摩根大通 Q3 利润超预期,投行收入激增 16%,交易业务创纪录

More news, ongoing updates

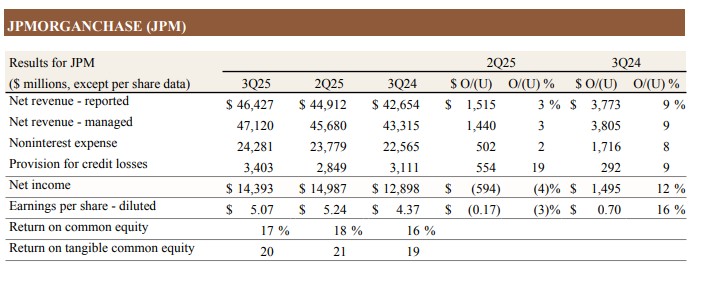

On Tuesday before the U.S. stock market opened, JPMorgan Chase released its third-quarter financial report, which showed adjusted revenue of $47.12 billion, exceeding the estimate of $45.48 billion; profit of $14 billion, a year-on-year increase of 12%; earnings per share of $5.07, a year-on-year increase of 16%; and a return on tangible common equity (ROTCE) of 20%, significantly up from 19% in the same period last year.

In terms of specific business segments, investment banking has fully recovered, with fee income of $2.6 billion, a year-on-year increase of 16%; ranked first in global investment banking fees with a market share of 8.7%; ECM and M&A activities have shown significant recovery; trading business reached a historical high, with revenue of $8.9 billion, a year-on-year surge of 25%, setting a record for Q3; fixed income trading grew by 21%, and equity trading skyrocketed by 33%.

However, credit cost pressures have increased, with credit loss provisions of $3.4 billion and net charge-offs of $2.6 billion; net provisions increased by $810 million, mainly concentrated in consumer business. Nevertheless, the capital adequacy ratio remains robust, with a CET1 ratio of 14.8% (standard method) and 14.9% (advanced method); book value per share is $124.96, a year-on-year increase of 9%.

JPMorgan Chase CEO Jamie Dimon stated that the U.S. economy remains resilient overall, but the level of uncertainty is still rising, with some signs of weakness, especially in employment growth.

Strong Recovery in Investment Banking, but Sustainability is Questionable

The 16% growth in investment banking revenue is undoubtedly the most impressive data of the quarter. Driven by the recovery in ECM and M&A activities, JPMorgan Chase has reaffirmed its position as the global investment banking leader, with a market share of 8.7%, leading its peers.

However, this recovery relies more on improvements in the market environment rather than structural changes. CEO Dimon also admitted that there are still challenges such as "complex geopolitical conditions, tariffs, and trade uncertainties," which could reverse the trend of recovery in investment banking at any time.

Notably, trading revenue reached a historical high, with income of $8.9 billion, a year-on-year surge of 25%. The 21% growth in fixed income trading and the 33% surge in equity trading were mainly benefited from market volatility and increased client activity.

However, the high volatility of trading revenue means that such performance is difficult to replicate, especially when the market tends to calm down.

Slowdown in Consumer Banking Growth, Rising Credit Risks

The performance of the Consumer and Community Banking (CCB) segment shows a divergent pattern. On one hand, net income of $5 billion, a year-on-year increase of 24%, seems strong, but deeper data shows that the growth momentum is weakening. Average loans grew only 1% year-on-year, and the net charge-off rate for credit card services climbed to 3.15%, reflecting a marginal deterioration in consumer credit quality.

Particularly noteworthy is that credit loss provisions reached $2.5 billion, with provisions for credit card business increasing by $550 million. This trend sharply contrasts with the Federal Reserve's interest rate cut cycle, indicating the bank's cautious attitude towards the economic outlook Dimon mentioned that the "signs of weak job growth" further confirm the pressure that consumers' financial conditions may face.

Capital return hits a new high, but valuation pressure remains

A 20% return on tangible common equity (ROTCE) is another highlight of this quarter, significantly surpassing most peers.

However, this performance largely benefited from exceptionally strong trading income and a cyclical recovery in investment banking. A more sustainable indicator is that net interest margin continues to be under pressure, with net interest income excluding market activities flat year-on-year, reflecting the impact of changes in the interest rate environment on traditional banking operations.

In terms of capital return, JPMorgan Chase repurchased $8 billion in stock this quarter, with a net payout ratio of 73% over the past 12 months. This aggressive capital return strategy has certainly boosted earnings per share, but it has also raised concerns about insufficient investment for future growth.

Expectation gap and investment logic

The market had previously held a cautious attitude towards the Q3 performance of large banks, mainly worrying about net interest margin compression and rising credit costs. JPMorgan Chase's performance alleviated some of these concerns, but the real expectation gap lies in the better-than-expected performance of trading operations. The $8.9 billion in trading income not only set a historical record for Q3 but, more importantly, demonstrated the bank's profitability amid market volatility.

However, investors need to view this "better-than-expected" performance rationally. The high volatility of trading income means that the next quarter may face mean reversion pressure. More critically, the current strong performance largely relies on favorable macro conditions, and the uncertainty factors that Dimon repeatedly emphasizes could become a drag on performance at any time.

From a long-term investment logic perspective, JPMorgan Chase's core competitive advantage still lies in its diversified business portfolio and strong capital strength. The $15 trillion in cash and securities provides ample liquidity buffer, and the 14.8% CET1 ratio far exceeds regulatory requirements. However, at the current valuation level, investors should focus more on the sustainability of business growth rather than short-term performance spikes.

Continuously updated