"TACO faction vs Wait-and-see faction" -- Will October be a repeat of April?

Trump's new round of tariff threats has triggered fluctuations in global markets, but the level of market panic has decreased. Several institutions analyze that this decline may be a buying opportunity for "TACO trades," rather than a severe adjustment like in April. The VIX index indicates a relatively calm market response, and some teams believe that domestic political factors in the U.S. will limit Trump's policy implementation. Overall, the market is pricing in friction and setbacks more cautiously

Trump's new round of tariff threats has triggered fluctuations in global markets. Unlike the sudden shock in April, multiple institutions point out that the market has accumulated coping experience, and the level of panic has significantly decreased.

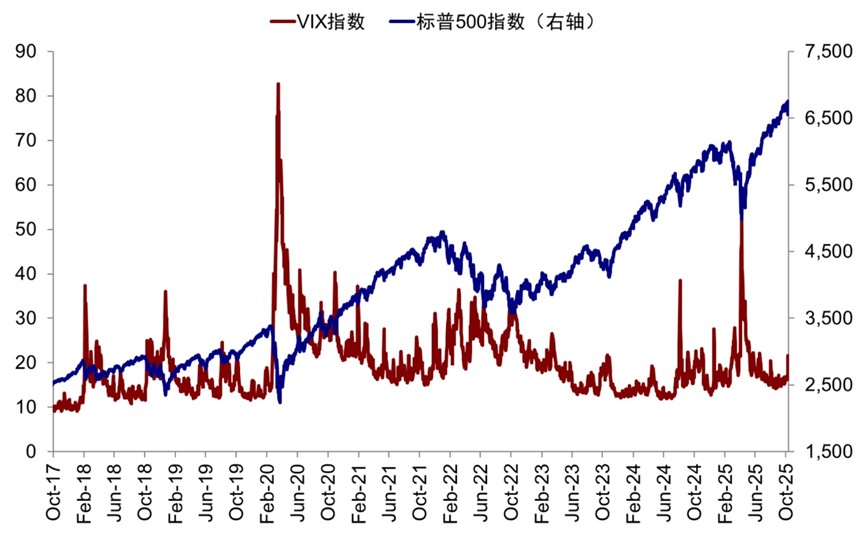

The Minsheng Securities team led by Shao Xiang observed that although the VIX index has risen, it has not reached extreme levels, and the overseas market's reaction has been more "calm." The latest data from the China International Capital Corporation team led by Liu Gang shows that the current VIX index is 21.7, far lower than the 60 seen after the tariffs in April.

The core divergence lies in whether this round of decline is a buying opportunity under the "TACO trade" or a replay of the severe adjustments seen in April.

The Guangfa team led by Liu Chenming believes that this is likely another "TACO trade," where the sharp drop will create buying opportunities. The Minsheng team led by Shao Xiang indicates that this round appears more like May—pricing in friction and setbacks under a tone of avoiding loss of control. The Minsheng team led by Mu Yiling is more cautious: based on experiences since April, it is not simply a "golden pit" following "bad news," and the current easing of conflicts is not enough to support continued upward movement. The China International Capital Corporation team led by Liu Gang emphasizes that compared to early April, the relatively "unfavorable" factors include more floating profits and higher valuations, leading to a greater willingness to take profits and secure gains, which will cause short-term volatility.

TACO Faction: Historical Experience Support

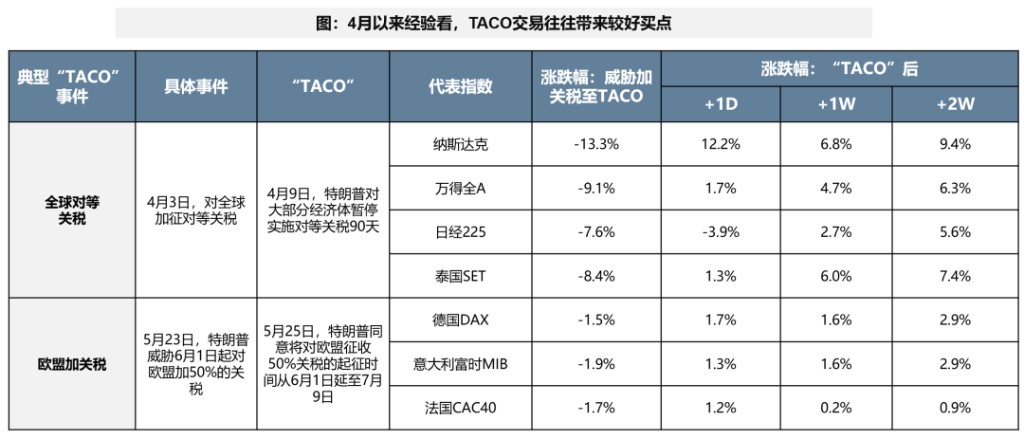

The Guangfa team led by Liu Chenming believes that this event is likely to repeat the "TACO trade" model seen since April.

