Zero revenue but a valuation of over 26 billion dollars? The most serious AI bubble is actually in energy stocks!

In the energy sector, the AI-driven speculation frenzy is accelerating, with some zero-revenue energy companies valued at over $45 billion. Oklo, a nuclear energy startup backed by the CEO of OpenAI, has a market capitalization of $26 billion, making it the largest zero-revenue publicly traded company. Investors' optimistic expectations for AI's future energy demand are driving this trend, but these companies face high risks; once the frenzy cools down, they will encounter significant drop risks due to a lack of revenue support

Forget about the valuation bubble of tech stocks; a genuine AI-driven speculative frenzy may be accumulating in the energy sector at an unprecedented pace. A group of energy companies with no revenue at all has seen their total market value soar to over $45 billion, supported solely by investors betting that tech giants will pay for their yet-to-be-built power generation facilities in the future.

The most striking case in this frenzy is Oklo, a nuclear energy startup backed by OpenAI CEO Sam Altman. According to data from S&P Global Market Intelligence, the company's stock price has surged about eightfold this year, reaching an astonishing market value of $26 billion, making it the largest U.S. publicly traded company with no revenue in the past 12 months.

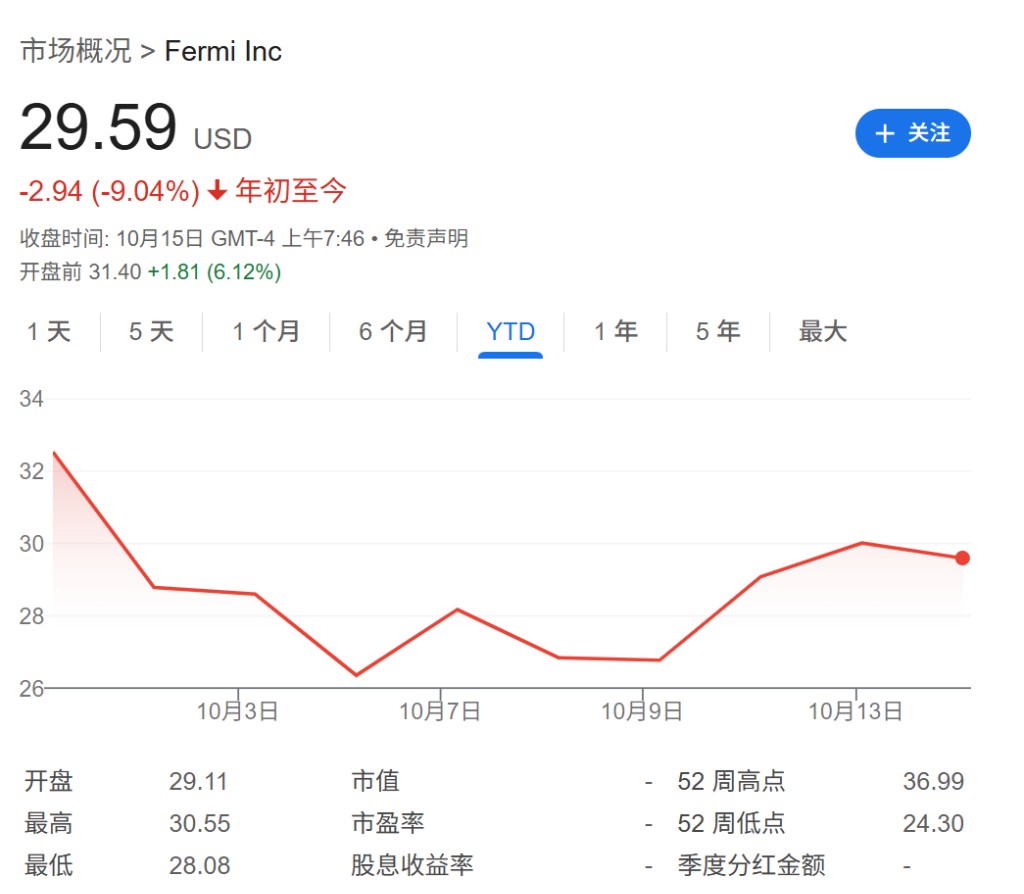

Another zero-revenue company, Fermi, is equally hot. The company was valued at around $19 billion on its first day of trading earlier this month, and its current market value still exceeds $17 billion. According to data from Jay Ritter, a finance professor at the University of Florida, historically, only two zero-revenue companies have had a market value exceeding Fermi's on their first day of trading, after adjusting for inflation.

