Elon Musk proposes "AI Energy" solution: Nighttime energy storage and daytime discharge will double the electricity output in the United States

In response to the power crisis caused by artificial intelligence data centers, Musk proposed that large-scale deployment of industrial-grade battery storage systems could effectively double the generating capacity of the U.S. power grid. Huatai Securities analysis pointed out that, in the context where traditional energy sources like nuclear power are unable to meet immediate needs, the deployment of electrochemical energy storage and fuel cells with shorter deployment cycles is becoming the focus of market attention, and is expected to alleviate the increasingly severe power gap

The explosive growth of artificial intelligence is pushing the U.S. power grid to its limits. Recently, Elon Musk proposed that through the large-scale deployment of industrial-grade battery storage systems, the effective generating capacity of the U.S. power grid could be doubled, providing a clear path to solve the AI energy crisis.

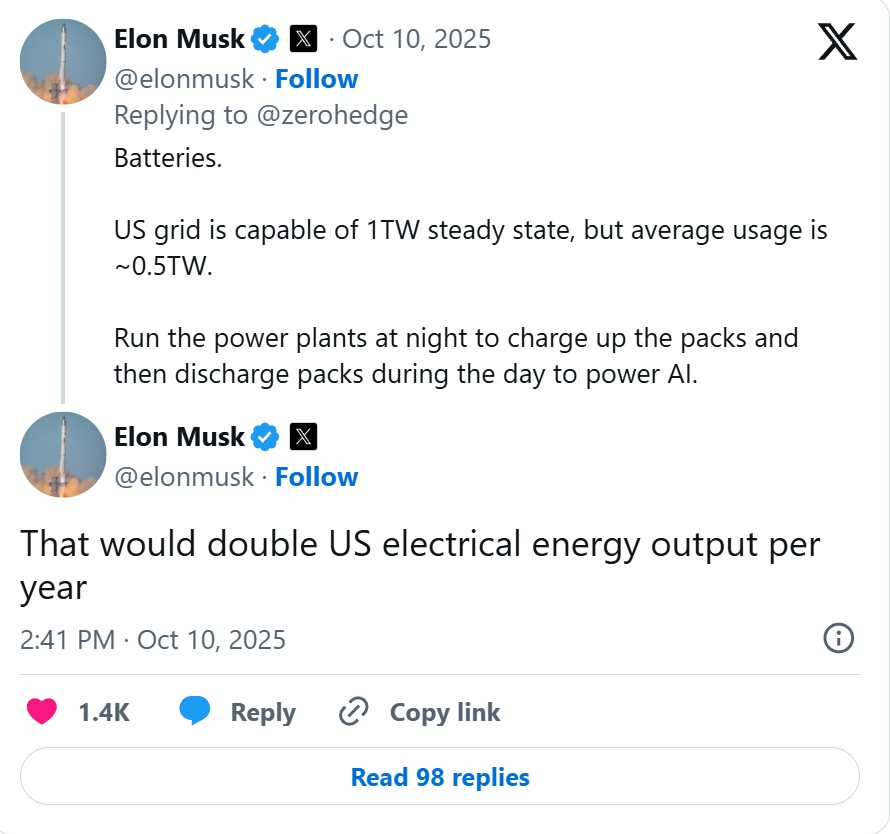

Recently, Musk stated on social media platform X that the U.S. power grid has a stable output capacity of about 1 trillion watts, but the daily usage is only 0.5 trillion watts. By operating power plants at night to charge battery packs and releasing electricity during the day to support AI computations, it could "double the annual electricity generation in the U.S." He called large-scale industrial-grade batteries the winning solution for stabilizing the grid.

Musk's statement comes at a time when market concerns about an energy crisis triggered by the surge in AI computing power are intensifying. Huatai Securities estimates that from 2025 to 2026, the domestic AI data centers in the U.S. will add an annual electricity demand of 6-13 gigawatts, pushing the peak load growth rate to four times the historical average.

Analysis indicates that due to the long construction cycle of traditional power sources, rapidly deployable electrochemical energy storage is expected to become a core means of alleviating power shortages in the short term and bring significant growth opportunities to related industrial chains.

AI Triggers Power Crisis, Energy Storage Becomes Key Solution

The rapid development of AI data centers is driving a swift increase in electricity demand in the U.S. Expectations of power shortages have already been reflected in market prices, with large tech companies forced to sign power purchase agreements at high prices of $120 per megawatt-hour, nearly double the market average, and the capacity price in the PJM power market has also risen by 22% compared to the previous cycle.

Huatai Securities estimates that the U.S. still faces a power gap of 11-20 gigawatts. In the face of an expanding gap, traditional power generation solutions are difficult to provide timely support due to their long construction cycles. New natural gas power generation projects require a construction period of 3 years, while nuclear power plants need more than 10 years. The severe lag in traditional power construction has forced the market to turn to more flexible solutions.

Against the backdrop of traditional power sources being unable to respond quickly, new energy technologies represented by electrochemical energy storage are becoming the key to solving short-term power shortages. Huatai Securities stated that unlike the long construction cycles of gas turbines and nuclear power plants, the deployment speed of energy storage systems is extremely fast, typically taking only 1 to 1.5 years to go online.

According to Huatai Securities' estimates, to make up for the expected power gap of 18-27 gigawatts by the end of 2026, the U.S. will need to add 110-205 gigawatt-hours of energy storage capacity in the next two years. This means that compared to the 37 gigawatt-hours of installed capacity in 2024, the market needs to maintain an annual growth rate of over 50%.

This trend is expected to benefit battery cell companies, energy storage integrators, and backup power equipment companies comprehensively. For investors, if the Federal Reserve starts a rate-cutting cycle in the future, it will further enhance the investment returns of photovoltaic and energy storage projects, creating a "double boost" for the industry