The "680 million annual salary" has once again pushed Li Xiang to the forefront

Still need to lead Li Auto to break through the next pass

Author | Chai Xuchen

Editor | Wang Xiaojun

A list of salaries for Hong Kong stock market tycoons has once again brought Li Xiang, the chairman of Li Auto, into the spotlight.

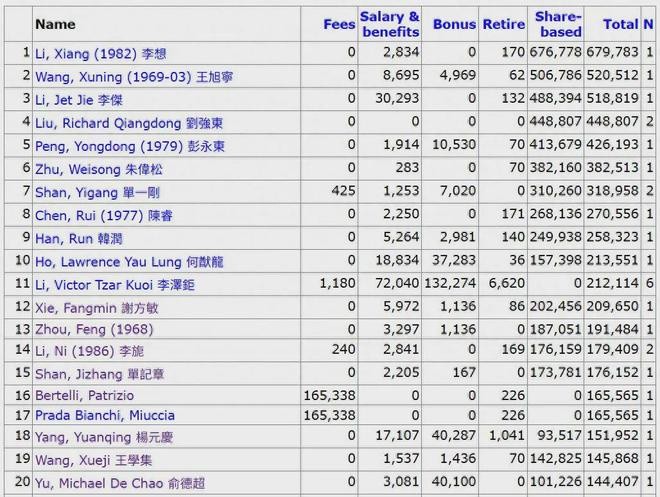

Recently, the financial website David Webb released the 2024 salary ranking of directors of Hong Kong-listed companies. The list shows that a total of 31 directors earned over HKD 100 million for the entire year, with Li Xiang, chairman and CEO of Li Auto, topping the list with a total salary of nearly HKD 680 million (approximately RMB 639 million).

Earning over 60 million annually has indeed left many workers feeling overwhelmed. It is worth mentioning that in the currently highly competitive automotive market, Li Xiang's ranking is somewhat "eye-catching." In comparison, the annual salaries of directors outside the list, such as Zhu Jiangming, chairman of Leapmotor, Wang Chuanfu, chairman of BYD, Wei Jianjun, chairman of Great Wall Motors, and He Xiaopeng, chairman of XPeng, ranged from HKD 8.1 million to HKD 1.7 million last year.

It can be said that Li Xiang has become the highest-earning executive among Hong Kong-listed automotive companies and even among all listed companies in Hong Kong last year. In fact, aside from chairman Li Xiang, the income of other executives at Li Auto is also enviable: President Ma Donghui's annual income reached HKD 40.27 million, and CFO Li Tie's annual income reached HKD 39.16 million.

It should be noted that in 2023, Li Xiang's total annual salary was only HKD 1.92 million. This has raised questions in the market about whether it is reasonable for Li Xiang and the executives to earn so much after selling 500,000 units last year. The financial report of Li Auto revealed the reasons behind this.

Last year, Li Xiang's salary of HKD 639 million consisted of two parts: a base salary of HKD 2.665 million and a share-based payment of HKD 636 million, which was confirmed in the year due to the completion of the first batch of assessments for the "CEO Award" in 2024. This share-based payment is the key part of Li Xiang's top ranking in salary.

Currently, Li Auto is implementing three phases of its equity incentive plan, namely the "2019 Plan," "2020 Plan," and "2021 Plan." The "CEO Award" is specifically designed for Li Xiang under the "2021 Plan" after Li Auto went public.

This plan grants Li Xiang a total of 10.86 million Class B common stock options, which will be divided into six batches, each corresponding to 18.09 million shares. Each batch's vesting requires meeting specific conditions, with the first batch requiring a delivery volume exceeding 500,000 units within any 12 months. Subsequent batches require deliveries of 1 million, 1.5 million, 2 million, 2.5 million, and 3 million units, respectively.

But after achieving the delivery of 500,000 units last year, did Li Xiang really receive over HKD 600 million in cash?

In fact, according to the aforementioned incentive plan, for Li Xiang to realize the options, he not only needs to meet the sales assessment but also must make the corresponding investment at a price of USD 14.63 per share (or USD 29.26 per ADS). However, based on Li Auto's stock price of USD 22.79 per ADS on October 14, it is clear that if Li Xiang exercises the options, he would still have to "top up" a significant amount himself Industry insiders point out that the over 600 million shares of stock payment under Li Xiang's name are not cash earnings that Li Xiang can directly obtain, but rather the cost that the company needs to bear to complete this incentive. According to relevant requirements of U.S. accounting, this portion of expenses will be marked as stock payment expenses in Li Xiang's total compensation.

Although Li Xiang's hundreds of millions in annual salary is a "false alarm." However, an undeniable fact is that Li Xiang is clearly unwilling to "pay out of pocket" to receive incentives in the future.

Last year, under Li Xiang's leadership, Li Auto's sales grew, but its stock price has fluctuated significantly this year; in contrast, Tencent's Ma Huateng has a lower salary compared to the company's stable performance. Therefore, how to stabilize sales and stock prices is crucial for whether Li Xiang can unlock more batches of incentives and lead Li Auto to become a giant.

Fairly speaking, Li Auto indeed urgently needs new growth points to break the deadlock. After the "refrigerator, color TV, and large sofa" and range extension strategies were replicated by peers, Li Auto has become a victim of "homogenization."

In the first half of this year, Li Auto's continuous 14-month year-on-year growth trend was halted, with total sales in the first half down 24%, overtaken by Hongmeng Zhixing. Under competition, Li Auto's advantage in the high-end market has been eroded. The overall market share of the L7/L8/L9 series has dropped from 32% in the same period last year to 26% now, with the entry-level L6 becoming the main sales model, accounting for over 40%.

Entering 2025, Li Auto urgently needs to find new growth points in the pure electric market; the i series and AI strategy must not fail, and the market is eager to see Li Auto restart its growth. Only in this way can Li Auto's dream of becoming an automotive giant be realized, and in the future, Li Xiang can rightfully become the "salary king" of Hong Kong stocks