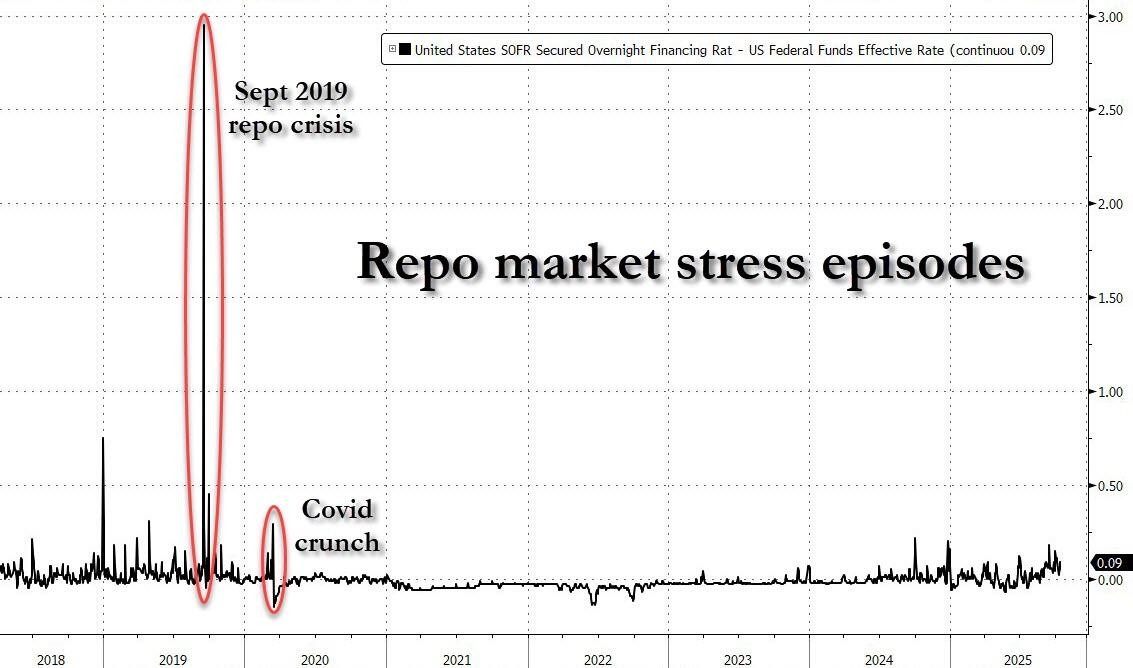

分析稱,一旦準備金變得稀缺,銀行融資鏈條將面臨壓力,回購市場可能失靈,甚至引發系統性震盪。2019 年 9 月的回購市場危機便是因流動性回撤過快所致,堪稱前車之鑑。

市場預警機制啓動,SRF 意外爆量使用

在當前環境下,聯儲降息本身已不足以緩解市場焦慮。市場開始尋找真正代表 “流動性壓力” 的早期信號,而 SOFR(擔保隔夜融資利率)與聯邦基金有效利率之間的利差,正是這類 “預警指標” 之一。

雖然這一利差近來已有輕微擴張,但始終未達到類似 2019 年危機時的極端水平。然而,本週三清晨,市場迎來了一個久違的流動性警訊:美聯儲的 SRF 機制突然被使用 67.5 億美元,遠超常態水平。

這一工具原本是聯儲在疫情後設置的緊急流動性兜底渠道,允許銀行以國債或機構債作為抵押換取現金,正常情況下很少使用。

歷史數據顯示,除季度末 “賬面調整” 時期外,SRF 在其他時間段幾乎無人問津,而本次操作卻打破了這一規律,説明市場真實流動性狀況已悄然轉變。

RRP 用量跌至四年新低,美債融資 “被動池” 正枯竭

流動性緊張的另一大根源,來自美聯儲的另一項關鍵工具——逆回購機制(RRP)。該機制原本用於吸收疫情期間釋放的大量超額資金,其餘額在 2022 年底一度達到 2.5 萬億美元高峰。

