Gold: How much to allocate and when to sell?

U.S. stock indices fell, and risk aversion drove gold prices up, with London gold closing at $4,017.845 per ounce and Shanghai gold at 913.26 yuan per gram. In the medium to long term, gold is viewed positively, and it is recommended that the proportion of gold in residents' asset allocation be 2-10%, while institutions can appropriately increase this. Ray Dalio believes a reasonable proportion is 15%, while Jeffrey Gundlach suggests it could be as high as 25%. Gold is an effective safe-haven asset during periods of high inflation and geopolitical uncertainty. The investment portfolio should adopt a simple rebalancing model, with the gold allocation ratio based on risk diversification

Matters

With the decline of the three major U.S. stock indices, risk aversion has driven gold prices to continue rising. As of October 12, 2025, the price of London gold closed at $4,017.845 per ounce, and Shanghai gold closed at 913.26 yuan per gram. We remain optimistic about the medium to long-term price trend of gold, with a suitable proportion of gold in residents' asset allocation being between 2-10%, while institutional allocation can be appropriately increased.

Views

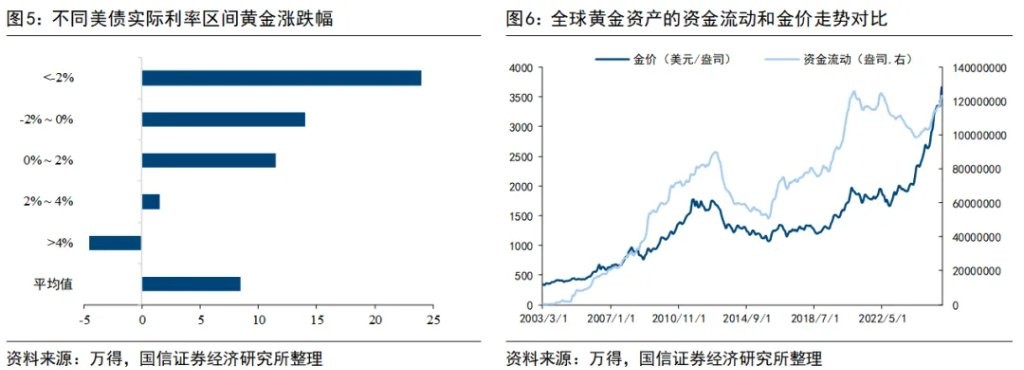

Gold plays an important role in asset allocation for diversification and risk hedging, and the topics of missing out on price increases and allocation ratios are of concern to the market. Regarding the optimal allocation ratio for gold, Ray Dalio recently suggested that a reasonable proportion is 15%, as the current economic environment of high inflation and high government debt is similar to that of the 1970s. In this context, holding cash and bonds is not an effective means of wealth preservation, while gold is a safe-haven asset independent of the credit system, capable of providing a hedge during periods of currency depreciation and geopolitical uncertainty. Jeffrey Gundlach believes the ratio could be as high as 25%, based on his judgment of a weakening dollar and persistent inflationary pressures. He views gold as a form of insurance and predicts that gold will continue to perform well in an environment of negative real interest rates.

If we extrapolate the past two years of gold price trends in a linear fashion, we would conclude that a higher allocation to gold is better. However, encountering a turning point in gold prices in the future would be a very dangerous signal, easily leading to the same mistakes made by Paulson in 2013. We constructed an investment portfolio using a simple rebalancing model of four asset classes: stocks, bonds, cash, and commodities (25±10%, returning to a balanced ratio of 25% when hitting the lower/upper limits of 15% and 35%). Since 2013, the net value has reached 4.14, making it difficult to outperform the net value level of gold, which has been above 5.84 during the same period, especially with significant underperformance since 2023. Similar to how risk parity strategies assigned the highest possible weight to bonds over the past 3-5 years, an overweight in bonds only pertains to a long-term bull market in bonds. Once a seesaw reversal occurs, a neutral strategy can easily falter. Starting from certainty and determining the allocation based on long-term gold reviews is more critical than timing to find the peak gold price.

For household asset allocation, from the perspective of risk diversification, a gold proportion of 2-10% is more appropriate. For instance, from 2005 to 2019, a global multi-asset portfolio that allocated 2% to 10% of its assets to gold showed improvements in cumulative returns, Sharpe ratios, and maximum drawdowns compared to portfolios without gold. For example, a portfolio with 10% gold allocation achieved a cumulative return of 138.50%, a Sharpe ratio of 0.52, and a maximum drawdown of -29.43%, significantly outperforming a portfolio without gold allocation (cumulative return of 126.10%, Sharpe ratio of 0.46, maximum drawdown of -33.29%). This indicates that gold makes a substantial contribution to enhancing risk-adjusted returns and controlling downside risk in the portfolio For institutional asset management products, gold asset allocation can be moderately increased to over 10%. If we analyze the traditional 60/40 stock-bond portfolio using mean-variance optimization, the optimal allocation of gold in the portfolio averaged 18% from 1972 to 2014. Gold not only performs robustly in different inflation environments, especially when the annual inflation rate exceeds 5%, with an average annual return of 16.2%, but also exhibits positive or low negative correlation return characteristics during downturns in the stock, bond, and commodity markets. Overall, gold, as a non-correlated asset, can effectively enhance portfolio resilience, and its strategic allocation value is particularly prominent in today's global environment of high debt, low real interest rates, and geopolitical uncertainty. In the context of low long-term bond yields and insufficient coupon protection, asset allocation has shifted from a bond-based "fixed income +" to a "gold +" paradigm.

