A post triggered the "largest disaster in cryptocurrency history": Binance outage, the "third largest stablecoin" depegged and the tragic "iron chain linking boats"

在市場最需要流動性託底的關口,幣安等幾家中心化交易所卻集體 “掉鏈子”:宕機、訂單簿卡頓、賬户凍結輪番上演。有人懷疑,幣安統一保證金系統遭到 “定點攻擊”——全球第三大穩定幣暴挫脱錨,抵押品價值瞬間崩塌,直接引爆鏈式強制清算。

本週五,美國總統特朗普在社交媒體上的一篇關於關税威脅的帖文,像一顆重磅炸彈,引發了加密貨幣市場的一輪慘烈 “洗血” 行情。

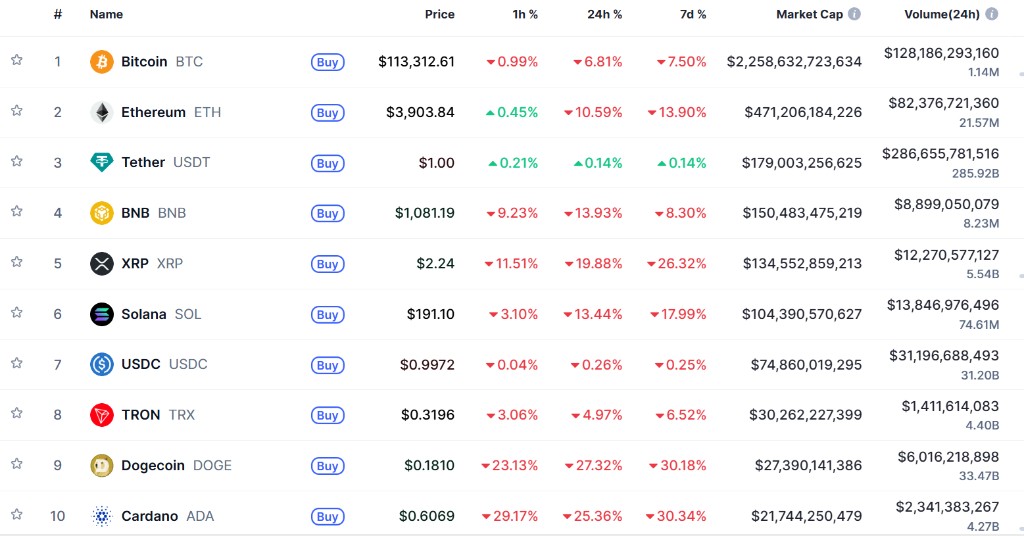

比特幣價格週五從逾 12.6 萬美元歷史高點大幅回落,一度失守 11 萬美元關口,當天跌幅達 13.5%。以太幣一度暴跌逾 17%,瑞波幣和狗狗幣則更是暴跌逾 30%。

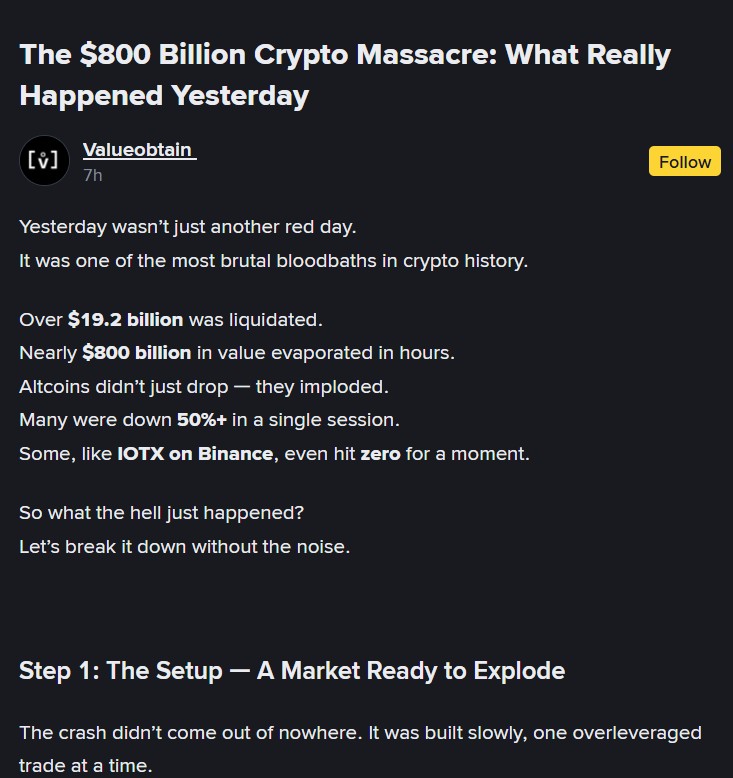

加密貨幣市場總市值在數小時內蒸發近 8000 億美元。據統計,全網槓桿頭寸清算總額超過 200 億美元,被業內描述為 “加密貨幣歷史上最大的清算事件。”

