The crisis under the feast of US stocks: valuations approaching perfection, but profit expectations are already turbulent

美股在接近歷史高點時,分析師對企業盈利的樂觀情緒顯露疲軟,可能影響本財報季的漲勢。花旗的盈利預期調整指數自 8 月以來首次持平,標普 500 的預期市盈率已達 22 倍,超出過去十年的平均水平。儘管一些公司如李維斯和特斯拉發佈了積極的業績預告,股價卻未能如預期上漲。市場情緒受到特朗普關税威脅的影響,但近期期貨價格有所反彈。

智通財經 APP 獲悉,就在美股逼近歷史高點之際,分析師對企業盈利的樂觀情緒正顯露疲軟跡象,這意味着在本財報季,美股漲勢可能遭遇阻礙。

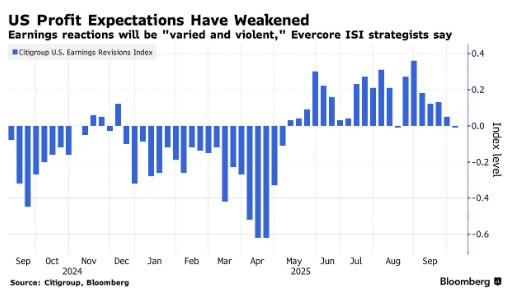

花旗一項追蹤美國企業盈利預期調整的指數——即分析師上調與下調盈利預期的數量對比——自 8 月以來首次持平。與此同時,標普 500 指數的預期市盈率已達 22 倍,高於過去十年近 19 倍的平均水平。

Evercore ISI 策略師 Julian Emanuel 在一份報告中指出,盈利對股價的影響將 “將呈現分化且劇烈的態勢,難以成為推動指數上行的催化劑”,他還補充稱,當前市場已處於 “接近完美定價” 的狀態。

本週二,摩根大通 (JPM.US)、花旗 (C.US) 等銀行將率先發布財報,標誌着美股第三季度財報季正式進入高峰。從早期市場反應來看,投資者的預期已處於高位。

以李維斯 (LEVI.US) 為例,儘管該服裝企業上調了盈利指引,但在今年股價已累計上漲 42% 的背景下,其業績仍未達到市場預期,導致股價在週五單日下跌 13%。特斯拉 (TSLA.US) 的情況類似:儘管該公司公佈的第三季度汽車交付量創下紀錄 (多數分析師此前已預計其季度表現強勁),股價卻依舊走低。特斯拉將於 10 月 22 日發佈該季度完整財報。

上週,受人工智能領域樂觀前景及美國經濟穩健表現的推動,美股創下歷史新高。但隨後,特朗普針對中國發出的關税威脅扭轉了市場情緒。不過,週一美股期貨價格呈現反彈趨勢,原因是特朗普釋放出願與中方達成協議的信號。

加拿大皇家銀行資本市場策略師 Lori Calvasina 表示,由於企業受到關税政策的衝擊加劇,本季度盈利超預期的企業比例可能會低於上一季度。數據顯示,分析師當前預計美國企業盈利同比增幅為 7.4%,這一增速將是兩年來的最低水平。

Calvasina 指出:“對於標普 500 指數成分股中的那些市值龍頭企業而言,市場對其盈利的情緒正處於關鍵轉折點。”

另一方面,摩根士丹利的策略師則認為,當前盈利預期調整廣度的惡化,與 10 月通常較弱的季節性趨勢相符。他們在報告中寫道:“鑑於我們預計 2026 年企業盈利預期將進一步改善,我們認為當前的調整隻是市場後續上行前的短暫停頓。”