美股遭重挫!VIX 指数飙升 但市场抛售仍显理性

美股遭遇自 4 月以來最糟糕的單日表現,標普 500 指數和納斯達克綜合指數分別下跌 2.71% 和 3.56%。VIX 指數暴漲 31.65%,報 21.63,儘管仍低於歷史高位,市場拋售被認為是理性反應。分析師指出,當前波動性並未引發恐慌,市場表現相對有序。

智通財經 APP 獲悉,美股遭遇 “黑色星期五”,標普 500 指數、納斯達克綜合指數分別收跌 2.71%、3.56%,均創 4 月以來最大單日跌幅;道瓊斯工業平均指數收跌 1.9%。

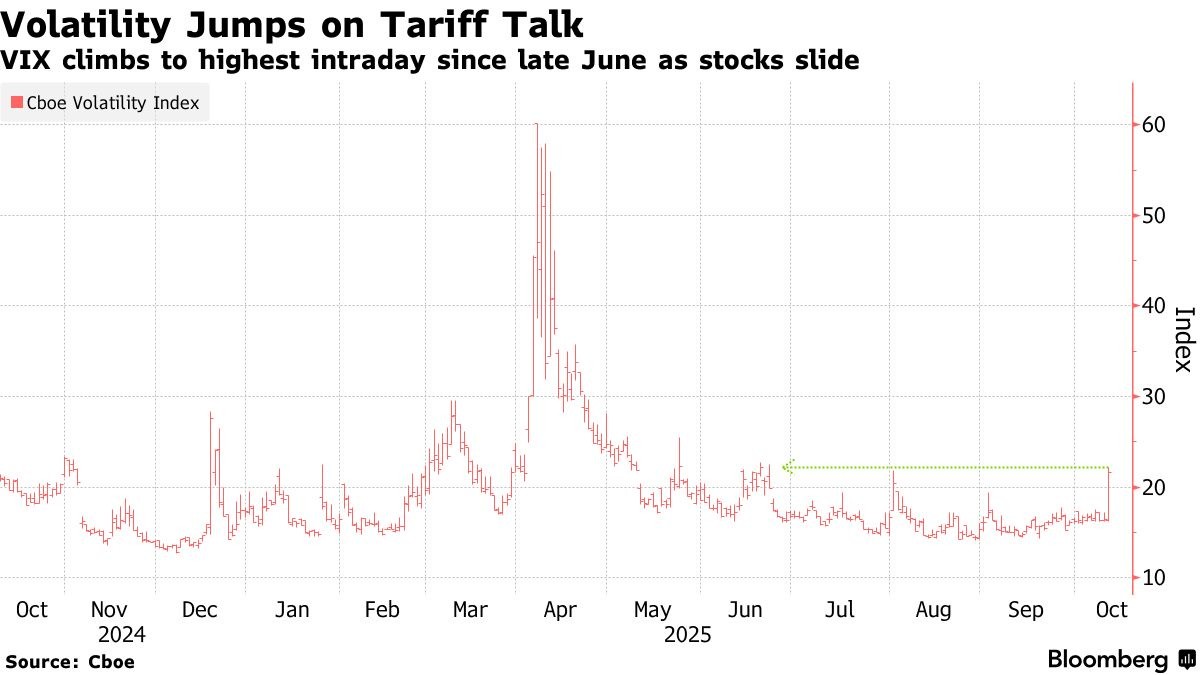

美股自 4 月以來最糟糕的單日表現令波動率指標大幅上升,儘管其水平仍遠低於過去伴隨持續拋售的階段。數據顯示,芝加哥期權交易所波動率指數 (VIX) 週五暴漲 31.65%,報 21.63,為兩個多月以來首次突破 21——VIX 指數與標普 500 指數的走勢約有 80% 的時間呈反向關係。

自 4 月以來,美股波動率一直受到壓制,VIX 指數多次維持在 17 以下 (其長期平均值為 20),標普 500 指數也連續五個月上漲。據花旗集團股票與衍生品交易策略師 Vishal Vivek 表示,在週五之前,標普 500 指數已連續 100 個交易日未出現單日漲跌幅超過 2% 的情況。

Vishal Vivek 表示:“當你在一段波動平靜期後,因一條令投資者擔憂的頭條新聞而出現像今天這樣的回調時,VIX 指數顯著上升並不令人意外。”

儘管此次 VIX 指數的跳漲相較近期走勢顯得劇烈,但與以往市場動盪時期相比,這一波動仍只是 “輕微波瀾”。在 2008 年金融危機期間,VIX 指數曾突破 89,在新冠疫情初期則升至 85 以上。2025 年 4 月 2 日特朗普宣佈對貿易伙伴加徵所謂對等徵税後,該指標一度觸及 50。

芝商所全球市場公司衍生品市場情報主管 Mandy Xu 表示,VIX 指數處於 21 水平 “並不值得擔憂”。她指出:“受新聞推動出現一定程度的價格重定價是正常的,但市場並未陷入恐慌。”

衍生品交易員也認為,此次拋售過程相對有序。野村控股全球股票衍生品董事總經理 Alex Kosoglyadov 表示:“我們並未看到客户急於買入保護性頭寸。” 他指出,由於期權市場的多空頭寸保持相對均衡,做市商和交易商在應對波動率上升方面準備充分,“經銷商的頭寸非常乾淨,相比 2025 年 4 月或 2024 年 8 月的拋售期,當前賬面更為平衡”。

儘管美國勞動力市場放緩跡象明顯、政府停擺以及對美聯儲獨立性的擔憂增加,在週五之前,標普 500 指數自 8 月初以來尚未出現超過 1% 的單日跌幅。每當美股下挫,逢低買入者都會迅速入場,押注人工智能交易將繼續抵消宏觀層面的憂慮。

Oraclum Capital LLC 首席投資官兼聯合創始人 Vuk Vukovic 表示:“市場中存在強大的支撐力量——每次出現下跌,都會被買盤迅速推高。”“這次的跌幅略大一些,但我們仍處於兩週前的水平,所以並沒有太大戲劇性。” 他還表示:“這更像是波動率賣方進場的機會,而不是該進行避險的時刻。”