而當市場最需要流動性時,部分中心化交易所(CEX)卻掉了鏈子。在清算高峰期,幣安等交易所出現系統延遲和交易中斷,大量用户報告無法執行訂單或管理倉位,導致損失擴大。

社交媒體上充斥着對幣安的憤怒情緒,指責其在關鍵時刻 “拔掉網線”。此次事件不僅暴露了中心化交易所在極端行情下的技術瓶頸,也再次點燃了關於中心化與去中心化金融(DeFi)風險抵禦能力的辯論。

與此同時,有觀點直指此次暴跌並非簡單的市場行為,而是一場利用幣安系統漏洞、由特定資產脱錨引發的 “定點攻擊”。

一場 “鐵索連舟” 式的清算

根據幣安廣場上一篇廣為流傳的帖子分析,這次崩盤並非毫無徵兆,而是在一個高度槓桿化的市場環境中緩慢醖釀的。

帖子指出,首先,市場早已是一個 “滴答作響的定時炸彈”,其特點包括:交易員普遍採用高槓杆做多、未平倉合約量處於危險高位、以及大量低質量代幣上市導致流動性被稀釋。

特朗普的關税威脅成為了引爆這一切的 “外部火花”。傳統市場首先做出反應,比特幣和以太坊緊隨其後,而本就脆弱的山寨幣則瞬間崩潰。

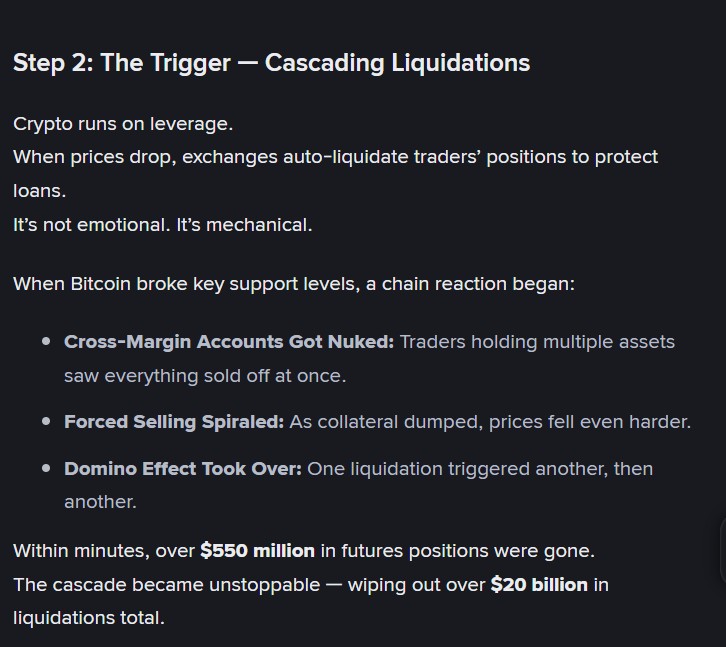

其次是連鎖反應的 “觸發”。加密貨幣市場運行在槓桿之上,當價格跌破關鍵支撐位時,交易所的自動清算機制便開始啓動。這並非情緒化的拋售,而是交易所為保護自身貸款而自動執行的程序。

帖子描述了爆倉連鎖反應的具體細節:

- 首當其衝的是,採用交叉保證金的賬户因部分資產價格下跌而被整體強制平倉,其抵押品(collateral)被系統強制賣出;

- 接着,強制拋售的抵押品進一步打壓價格,形成了 “一次清算觸發另一次清算” 的瀑布效應。

數據顯示,在短短几分鐘內,就有超過 5.5 億美元的期貨頭寸消失,最終導致了總額超 200 億美元的清算慘案。

宕機風波:中心化交易所遭遇信任危機

在市場最需要流動性與穩定性的時候,部分加密貨幣中心化交易所(CEX)的表現卻不盡人意。

據 Cryptopolitan 報道,多家中心化交易所在清算期間遭遇了嚴重的系統擁堵,導致應用程序凍結、訂單簿卡頓,部分用户甚至在市場劇烈波動時被鎖定賬户,無法進行任何操作。

除幣安外,Coinbase 和 Robinhood 等平台也報告了類似問題。

與此形成鮮明對比的是,去中心化金融(DeFi)平台平穩地通過了這次壓力測試。據報道,Uniswap 和 Aave 等去中心化交易所(DEX)在市場動盪中未出現任何技術問題或服務中斷。