This speculative wave highlights the market's extreme optimism about future energy demand driven by AI. However, unlike tech giants with massive profits that can withstand industry fluctuations, these energy startups have little room for error. Once the AI frenzy cools down, they will face the most severe risk of decline due to a lack of actual revenue support.

Betting on the Future of Nuclear Energy: Startup Valuations Soar

Against the backdrop of surging demand for AI computing power, investors are turning their attention to nuclear energy, which can provide stable, large-scale electricity, especially small modular reactors (SMRs).

Oklo is the star of this field, but its high valuation is built on a series of future possibilities. The company is developing SMRs that use liquid metal sodium as a coolant, but it has yet to obtain operational permits from the U.S. Nuclear Regulatory Commission and has not signed any binding contracts with power purchasers. Wall Street analysts expect Oklo may not generate significant revenue until 2028.

This frenzy is not an isolated case. Other companies developing smaller "micro-modular" nuclear reactors have also achieved high valuations. Nano Nuclear Energy, which went public last year, has seen its stock price rise more than double this year, with a valuation exceeding $2 billion. Meanwhile, Terra Innovatum, which went public through a SPAC merger last week, also has a market value exceeding $1 billion. These companies share a common characteristic: they have yet to achieve revenue but have already garnered enthusiastic support from the capital markets. **

Valuation Frenzy Spreads: From Natural Gas to Hydrogen

This energy investment frenzy triggered by AI is not limited to the nuclear sector. Fermi, led by former U.S. Energy Secretary Rick Perry and Toby Neugebauer, plans to build up to 11 gigawatts (GW) of power generation capacity for data centers, a scale equivalent to the total installed power generation capacity of the entire state of New Mexico.

Although the company's energy portfolio plan includes natural gas, nuclear, solar, and battery storage, it has so far only secured natural gas equipment that meets 5% of its total target, and it also lacks any binding customer contracts. Notably, its market value of over $17 billion is approaching that of Talen Energy, which already has about 11 GW of operational power generation assets.

In addition, some companies that have generated some revenue but are far from profitability are also caught up in this frenzy. Nuclear SMR company NuScale Power's stock price has soared 155% this year, with the company currently only earning some engineering and licensing fees from a SMR project in Romania. Similarly, hydrogen fuel cell company Plug Power, which has seen its stock price languish for years, has surged 90% this year due to the AI concept, reaching a market value of $4.8 billion. According to Wall Street analysts surveyed by FactSet, both companies are unlikely to achieve profitability before 2030.

History Repeats? Potential Risks Under High Valuations

One possible reason investors are flocking to these more speculative energy companies is that the valuations of those already profitable companies are also very high. Fuel cell company Bloom Energy's stock price has risen over 400% year-to-date, with a forward price-to-earnings ratio as high as 133 times. Nuclear fuel company Centrus Energy's forward price-to-earnings ratio has also reached 99 times. For investors seeking high returns, these lofty valuations may have led them to turn to more imaginative startups.

The influx of commercial interests may help push expensive or unproven technologies toward maturity. However, looking back at the history of electric vehicle startups with zero or minimal revenue that went public in 2020 (such as Nikola, Fisker, and Lordstown), the outcome often ends in a bubble burst rather than soaring success. That history suggests that many similar companies may ultimately fade away.

For investors, the risks are evident. If the AI boom ultimately proves to be a bubble, or if the growth in energy demand falls short of expectations, these energy companies that heavily rely on future expectations will face the greatest downward pressure. Without revenue as a safety net, they will be among the hardest hit.

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investing based on this is at your own risk