U.S. Stock Market Outlook | Three Major Index Futures Rise Together, Earnings Season Kicks Off

10 月 13 日美股三大股指期貨齊漲,道指期貨漲 0.77%,標普 500 指數期貨漲 1.14%,納指期貨漲 1.69%。本週將迎來關鍵財報季,六大銀行的業績將成為市場焦點,預計表現強勁。市場情緒因貿易戰風險和政府停擺而惡化,投資者需為財報季的波動做好準備,預計標普 500 成分股公司股價將波動 4.7%。

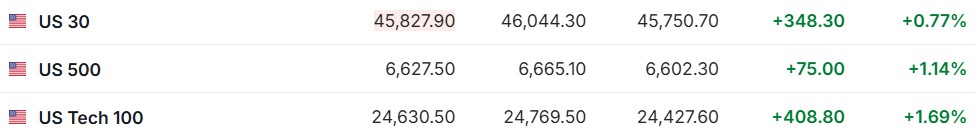

1. 10 月 13 日 (週一) 美股盤前,美股三大股指期貨齊漲。截至發稿,道指期貨漲 0.77%,標普 500 指數期貨漲 1.14%,納指期貨漲 1.69%。

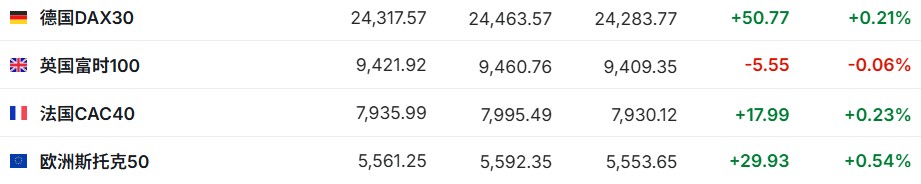

2. 截至發稿,德國 DAX 指數漲 0.21%,英國富時 100 指數跌 0.06%,法國 CAC40 指數漲 0.23%,歐洲斯托克 50 指數漲 0.54%。

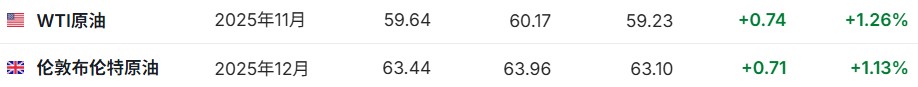

3. 截至發稿,WTI 原油漲 1.26%,報 59.64 美元/桶。布倫特原油漲 1.13%,報 63.44 美元/桶。

市場消息

美股迎關鍵財報周!六大行業績成市場 “試金石”,能否對沖政治僵局陰霾?受貿易戰風險加劇、美國聯邦政府停擺持續等因素影響,市場情緒迅速惡化導致美股上週遭遇 “黑色星期五”。在即將到來的一週裏,由於華盛頓的政治僵局仍在持續,市場將無法獲得若干關鍵經濟數據的更新,包括進口價格、零售銷售和初請失業金等數據。美股新一輪財報季將於本週拉開帷幕,打頭陣的美國六大銀行——摩根大通、高盛、摩根士丹利、美國銀行、花旗以及富國銀行——的業績將成為焦點。市場預計得益於投行業務的強勢復甦,加上美國經濟的韌性令借款人保持良好狀態並支撐消費者和商業貸款部門,這六大銀行的第三季度業績將表現強勁。

牛市面臨考驗!期權市場預示美股將迎 2022 年以來最動盪財報季。美股投資者們再次為即將到來的財報季的股市波動做好了準備。數據顯示,對標普 500 指數成分股公司的股票期權走勢顯示,公司業績公佈後,股價平均預計將波動 4.7%。這一波動幅度與 7 月份的情況較為接近。當時,預計的股價變動幅度是自 2022 年以來財報季開始時的最高值,財報季開始日期則以摩根大通 (JPM.US) 的業績公佈日期為準。期權價格的上升彰顯了美股牛市面臨的風險,尤其是在標普 500 因特朗普威脅對華加徵更高關税而暴跌之後。除了特朗普的經濟政策和貿易爭端給企業盈利帶來不確定性,美國政府停擺問題引發擔憂,以及人工智能股票可能形成泡沫風險。

美股牛市迎三週年!“科技獨角戲” 難持久,美股亟需 “擴圈” 以續命。美國股市的本輪牛市將在上週日迎來三週年紀念,但如果歷史可以作為參考,它需要儘快擴大上漲範圍,才能保持動力。數據顯示,標普 500 指數自 2022 年 10 月 12 日開啓當前牛市以來累計上漲 83%,市值增加約 28 萬億美元。在上週五因美國總統特朗普發出關税威脅而導致的拋售之前,該指數的漲幅一度達到 88%。根據 CFRA Research 的數據,即便經歷了這次回調,標普 500 在過去 12 個月中仍上漲 13%,是牛市第三年平均漲幅的兩倍。自二戰以來,美國共有 13 輪牛市,其中 7 輪延續到了第四年,平均累計漲幅為 88%。

規模驚人!美國防部擬斥資 10 億美元囤積關鍵礦產以強化戰略儲備。美國國防部正計劃採購價值高達 10 億美元的關鍵礦產,作為強化金屬供應安全、確保美國國防系統及先進技術所需原材料供應的最新舉措。根據國防後勤局 (Defense Logistics Agency,簡稱 DLA) 最近公佈的文件,這一行動標誌着美國戰略物資儲備數年來最大規模的擴張之一。一位前美國國防部官員形容該計劃 “深思熟慮且影響深遠”,並指出國防部正在 “積極尋找新的戰略資源與材料” 以維護國家安全。另一位前官員表示,此次行動的規模——約 10 億美元——意味着美國國防部在重建戰略儲備的努力上顯著提速。

