If "bull market history" repeats, will gold prices surge to $6,000 next spring?

I'm PortAI, I can summarize articles.

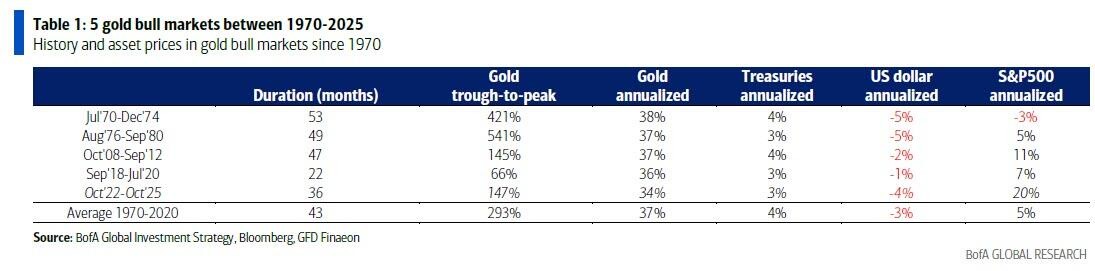

美銀 Hartnett 指出,儘管金價已突破 4000 美元,但黃金的結構性多頭仍然稀少。新任美聯儲主席的政策及即將到來的黃金重估可能推動貶值交易。歷史數據顯示,過去四次牛市中,金價平均上漲 300%,這可能意味着明年春季金價有望達到 6000 美元。

美銀 Hartnett 認為,儘管本週金價突破了 4000 美元,但 “很少有人仍然結構性地做多黃金”(他計算出,在美國銀行內部,黃金僅佔私人客户資產管理規模的 0.5% 和機構資產管理規模的 2.3%)。

與此同時,新美聯儲主席的提前選擇 + 繁榮/泡沫政策(參見阿根廷救助計劃)+ 尤其是即將到來的黃金重估(1934 年和 1973 年),都有利於貶值交易。雖然歷史不能預示未來,但過去四次牛市期間,金價在 43 個月內平均上漲了約 300%,這意味着明年春季金價將達到 6000 美元的峯值。