中美关税再 “升级” 的背后

中美之间的贸易摩擦加剧,特朗普威胁自 11 月 1 日起对中国所有产品征收 100% 关税,导致美股大跌。10 月以来,双方在船舶费用、稀土出口管制等方面出现多次摩擦。中国交通运输部决定对美船舶收取额外港务费,作为反制措施。同时,稀土出口管制政策也在升级,要求跨国公司销售含有中国稀土的商品需获得许可。这些措施使得中美贸易关系更加紧张。

一、发生了什么?

10 月以来,中美双方在船舶费用、稀土出口管制、反垄断等多个方面出现摩擦增多迹象,直到昨天特朗普威胁全球加征 100% 额外关税,使得中美关税再度骤然 “升级”。

这其中,既有中国的 “先手”(如稀土管制),也有针对美国政策的 “反制”(如船舶港务费)。按时间顺序看,

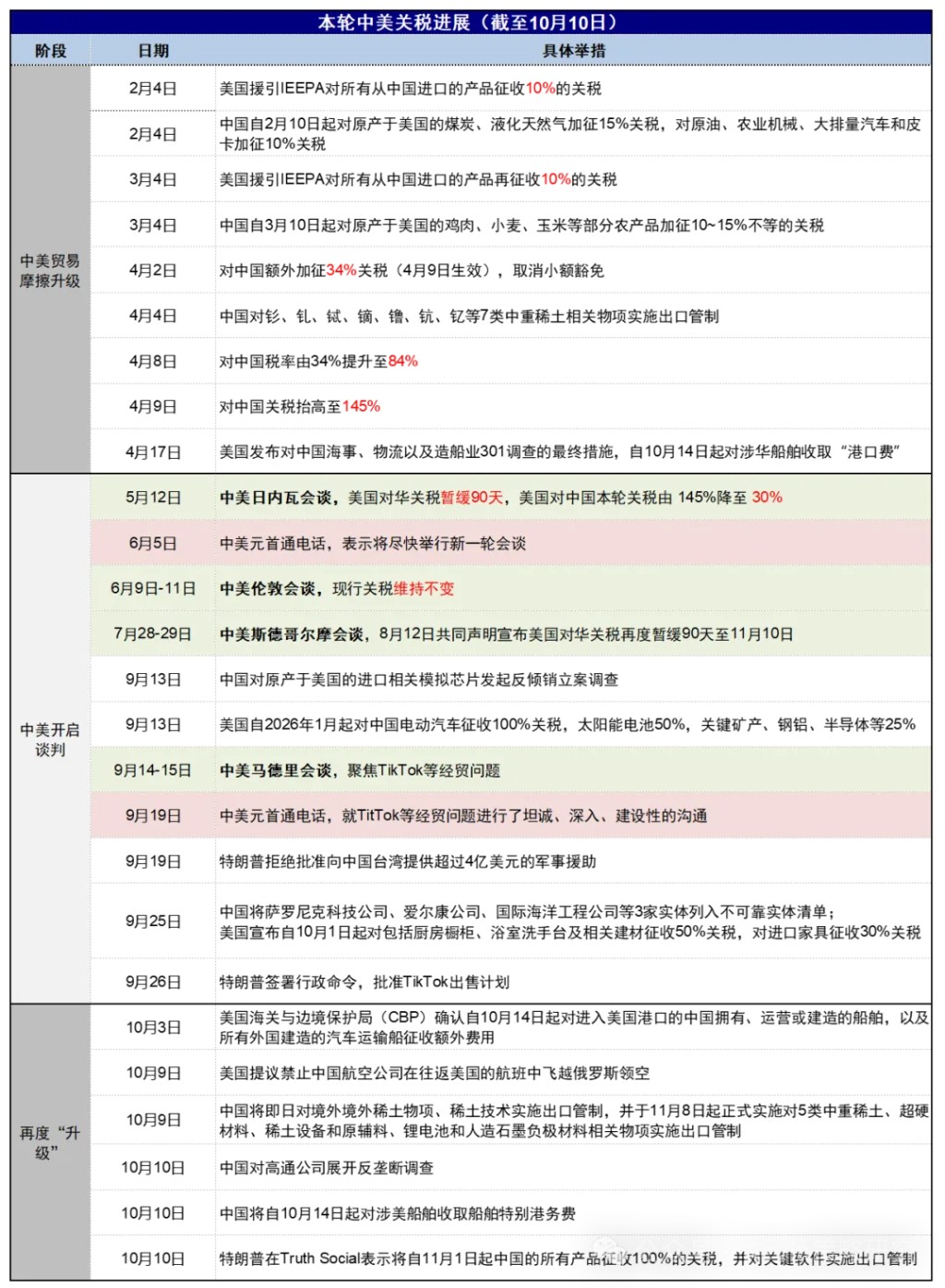

1)“港口费”:10 月 3 日,美国海关与边境保护局(CBP)确认自 10 月 14 日起对进入美国港口的中国拥有、运营或建造的船舶,以及所有外国建造的汽车运输船征收额外费用。该政策始于去年 4 月,美国对中国海事、物流以及造船业开启 301 调查,并于今年 4 月 17 日宣布于 180 天过渡期后正式收取 “港口费”。作为应对,中国交通运输部在 10 月 10 日发布公告,决定自 10 月 14 日起对美船舶收取船舶特别港务费。这一点更多是象征性的反制,对美国的实质影响有限。