關税風暴再起,華爾街押寶 “新型避風港”——中國價值股。隨着最新一輪中美貿易緊張局勢顯著升温,來自華爾街金融巨頭的頂級策略師們表示,除了黃金與美債這兩大傳統意義上的避險資產,全球投資者們還應將配置重點轉向一種新型避險勢力——即中國股市中估值相對便宜且具防禦性的價值股板塊。此外,從更加長期的股票投資視野來看,中國科技股仍將是值得投資者們最為青睞的市場板塊之一。隨着押注特朗普政府關税立場將大幅緩和的 “TACO 交易” 有可能時隔半年之久再度席捲全球,與人工智能密切相關聯的熱門中國科技股或將是全球資金在中長期範圍內的重點配置板塊。

歐佩克維持全球原油需求增長預期,預計明年供應缺口顯著收窄。歐佩克週一表示,維持今年及明年的全球原油需求增長預期不變,並預計隨着歐佩克 + 加快增產步伐,2026 年的市場供應缺口將明顯縮小。歐佩克 + 近期加大原油供應力度,此前該組織決定比原計劃更快地撤銷部分減產措施。歐佩克週一報告指出,雖然原油需求預計保持穩定,但歐佩克 + 在 9 月將日產量提高了 63 萬桶至 4305 萬桶,反映出此前已批准的增產配額落實情況。根據計算結果,若歐佩克 + 維持 9 月的產量水平,市場對歐佩克 + 原油的平均需求約為每日 4310 萬桶,意味着全球石油市場的供應缺口僅為每日 5 萬桶。

個股消息

3700 億暴漲是否曇花一現?甲骨文 (ORCL.US) AI 大會成關鍵驗證時刻。甲骨文本週將有機會向投資者證明,其今年市值增長約 3700 億美元的股價漲勢具有堅實基礎。這家軟件製造商週一在拉斯維加斯揭幕為期四天的"AI 世界大會"。會議焦點將集中在甲骨文的雲計算業務上——該業務的快速擴張推動其股價今年累計上漲 76%,使其成為標普 500 指數 2025 年表現最佳的成分股之一。此次會議正值市場擔憂甲骨文為向 OpenAI 等 AI 公司出租算力而犧牲利潤之際。上週,媒體稱甲骨文雲業務利潤率低於華爾街多數預期,導致其股價週二盤中暴跌 7.1%。甲骨文曾預測該業務未來三個財年收入將激增 700%。

REITs 巨頭 Tritax10 億英鎊收購黑石 (BX.US) 英國倉儲資產,將以 9% 股權支付部分對價。黑石已同意將其持有的價值 10 億英鎊 (約合 13 億美元) 的英國倉儲資產組合出售給 Tritax Big Box 房地產投資信託基金,這筆交易將使這家另類資產管理公司獲得該業主的部分股權。根據週一發佈的聲明,Tritax 將支付 6.32 億英鎊現金 (資金來源於一筆 6.5 億英鎊的貸款),並向黑石集團發行價值 3.75 億英鎊的新股,這將使總部位於紐約的黑石獲得約 9% 的股權。Tritax 將以每股 161 便士的價格向黑石集團發行股票,較其上週五收盤價有 13.5% 的溢價,但低於該業主報告的截至 6 月的六個月期間每股 188.17 便士的 EPRA 淨資產值。

暴跌後果斷出手!MARA(MARA.US) 豪擲 4600 萬美元抄底比特幣。在加密貨幣市場經歷歷史性暴跌後,機構投資者似乎將此次回調視為佈局良機而非持續疲軟的開端。據報道,比特幣礦企 MARA Holdings 早些時候從機構加密貨幣流動性提供商 FalconX 大手筆收購 400 枚比特幣,價值達 4629 萬美元。據 Bitcoin Treasuries Net 數據顯示,此次交易通過 MARA 旗下 “3MYao” 錢包地址完成。交易後,這家上市礦企的比特幣總持倉量突破 5.3 萬枚,繼續穩居企業持幣量排行榜次席,僅次於持有 640,031 枚比特幣的 Strategy(MSTR.US)。

AI 需求推升芯片價格,三星電子 Q3 利潤或創三年新高。受客户重建庫存帶動服務器需求激增影響,內存芯片價格持續上漲,市場預期三星電子第三季度利潤將創下 2022 年以來新高。據 LSEG SmartEstimate 對 31 位分析師的預測顯示,這家全球最大內存芯片製造商 2025 年 7-9 月營業利潤預計達 10.1 萬億韓元 (約合 71.1 億美元),較上年同期同比增長 10%。該預測更側重於歷史預測準確率高的分析師觀點。此次復甦主要得益於傳統內存芯片定價提升,有效抵消了高帶寬內存芯片銷量疲軟的影響。由於三星尚未向英偉達 (NVDA.US) 供應最新 HBM 產品,其 HBM 芯片業務表現相對滯後。

重要經濟數據和事件預告

次日北京時間凌晨 00:10:2026 年 FOMC 票委、費城聯儲主席保爾森發表講話。

待定 世界銀行和 IMF 舉辦 2025 年秋季年會,至 10 月 18 日,世界金融領導人將齊聚於此。

業績預告

週二盤前:愛立信 (ERIC.US)、摩根大通 (JPM.US)、富國銀行 (WFC.US)、高盛 (GS.US)、花旗 (C.US)、貝萊德 (BLK.US)、強生 (JNJ.US)