Bank of America Hartnett: The currency devaluation trade is far from over, and gold is expected to hit $6,000 next spring

Michael Hartnett, Chief Investment Strategist at Bank of America, stated that the long-term outlook for currency depreciation trades remains optimistic, with gold prices expected to hit $6,000 in the spring of next year. He pointed out that although gold and silver have undergone a round of adjustments, this has created better entry opportunities for subsequent increases. Hartnett emphasized that changes in Federal Reserve policy, government stimulus measures, and gold revaluation will support currency depreciation trades. Data shows that the proportion of gold in institutional and private client asset allocations remains relatively low, indicating that the market's structural bullish positioning on gold is not crowded, leaving ample room for future price increases

Michael Hartnett, Chief Investment Strategist at Bank of America, stated that the long-term outlook for currency depreciation trades remains optimistic, predicting that based on historical bull market performance, gold prices could surge to $6,000 by next spring.

In a report last week, Hartnett pointed out that the "overheated" precious metals market has undergone a round of adjustments, with gold failing to break through $4,000 and silver facing pressure around $50, primarily due to short covering of dollar trades. He believes this adjustment creates better entry opportunities for subsequent price increases.

The strategist emphasized that expectations of changes in Federal Reserve policy, government stimulus measures, and a potential gold revaluation (similar to those in 1934 and 1973) will support currency depreciation trades.

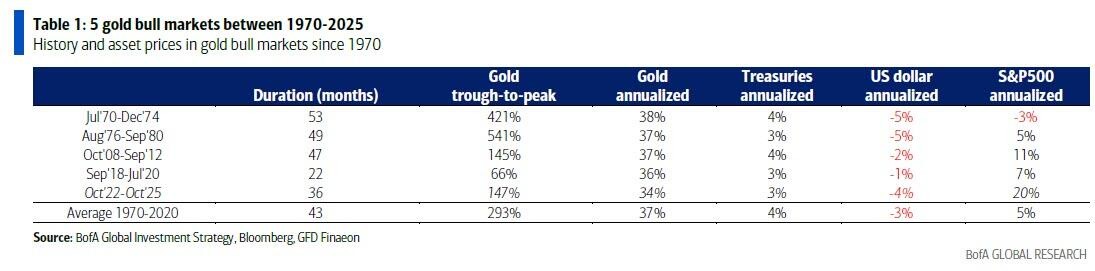

Based on historical data from the past four bull markets, Hartnett calculated that gold has averaged a price increase of about 300% over a duration of 43 months, suggesting that gold prices could peak at $6,000 by next spring, which would require investors to increase their purchases by 28%.

Bank of America data shows that the allocation of gold in institutional and private client portfolios remains relatively low, at only 2.3% and 0.5%, respectively, indicating that the market's structural bullish positioning in gold is not crowded.

Institutional Allocation Still Insufficient, Ample Room for Growth

Despite the recent significant rise in gold prices, the allocation ratio among institutional investors remains low. According to Bank of America data, gold accounts for only 0.5% of private client asset allocations and 2.3% of institutional client allocations.

This level of allocation indicates that few investors are structurally bullish on gold. The relatively low holding ratio provides ample room for future price increases and reduces the risk of sharp price declines due to large-scale sell-offs.

Hartnett believes that the current state of insufficient allocation contrasts sharply with gold's long-term investment value, offering potential opportunities for investors who position themselves early.

Policy Expectations and Historical Revaluation Support Long-Term Trends

Factors driving long-term increases in gold include early positioning for the new Federal Reserve Chair, the implementation of prosperity bubble policies, and the upcoming gold revaluation. Hartnett specifically mentioned historical precedents for gold revaluation similar to those in 1934 and 1973.

Policies such as the Argentine rescue plan are seen as typical representatives of "prosperity bubble policies," which usually raise inflation expectations and thus support demand for inflation-hedging assets like gold.

The logical basis for currency depreciation trades lies in the loose monetary policies adopted by central banks worldwide to stimulate economic growth, which could ultimately lead to a decline in the purchasing power of fiat currencies, making physical assets like gold more attractive.

Commodities Market Restructuring Imminent

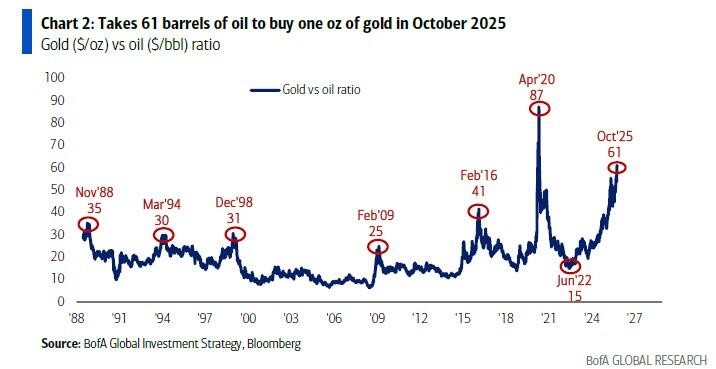

Hartnett noted significant changes in the commodities market. In June 2022, 15 barrels of oil could buy 1 ounce of gold; now it takes 61 barrels, a combination of a sharp decline in oil prices alongside a significant rise in gold that is historically anomalous

Looking ahead, Hartnett expects oil prices may further drop to $50 per barrel, which would be the biggest positive surprise in the fourth quarter. He believes that the increase in OPEC supply, driven by Trump's Gaza peace agreement, will lower oil prices, benefiting both inflation control and consumer welfare, as well as meeting the electricity demand for AI development.

The strategist also suggests tactically going long on the dollar and zero-coupon bonds as effective hedging tools against the risk contagion from subprime consumers.

In addition, Bank of America expects both gold and silver prices to rise further next year, raising its 2026 gold price forecast to $5,000 per ounce, with an average price of $4,400; and raising its silver price forecast to $65 per ounce, with an average price of $56.25.

Risk Warning and Disclaimer

The market carries risks, and investments should be made cautiously. This article does not constitute personal investment advice and does not take into account the specific investment objectives, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk