Goldman Sachs warns about the future of silver: Difficulties in physical delivery are the driving force behind this round of surge, and a sharp adjustment may occur in the next 1-2 weeks

The tight supply in the silver market is mainly due to the reduced free float of the LBMA. Strong ETF buying is a key driver, while retail demand in India remains high ahead of Diwali, and derivative positions further exacerbate the physical tightness. Goldman Sachs expects that a large influx of physical silver from China and the United States will alleviate the tension in the LBMA market within 1-2 weeks, but the adjustment process will be extremely volatile

The London Bullion Market Association (LBMA) silver price broke through $50 per ounce yesterday, setting a new historical high. However, Goldman Sachs commodity traders warned that the physical delivery difficulties behind this surge will ease in the next 1-2 weeks, and the market may face a sharp adjustment.

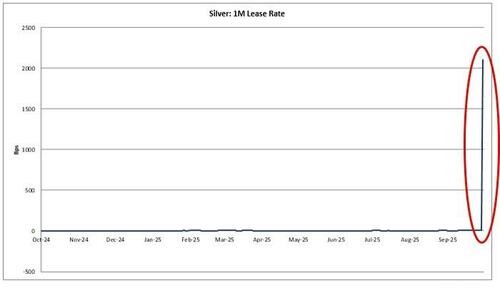

This surge is backed by extreme signs of tension in the silver market, with one-month leasing rates soaring to -21%, and daily leasing rates reaching an extreme level of -200%, reflecting severe physical supply tightness in the London spot market.

This supply tightness has led to a misalignment of the normal relationship between LBMA and COMEX futures prices, with LBMA spot prices unusually trading at a premium of $2.7 over COMEX futures. The Chicago Mercantile Exchange has thus raised margin requirements for silver and gold futures.

Goldman Sachs expects that a large influx of physical supply from China and the United States will alleviate the tightness in the LBMA market in 1-2 weeks, but the adjustment process will be extremely volatile.

Supply Tightness Due to Multiple Factors

According to Ole Hanson, head of commodity strategy at Saxobank, the supply tightness in the silver market is mainly due to a reduction in the freely available volume in the LBMA. Strong ETF buying is a key driver, while retail demand in India remains high ahead of the Diwali festival.

Additionally, LBMA inventories were already tight in the first quarter due to a surge in imports related to U.S. tariffs. Although China's net exports remain strong, with a year-on-year increase of 241%, out of the 101 million ounces exported, 99.9 million ounces went to Hong Kong, which is outside the LBMA system.

Goldman Sachs commodity trader Adam Gillard pointed out that derivative positions further exacerbated the physical tightness. The LBMA shorts mainly come from EFP long positions (as a cheap option against potential Section 232 tariffs), producer hedging, and speculative leasing rate shorts established too early by sellers.

Delivery Challenges Restrict Arbitrage Mechanism

In theory, traders could resolve the supply tightness by finding LBMA standard silver bars, transporting them to London, and hedging the silver premium. However, practical operations face multiple obstacles.

Logistics companies need 2-3 weeks to gather metal from multiple delivery warehouses in the U.S. and then airlift it to London. Not all COMEX brands meet LBMA delivery standards, which further extends logistics time.

December COMEX longs may not receive physical delivery until the end of the delivery window (end of December), increasing financing costs and adding uncertainty to the choices of LBMA shorts. LBMA forward liquidity has dried up, meaning that EFP-related silver shorts can only be established in the spot market, which explains the overnight roll-over rates reaching 200%.

Adjustments Imminent but Process Volatile

Goldman Sachs expects to see a significant influx of physical flows from China and the United States into the LBMA market within 1-2 weeks, with the curve ultimately flattening.

However, this adjustment process is expected to be extremely volatile. Currently, demand far exceeds available supply, and the supply-demand relationship will ultimately dominate price trends. Market participants need to prepare for the impending sharp fluctuations.

Hedge funds find it difficult to short silver in arbitrage trades against the Shanghai Gold Exchange due to capital controls preventing physical delivery. Meanwhile, precious metals banks may not renew leases for metals within the United States to obtain the physical required for exports