但自那之後持續回落,截至本週已跌至僅 35 億美元,為 2021 年 4 月以來最低。

這不僅是一個技術性指標變化,更意味着美債融資的 “被動池” 正在枯竭。過去兩年,正是 RRP 充足的環境,讓美國財政部可以持續發行 T-Bills(短期國債)而不對市場形成衝擊。如今隨着 RRP“水源見底”,財政發債的融資壓力將重新壓向銀行與資金市場。

鮑威爾鬆口:縮表終點或將提前,高盛巴克萊同步下調預期

面對這一形勢,美聯儲似乎已開始鬆口。鮑威爾本週二在全美商業經濟協會(NABE)年會上表示,美聯儲或將在 “未來幾個月” 內接近資產負債表縮減的 “停止點”。換言之,縮錶行動可能提前結束。

高盛隨即發佈研報,將原本預計 2025 年 3 月結束縮表的時間提前至 2025 年 2 月,並預測 FOMC 將在明年 1 月的會議上正式宣佈。巴克萊甚至更進一步,預計 FOMC 將在今年 12 月宣佈停止縮表,並於明年 1 月執行。

但問題在於,停止縮表可能還不夠。當前的流動性壓力可能迫使聯儲不只是暫停緊縮,更需重啓 “注水” 模式——包括量化寬鬆(QE)、回購工具。

關鍵指標跳升,流動性緊張跡象浮現

從美聯儲的兩個關鍵工具——逆回購機制(RRP)與常設回購機制(SRF)——的使用情況來看,市場流動性的狀況已經發生轉變。前者被視為流動性充裕的同步指標,後者則反映突發性流動性短缺。而從兩者此番出現的異常變動看,市場資金狀態 “發生了翻轉”——而且這次並非季末慣例造成。

本週三的 SRF 操作就是一個關鍵轉折。根據彭博社記者報道:

週三上午,市場機構在首輪 SRF 操作中借入 67.5 億美元;操作背景為隔夜回購利率高企,交易區間在 4.30%-4.34% 之間,普遍高於美聯儲政策利率;SRF 本意是短期緩衝工具,其使用量大增説明臨時資金壓力已超出市場自身調節能力。

此外,另一關鍵指標——SOFR 減去超額準備金利率(SOFR-ON RRP)——也在週三升至 4 個基點,為近年來非季末情況下的最高水平。

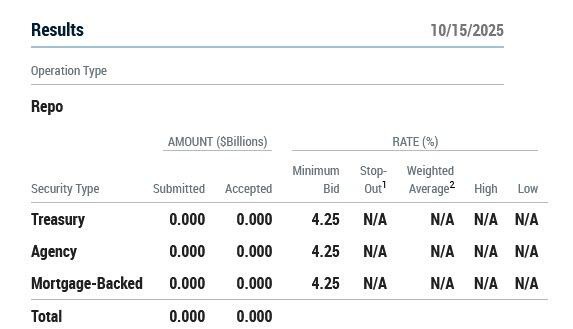

午後 SRF 歸零,警報是否暫時解除?

儘管週三上午的流動性操作顯得緊張,但美聯儲當天下午 1:30 至 1:45 的第二輪 SRF 拍賣無人申購。這被視為一個緩解信號,説明上午的臨時流動性需求可能已得到滿足,市場並未陷入持續性危機。

不過,觀察人士提醒,是否真能 “安然過關”,還需視接下來幾天 SRF 與 SOFR 指標是否持續回落。一旦這類流動性需求持續或進一步擴大,市場將進入倒計時,迫使美聯儲加快重啓流動性工具。

當前,所有目光都聚焦在 SOFR 的下一步走勢上。如果隔夜利率與官方政策利率之間的利差持續擴大,意味着市場將進入自我強化的 “資金短缺鏈條” 之中。而一旦這些指標繼續惡化,美聯儲或被迫在 FOMC 會議前提前出手。