The team emphasizes that a 100% tariff level is difficult for the U.S. to bear and loses economic significance, resembling extreme pressure before negotiations. The institution mentioned that in the four rounds of U.S.-China talks that have taken place this year, there have been escalations in sanctions from both sides.

The Liu Chenming team wrote:

If it is likely a TACO trade, historical data shows that short-term declines provide good buying opportunities. Since April, global TACO trades have occurred multiple times, including Trump's threats to increase tariffs followed by continuous delays, threats to dismiss Powell but then quickly reversing, and threats to impose tariffs on copper but exempting refined copper, etc.

The Minsheng team led by Shao Xiang also believes that domestic political factors will constrain Trump's policy execution. The Minsheng team points out that the internal chaos in the U.S. will make Trump's tariff policies more constrained.

Compared to before, the current U.S. government is still in a shutdown, the risk of large-scale layoffs is rising, and the Republicans are still "scheming" against the Democrats over fiscal budget issues The Shao Xiang team pointed out that this round is more like May rather than April, the key lies in the Chinese side's "calm amidst the chaos" response attitude, without escalating countermeasures in a tit-for-tat manner, while the White House has also "left room" in its tariff policy. The core difference between April and May is that the former reflects some panic in the market facing future uncertainties, while the latter is pricing in friction and setbacks under the tone of avoiding loss of control.

The script in April was continuous tariff increases, ultimately leading to the U.S. making concessions under the market's unbearable burden; May, however, saw a tone set after the first negotiations where both sides intended to avoid derailment, with phase friction still controllable, ultimately breaking the deadlock through a phone call. This time, combined with Trump's restraint reflected in his responses to reporters over the weekend, and the rational response from the Chinese side, we still believe that this tone between the two sides has not changed and will not become a turning point for the market.

However, this is not a reason for "bottom fishing" or aggressive pricing "TACO" in the short term. The Shao Xiang team wrote:

The bottom line can be maintained between China and the U.S., but the content of agreements that can be expected in the short term may be limited. We are still in the "playing cards" period of China-U.S. policy, and the tactical game has not yet settled. In addition, compared to April, the stock market prices and valuations are significantly higher, especially for some technology stocks.

The team expects that in this round of impact, the adjustment of A-shares will be relatively controllable, but Hong Kong stocks, as an offshore market, are more sensitive to emotional shocks and capital flows, and may experience greater volatility and pressure.

Wait-and-see faction: Tactical game has not yet settled, high valuations restrict upside potential

Regarding the timing for bottom fishing, Minsheng Securities and China International Capital Corporation (CICC) are more cautious, emphasizing the constraining factors of current valuation levels significantly elevated compared to April.

The Minsheng Mu Yiling team also believes that in the absence of excessive panic in the market itself, whether global assets need to start reflecting the fundamental downturn led by the U.S. service industry and technology is an important question.

Just like the rebound after April set new highs was not primarily due to TACO, the current easing of conflicts alone is not enough to support continued upward movement. It is expected that global risk assets will not adjust dramatically, but will instead require a longer time to digest.

The CICC Liu Gang team provided specific valuation comparison data: The current valuation of leading Chinese technology and consumer stocks is 20 times, higher than the peak of 18.8 times before the equivalent tariffs at the end of March; the Hang Seng Index is currently at 11.7 times, compared to the pre-tariff peak of 10.8 times. The "seven sisters" of U.S. stocks currently have a valuation of 31 times, compared to 26.8 times before the equivalent tariffs in April; the S&P 500 index is currently at 21 times, compared to 20.5 times before the equivalent tariffs.