2)稀土出口管制:稀土管制作为 “先手” 在 4 月就已经出现在 “谈判桌” 上,然而 10 月 9 日的一系列举措更为严厉,不仅将在 11 月 8 日对超硬材料、部分稀土设备和原辅料、5 种中重稀土、锂电池和人造石墨负极材料实施出口管制,也将即日起对境外稀土出口和稀土技术实施管制。新规要求跨国公司销售的商品中,如果含有的中国稀土矿产占产品价值的 0.1% 或以上,则需要获得北京方面的许可,这将使得跨国科技公司的关键产业链面临挑战。这一政策的 “杀伤力” 更大,也是特朗普全面提高关税的主要借口。

3)再度加征关税:10 月 10 日晚,特朗普威胁将自 11 月 1 日起对中国的所有产品征收 100% 的关税,并对关键软件实施出口管制。若生效,美国对中国关税税率将从当前的 50-60%(2018 年的 13-20%+ 20% 芬太尼 +10% 对等关税 +232 行业关税)升至 180% 甚至更高。受此影响,美股市场周五大跌。

二、中美贸易摩擦的时间线

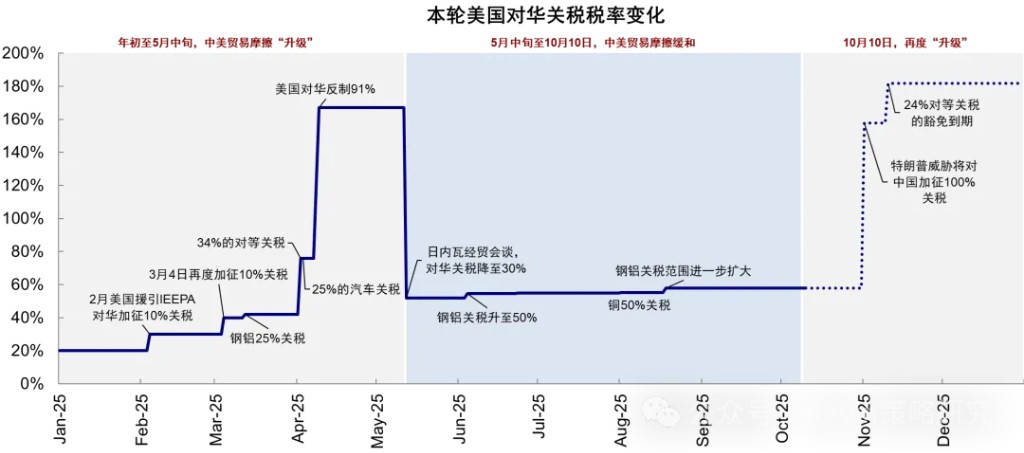

从特朗普当选以来,本轮中美关税摩擦历经了升级、缓和、到近期再 “升级” 的三个阶段:

1)1 月-4 月持续升级:2 月和 3 月,特朗普以 “芬太尼” 为由对中国进口商品两次分别加征 10% 关税,4 月对华加征 34%“对等关税”,随后不断升级 91%,致使美国对中国征收的关税税率一度达到 147%(145% 全面关税 +2% 的 232 特定行业关税),全球市场因此大跌,美国一度出现 “股债汇三杀”。

2)5 月-9 月逐步缓和:中美开启经贸磋商机制,5 月 12 日中美关税在日内瓦会谈后大幅 “降级”,美国对中国本轮关税降至 30% 中美关税 “降级” 的资产含义;随后在英国伦敦(6 月)、瑞典斯德哥尔摩(7 月底)以及西班牙马德里(9 月)进行三轮会谈。中美两国元首也两度进行通话,尤其是 9 月 19 日的中美元首通话,达成 TikTok 一致,并传递出可能直接会晤的信号,也是中美关税最为缓和的阶段。

3)10 月再度 “升级”。虽然这一次关税升级也算 “事出有因”,但是相比不久前市场还预期达成广泛的贸易和投资协议,取消芬太尼关税,甚至直接会晤,仍是一个意外和重大 “挫折”。

三、后续的可能演变?

此次关税的骤然升级,的确让人意外,但也折射出谈判的复杂性和博弈的难度。

那后续可能怎么演变?是为了促成谈判而先提高筹码的手段最终还是会走向妥协,还是就是单纯的再度升级、甚至最终 “撕破脸”?

首先,这件事本身的特点决定了势必存在很大变数,就如同近期的意外变化。但如果非要大胆猜测的话,双方再度坐下来谈判并达成某种程度妥协的可能性并不小,甚至可能很大。要不然,为何特朗普要把新关税生效的时间定在 11 月 1 日,正好是 APEC 会议(10 月 31 日-11 月 1 日)之后呢?