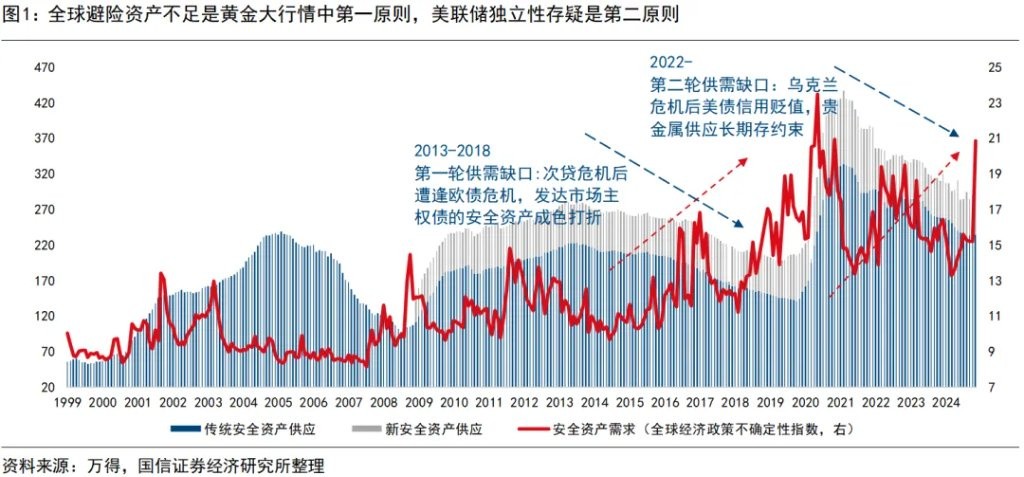

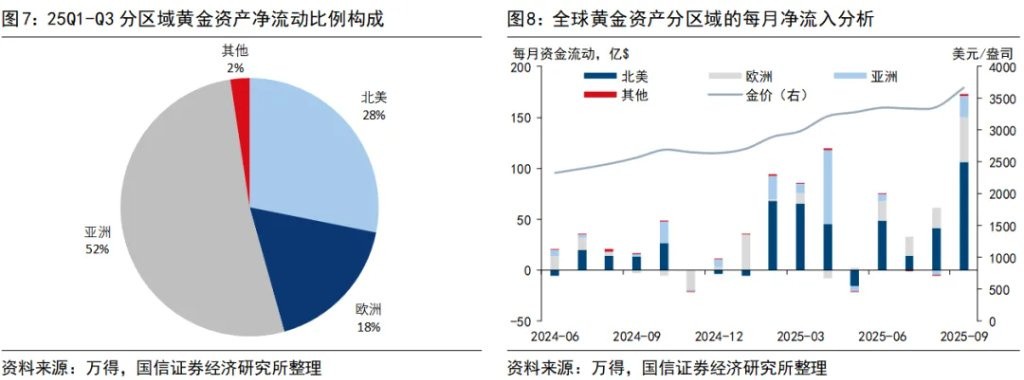

The gold market maintains a long-term optimistic view, and it is currently difficult to say we have reached a peak. We have been continuously recommending gold allocation opportunities since the second half of 2023. The first allocation principle is that there is a global shortage of safe-haven assets following the outbreak of the Ukraine crisis, marked by the inconsistency of the US and Europe in handling Russian and Ukrainian assets against common sense regarding safe assets; the second allocation principle is that the market believes the Federal Reserve lacks credibility, triggered by pressure from Trump combined with the Fed's "embarrassing rate cut" in September 2025. The essence of the first two principles is the re-evaluation of the dollar's credit leading to an increase in gold's value, while factors like interest rates and consumption are marginal pricing factors. The opportunity for the third wave of gold may be triggered by a reallocation of funds brought about by the peak of the overseas artificial intelligence technology wave, which currently shows no signs. In 2003-2004 and 2006-2007, US tech stocks and gold rose together, and the same logic applies to the end of the tech wave and the overvaluation of gold, with risk aversion spreading from geopolitical factors to capital flows, and the third phase signal has not yet been triggered.

Author of this article: Wang Kai, Source: Macro Asset Allocation Research, Original Title: "Wang Kai | Gold: How Much to Allocate, When to Sell"

Author of this article: Wang Kai, Source: Macro Asset Allocation Research, Original Title: "Wang Kai | Gold: How Much to Allocate, When to Sell"

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investing based on this is at one's own risk