其中,Aave 平台在無人為干預的情況下,完美處理了 1.8 億美元的清算;而 Uniswap 則處理了近 90 億美元的交易量。這一表現差異,使得行業對中心化平台的信任度再次受到考驗。

“定點攻擊” 還是系統缺陷?全球第三大穩定幣嚴重脱錨

隨着更多細節浮出水面,一種關於此次崩盤是針對幣安的 “定點攻擊” 的理論開始獲得關注。

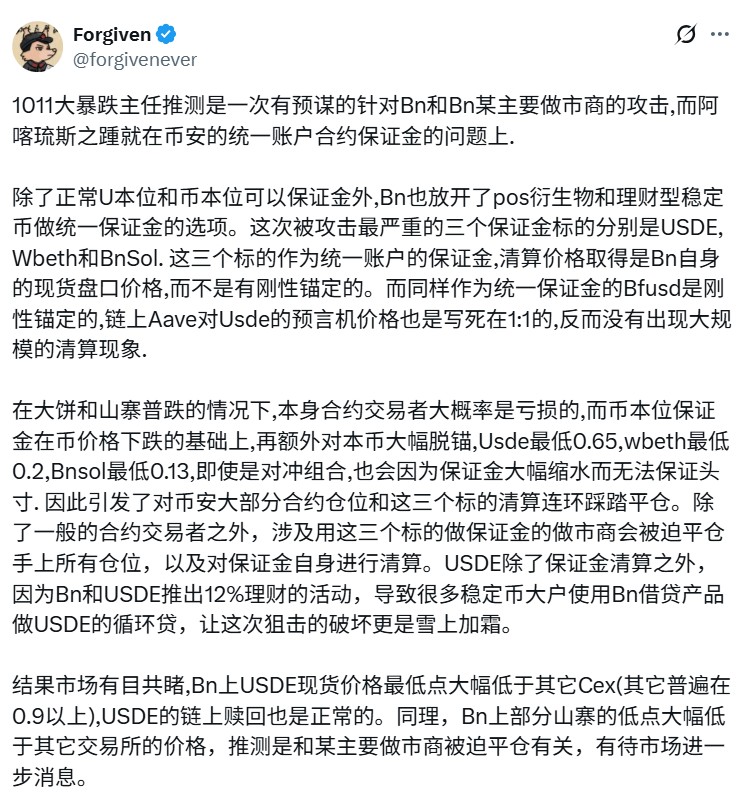

Conflux 網絡公司的高管 Forgiven 在社交平台發文稱,此次事件可能是一次針對幣安統一保證金(Unified Margin)系統的協同攻擊。該系統允許交易者混合使用多種資產作為保證金。

然而,這種靈活性在市場劇烈波動時卻變成了風險傳導渠道。隨着作為保證金的資產 USDe、BNSOL 和 WBETH 脱錨,抵押品價值崩潰,將觸發了大規模的強制清算。

Forgiven 指出,攻擊者可能利用了這一點,在幣安上集中打壓 USDe、BNSOL 和 WBETH 等特定資產的價格,使其發生嚴重脱錨。數據顯示,全球第三大穩定幣——USDe 在幣安上的價格一度跌至 0.65 美元,而同期在其他平台的價格仍為 0.90 美元。

Forgiven 認為,多個另類代幣僅在幣安上出現極端跌幅,是主要做市商的對沖投資組合被擊穿的跡象。

幣安成為眾矢之的

無論背後原因為何,作為全球最大的交易所,幣安已成為此次風波中用户批評的焦點。

大量用户聲稱在市場暴跌期間遭遇了賬户凍結、止損訂單失效等問題。更嚴重的是,Enjin(ENJ)和 Cosmos(ATOM)等代幣在幣安上出現 “閃崩”,價格瞬間歸零後又迅速反彈。這引發了用户關於市場操縱的指控,認為平台在混亂中牟利。

對此,幣安承認是 “劇烈的市場活動” 導致了系統延遲和顯示問題,並向用户保證 “資金是安全的(SAFU)”。目前,幣安表示其系統已恢復上線。

然而,這並未平息社區的怒火。批評者呼籲監管機構介入調查,而這已不是幣安首次因類似事件面臨指控。

圖:社交媒體上充斥着大量用户對幣安不滿的抱怨

最終,這場由槓桿驅動的崩盤雖然殘酷,卻也清除了市場中積累的過度風險。正如歷史上多次發生的那樣,去槓桿過程是市場週期的一部分,未來也會繼續。

但這一次,中心化交易所和去中心化交易所的風控問題會持續成為焦點。