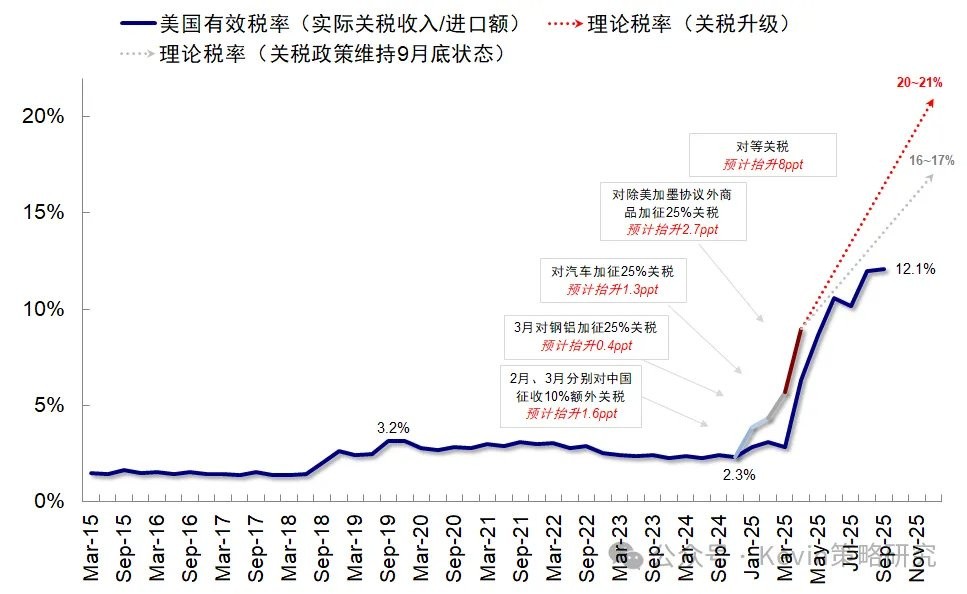

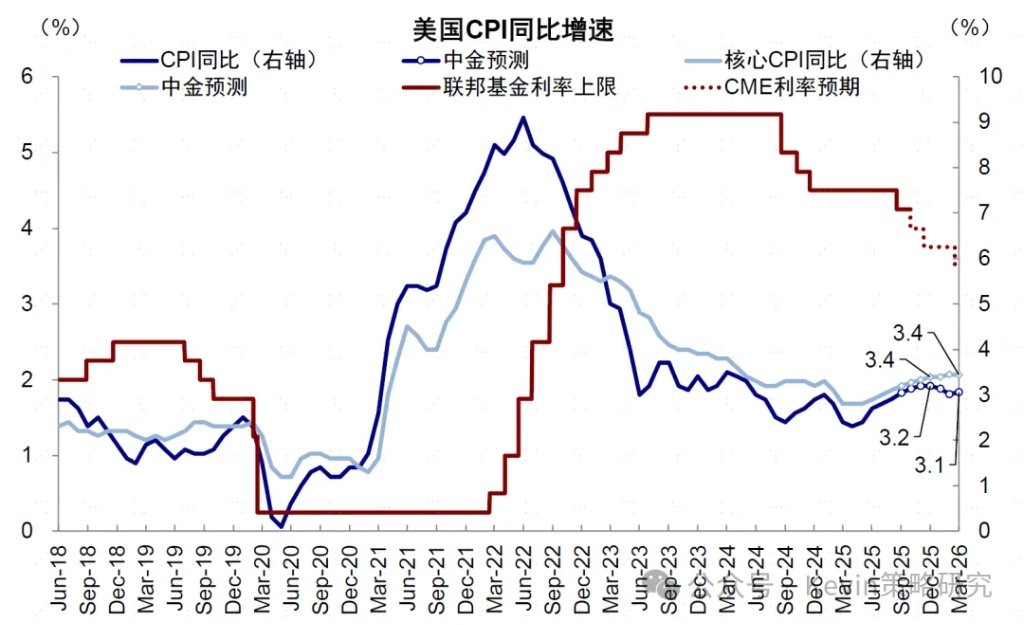

一个无法忽略的现实情况是,“非理性” 的高关税对双方都是无法承受之重,与 “贸易禁运” 无异,一边是供给冲击,比如对美国通胀和美债利率这个传导链条,一边是需求冲击。我们初步测算,100% 的对华额外关税会把美国有效税率从当前的 16-17% 推升至 20% 以上甚至更高,使得核心 CPI 从当前预期的 3.4% 到 3.5% 甚至更高。

要知道,越是双方势均力敌,且一方有底牌和底气,但升级的后果又是灾难性的情况下,才越有可能达成妥协和均衡,哪怕是不情愿且脆弱的均衡,类似于 “核威慑”。否则,一边倒的局面就绝无谈判的必要了。但也需要注意的是,短期的平衡是势均力敌下的无奈之选,长期的变数和不确定性依然存在,甚至可能加大。

另外,从预期情绪,市场环境,宏观环境,政策环境等各个维度,当前与 4 月也有很多不同,也会影响市场的反应。

本文作者:刘刚 Kevin,来源:Kevin 策略研究,原文标题:《中美关税再 “升级” 的背后》

风险提示及免责条款

市场有风险,投资需谨慎。本文不构成个人投资建议,也未考虑到个别用户特殊的投资目标、财务状况或需要。用户应考虑本文中的任何意见、观点或结论是否符合其特定状况。据此投资,责任自负。