Morgan Stanley's Q3 performance exceeded expectations across the board, with a rebound in investment banking becoming a highlight and the stock business contributing core momentum

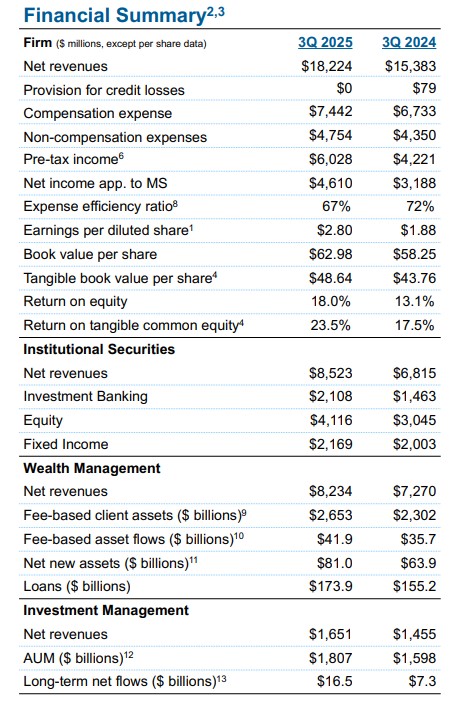

摩根士丹利第三季度净营收 182.2 亿美元,同比增长 18%,超出预估 166.4 亿美元;第三季度每股收益 2.80 美元,股本回报率 18%,超出预估 13.4%。其中,投行业务同比增长 44%,收入达到 21.08 亿美元;股票销售和交易业务营收 41.2 亿美元,远超预估的 34.1 亿美元。

摩根士丹利 Q3 财报交出了一份超预期的成绩单,净收入、每股收益、股本回报率三大核心指标均创同期纪录。

周三美股盘前,摩根士丹利发布 Q3 财报,第三季度净营收 182.2 亿美元,同比增长 18%,超出预估 166.4 亿美元;第三季度每股收益 2.80 美元,股本回报率 18%,预估 13.4%。

分业务来看,财富管理净营收 82.3 亿美元,预估 77.8 亿美元,股票交易收入激增 35% 至 41.2 亿美元,超出预估 34.1 亿美元,远超分析师预期的 6.6% 增幅,并超越高盛集团同类业务 37.4 亿美元的业绩。

值得一提的是,随着人们对美国信贷质量的担忧开始出现,大摩公布了一个值得注意的贷款损失准备金数字:0美元。大摩表示,贷款损失准备金较上年同期有所下降,主要原因是本季度宏观经济形势改善带来的好处较大,以及与投资组合增长相关的准备金减少。

投行业务反弹成亮点,股票业务贡献核心动能

机构证券板块 Q3 净收入 85.23 亿美元(同比 +25%),成为营收增长的主要推手,核心驱动力来自投行业务的强势反弹与股票业务的持续扩张。

-

投行业务同比 +44%:收入 21.08 亿美元,其中顾问业务 6.84 亿美元(同比 +25%),股权承销 6.52 亿美元(同比 +79%),债券承销 7.72 亿美元(同比 +39%)。财报提到 “IPO 及可转债发行活跃”,反映当前市场风险偏好回升,企业融资需求释放。但需注意,这一增长部分依赖于上半年积压项目的集中落地,后续若宏观利率环境波动,可能影响新增项目储备。

-

股票业务同比 +35%:收入 41.16 亿美元,机构经纪业务创纪录,客户交易活跃度提升。这与美股三季度波动加剧、对冲基金调仓需求增加直接相关,但高波动性的可持续性存疑。

-

固定收益业务略显平淡:收入 21.69 亿美元(同比 +8%),主要依赖信贷和大宗商品交易增长,外汇业务收入下滑形成拖累。在利率中枢仍处高位的背景下,固定收益作为 “压舱石” 的作用尚未完全发挥。

财富管理板块延续强势表现,净利息收入同比增长 12%

财富管理板块延续强势表现,Q3 净收入 82.34 亿美元(同比 +13%),税前利润率达 30.3%,创历史同期新高,印证了其 “稳定器” 属性。

-

净新增资产(NNA)810 亿美元:同比 +27%,创年内次高,其中 fee-based 资产流入 419 亿美元(同比 +17%),显示客户资金向收费型产品迁移趋势明显。截至 Q3 末,财富管理与投资管理合计客户资产达 8.9 万亿美元,规模效应下,资产管理费收入同比增长 12%。

-

净利息收入(NII)提升:贷款余额 1739 亿美元(同比 +12%),叠加利率维持高位,推动 NII 同比增长 12%,成为收入增长的第二曲线。但需关注后续若降息周期启动,NII 增速可能承压。

Q3 财报的另一大亮点是费用效率优化:总费用收入比降至 67%(去年同期 72%),年初至今 69%。具体来看,薪酬费用 74.42 亿美元(同比 +10%),与营收增长基本匹配;非薪酬费用 47.54 亿美元(同比 +9%),主要因交易执行相关支出增加,整体可控。

核心逻辑与预期差:“协同效应” 能否对冲周期波动?

摩根士丹利本季度的核心发展逻辑在于,其两大核心引擎在有利的市场环境下实现了完美共振。此前市场普遍预期投行业务将有所复苏,但高达 44% 的同比增长幅度,以及股票业务的创纪录表现,显然超出了大部分人的预期,这是本份财报最大的 “预期差”。

与此同时,财富管理业务不负众望,继续扮演着增长稳定器的角色,其持续的资产流入为公司提供了强大的财务安全垫,也为机构业务的扩张提供了资金支持。这种 “一体化投行” 模式,在顺周期时能放大收益,在逆周期时能抵御风险,其战略价值在本季度得到了淋漓尽致的体现。

此外,监管层面的一个利好也不应被忽视。美联储已同意将摩根士丹利的压力资本缓冲(SCB)从 5.1% 下调至 4.3%。这意味着监管机构对其风险管理的认可,更直接地意味着公司将被允许释放更多资本用于股票回购和分红,这对股东而言是实实在在的好处。