Will the US stock Q3 earnings season kick off with a bang? The recovery of investment banking business is expected to boost the strong growth of six major banks' performance

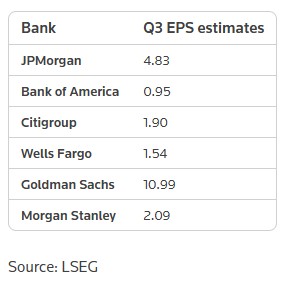

The third quarter earnings season for U.S. stocks is about to begin, with six major banks (JPMorgan Chase, Goldman Sachs, Morgan Stanley, Bank of America, Citigroup, Wells Fargo) expected to report strong performance, benefiting from the recovery in investment banking and the resilience of the U.S. economy. Analysts predict that JPMorgan Chase's earnings per share will grow by more than 10%, Bank of America by nearly 17%, Citigroup by 26%, and Goldman Sachs by about 31%. Investors are focused on the credit environment, employment data, and economic outlook

According to Zhitong Finance APP, the new round of earnings season for U.S. stocks will kick off next week. The six major U.S. banks—JPMorgan Chase (JPM.US), Goldman Sachs (GS.US), Morgan Stanley (MS.US), Bank of America (BAC.US), Citigroup (C.US), and Wells Fargo (WFC.US)—will successively announce their third-quarter results starting next Tuesday. The market currently expects that, benefiting from a strong recovery in investment banking and the resilience of the U.S. economy keeping borrowers in good shape and supporting the consumer and commercial loan sectors, the third-quarter performance of these six banks will be strong.

At the same time, investors will closely monitor these banks' economic outlooks and expectations for investment banking and trading businesses. Mac Sykes, portfolio manager at Gabelli Funds, stated, "The market will focus on any changes in the credit environment, the impact of employment data, and the overall economic outlook. Consumer confidence has declined, and corporate confidence is still evolving; we will observe whether the market volatility earlier this year has left hidden dangers."

Earnings Outlook for the Six Major Banks

Benefiting from strong investment banking and market revenues, JPMorgan Chase's earnings per share for the third quarter are expected to grow by more than 10%. The bank previously stated that it expects low double-digit growth in investment banking revenues for the third quarter.

Bank of America's earnings per share for the third quarter are expected to increase by nearly 17% year-on-year. The bank's Chief Financial Officer Alastair Borthwick mentioned in September that investment banking revenues for the third quarter are expected to grow by 10% to 15%. Analysts noted that investors are paying attention to the bank's stock buyback pace and capital management plans, with relevant details likely to be announced at the investor day in November.

Citigroup's earnings per share for the third quarter are expected to surge by 26% year-on-year, mainly driven by capital markets business. Citigroup previously stated that its investment banking revenues and market revenues are expected to achieve mid-single-digit growth.

Goldman Sachs' earnings per share for the third quarter are expected to grow by about 31% year-on-year, primarily due to a rebound in investment banking and trading departments. The market will focus on whether this growth is sustainable.

Morgan Stanley's earnings per share for the third quarter are expected to increase by more than 11% year-on-year. Analysts pointed out, "With its comprehensive advantages in capital markets, wealth management, global layout, and profitability, Morgan Stanley is expected to outperform its peers in mid-term revenue growth."

Additionally, investors will pay attention to Wells Fargo's growth plans following the lifting of the $1.95 trillion asset cap by regulators.

M&A Activity Revives, Regulatory Easing and Rate Cut Expectations as Catalysts

Investment banking activities were once stalled at the beginning of the year due to U.S. President Trump's announcement of tariffs, but have now become active again due to regulatory easing and expectations of further rate cuts by the Federal Reserve. JPMorgan Chase described this summer as one of its "busiest M&A seasons," with hiring activities also rebounding According to analysts at Piper Sandler, as of mid-September, 49 merger and acquisition (M&A) deals have been announced in the third quarter, up from 39 in the second quarter and 32 in the same period last year. The global M&A volume has reached $2.6 trillion, the highest level for the same period since the peak of the pandemic in 2021. M&A and initial public offerings (IPOs) have driven a surge in deal activity, and the equity capital markets remain strong.

However, some analysts remain cautious. Oppenheimer analyst Chris Kotowski wrote in a report, "Our view of the current M&A cycle is that while 'the bird is flapping its wings,' it has not really taken off yet." This stands in stark contrast to the market's expectations for an "epic wave of M&A" at the beginning of the year.

Outlook for Trading Revenue and Net Interest Income

Trading revenue in the U.S. banking sector is also expected to grow. Jefferies analysts stated, "Historically, the third quarter is usually a slow season for trading businesses. But the third quarter of 2025 seems to break this trend." They noted that equity trading volumes remain strong, and fixed income, foreign exchange, and commodity trading activities are also active.

Investors will also focus on the outlook for net interest income (NII). Analysts at Baird Equity Research indicated that as the U.S. economy remains resilient, NII expectations may remain robust.

Several large banks have reported that the financial condition of U.S. consumers remains good, with borrowers continuing to repay loans on time. Therefore, investors will be watching for any changes in delinquency or default rates.

Brian Mulberry, a portfolio manager at Zacks Investment Management, stated, "While there are currently no major concerns in investment banking and commercial banking, we are seeing stagnation in deposit levels and loan growth on the retail side." He added, "The rising potential default risk among some small businesses has also raised new concerns."

Morningstar analyst Suryansh Sharma noted, "Banks hold a significant amount of capital, and the macroeconomic environment remains stable. We will closely monitor whether management hints at a rebound in loan growth in the coming quarters."