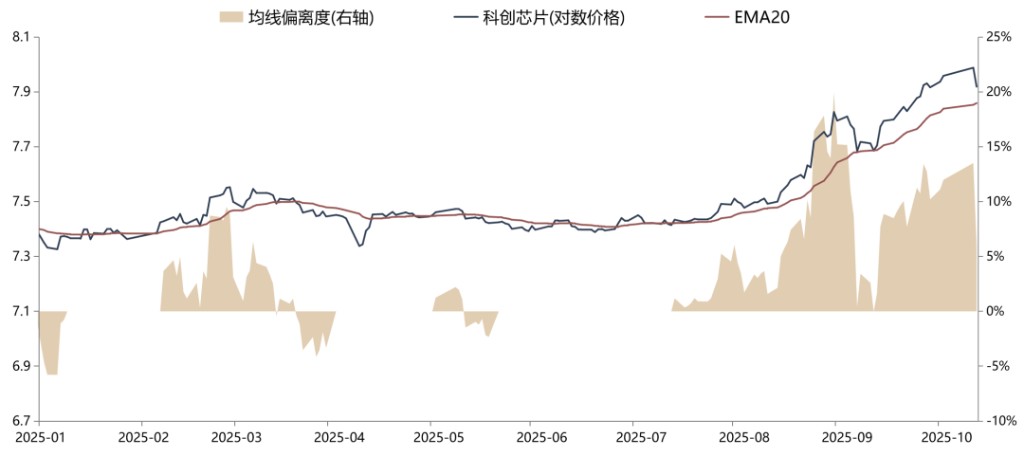

Therefore, CICC believes that compared to early April, the relatively "unfavorable" factors are more floating profits and higher valuations, leading to a greater willingness to take profits and secure gains, which will cause short-term volatility Guangfa Securities, based on historical reviews of bull markets breaking below the 20-day line, found that the Wind All A Index has favorable support between the 20-30 day lines, with an average pullback duration of 6.4 days and an average adjustment magnitude of 2.9%.

Is it time to shift to defensive sectors?

In terms of industry allocation, opinions among institutions vary.

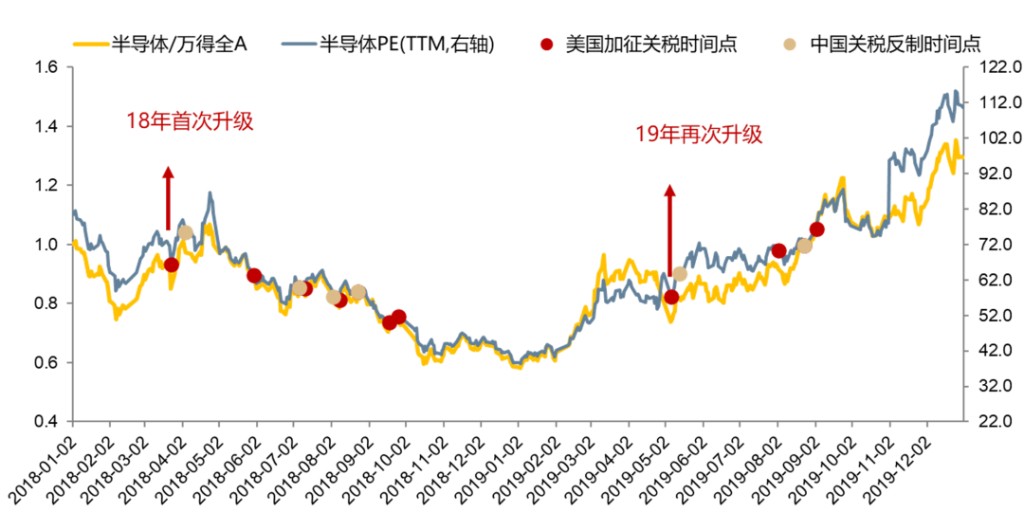

The Minsheng Shao Xiang team suggests that short-term funds may flow into defensive sectors such as dividends due to risk aversion, but they remain optimistic about core themes such as rare earths, domestic substitution, and military industry in the medium to long term.

In the short term, funds may flow into defensive sectors such as dividends due to risk aversion; however, from a medium to long-term perspective, under the backdrop of evolving Sino-U.S. relations, rare earths, domestic substitution, and military industry remain core themes with sustained allocation value. As for cyclical sectors like domestic demand, their recovery pace relies more on the specific implementation of subsequent domestic stable growth policies, so there is no need to rush.

The Guangfa Liu Chenming team is the most aggressive, suggesting that if technology innovation chips quickly drop near the EMA20, it would provide a rare buying opportunity, with a focus on AI computing chips, semiconductor equipment, and other domestic substitution-related industries.

The Minsheng Mou Yiling team, from the perspective of domestic policies "anti-involution" and the bottoming out of domestic demand, suggests focusing on domestic demand directions such as food and beverages, aviation and airports, and real estate, as well as non-bank financials benefiting from the bottoming and recovery of overall capital returns.

The CICC team is relatively conservative, suggesting that investors who have already reduced their positions should wait and choose a better time to enter, while those who have not reduced their positions can moderately adjust after panic subsides.

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investing based on this is at one's own risk