Goldman Sachs trader: Last Friday's performance of the US stock market was more like "protection" rather than "exit"

高盛交易员 Lee Coppersmith 认为,上周五,投资者主要通过期权等衍生品工具进行风险管理,而非大规模抛售股票。虽然期权交易量创历史纪录,但现货股票交易相对平静,标普 500 成交量仅比均线高 9%。市场关注系统性抛售触发点,CTA 策略多头仓位接近上限。投资者情绪仍有韧性,AI 发展和劳动力市场担忧两大主题延续,将在即将到来的财报季中占据中心位置。

上周五美股市场出现大幅波动,期权交易量创下历史纪录,但高盛资深交易员 Lee Coppersmith 表示,市场表现更像是投资者急于保护仓位,而非大举退出股市。

上周五,贸易和关税相关消息引发了对 4 月份市场动荡重演的担忧,但是在高盛交易员 Lee Coppersmith 看来,虽然期权市场异常活跃,但是现货股票交易相对平静,且标普 500 指数成交量仅比 20 日移动平均线高出 9%,显示投资者主要通过衍生品工具进行风险管理,而非大规模抛售股票。

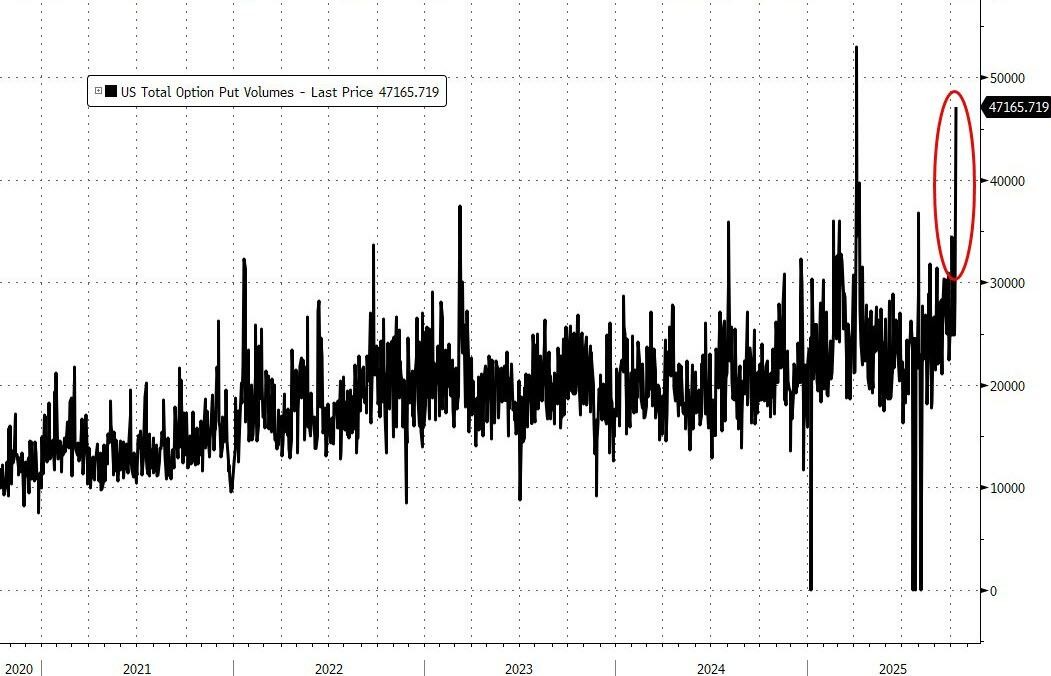

数据显示,美国期权总交易量突破 1 亿份合约大关,这是历史上仅有的第二次——上一次是在 4 月 4 日,当时市场下跌 5.97%。看跌期权交易量创下历史第二高纪录,看涨期权交易量则刷新历史新高,超过 6000 万份合约易手。

(看跌期权成交量)

(看涨期权成交量)

与此同时,Coppersmith 表示,虽然高盛的波动恐慌指数达到 9/10 的高位,上次触及该水平是在 4 月中旬,不过标普 500 隐含波动率远未达到 4 月或 8 月的水平,隐含相关性也未超过两年平均水平。

高盛交易员认为,标普 500 隐含波动率和偏斜度都出现强劲买盘,高盛交易台的资金流向也反映了这种需求。这主要是指数层面的现象,而非个股层面的广泛抛售。

系统性抛售触发点引发技术面担忧

市场关注的焦点之一是可能触发系统性抛售的技术关键点。高盛估计,系统性策略基金在美股的持仓规模接近 2200 亿美元。

具体而言,CTA 策略在标普 500 的多头仓位约为 480 亿美元,接近多年区间上限。短期触发阈值为 6580 点,该水平在上周五已被跌破;中期阈值约为 6290 点。如果跌破这些关键点位,资金流向可能转为负值。

上周五交易商伽马值(Gamma,γ)出现三年多来最大降幅,虽然交易商在局部仍保持净多头γ,但程度有所减弱。这种变化反映了市场结构性风险的积累。

消费金融板块承压突出

消费金融类股票成为另一个关注焦点。高收益消费金融发行人的交易活跃度升至 4 月初以来最高水平,相关股票也出现对应波动。

不过,高盛研究部门认为这种表现疲软主要是特殊情况,而非经济衰退风险的广泛重新定价。主要原因包括:

更广泛的服务业和零售类股并未同步走弱,这符合活动数据改善和消费者整体资产负债表健康的情况;即使在消费金融公司内部,表现疲软也集中在少数几家发行方。

高盛预计这种压力将保持局部化特征,不会蔓延至整个市场。

投资者情绪仍有韧性,两大主题延续

在上周五波动之前,美股投资者情绪实际在改善。上周录得 140 亿美元资金净流入,高盛情绪指标录得 +0.3,这是 2 月以来首次转为正值。

被动资金流入和零售保证金债务仍比 52 周正常水平高出 1 个标准差,不过上周五的价格走势可能将该指标重新拉回负值区间。

高盛交易员认为,两个主导美股市场的主题基本保持不变:AI 持续发展带来的增长动力,以及劳动力市场担忧造成的拖累。这些叙事主线将在本周开始的第三季度财报季中继续占据中心位置。

大型金融机构将于 10 月 14 日率先发布财报,月底前标普 500 约 70% 的市值公司将公布业绩。市场普遍预期标普 500 每股收益同比增长 6%,低于第二季度的 11%,但高盛研究部门预计将再次出现超预期结果。