Power constraints combined with supply-demand imbalance, will aluminum be the next copper?

鋁市場正經歷供需結構性轉變,預計 2026 年全球原鋁供應過剩將迅速縮窄,2027 年出現約 140 萬噸的供應缺口。電動汽車等行業推動鋁需求激增,但鋁冶煉高耗電特性限制了新產能擴張。鋁市場估值被低估,鋁 ETF 管理資產不足 4000 萬美元,遠低於銅產品的 10 億美元。供需格局迎來歷史性拐點,電力約束成為鋁產能擴張的關鍵因素。

長期被銅等工業金屬光芒掩蓋的鋁,正因一場潛在的供需結構性轉變而站上舞台中央。

據花旗分析師預測,全球原鋁供應過剩局面將在 2026 年迅速縮窄,並從 2027 年開始出現約 140 萬噸的供應缺口,佔原鋁消費總量的 2%。

與此同時,電動汽車、太陽能發電和數據中心等快速增長的行業正推動鋁需求激增。據 Wood Mackenzie 數據,電動汽車是能源轉型中鋁需求的最大來源,每輛電動車平均比燃油車多使用約 150 磅鋁材。而鋁冶煉的高耗電特性使新建產能面臨挑戰。

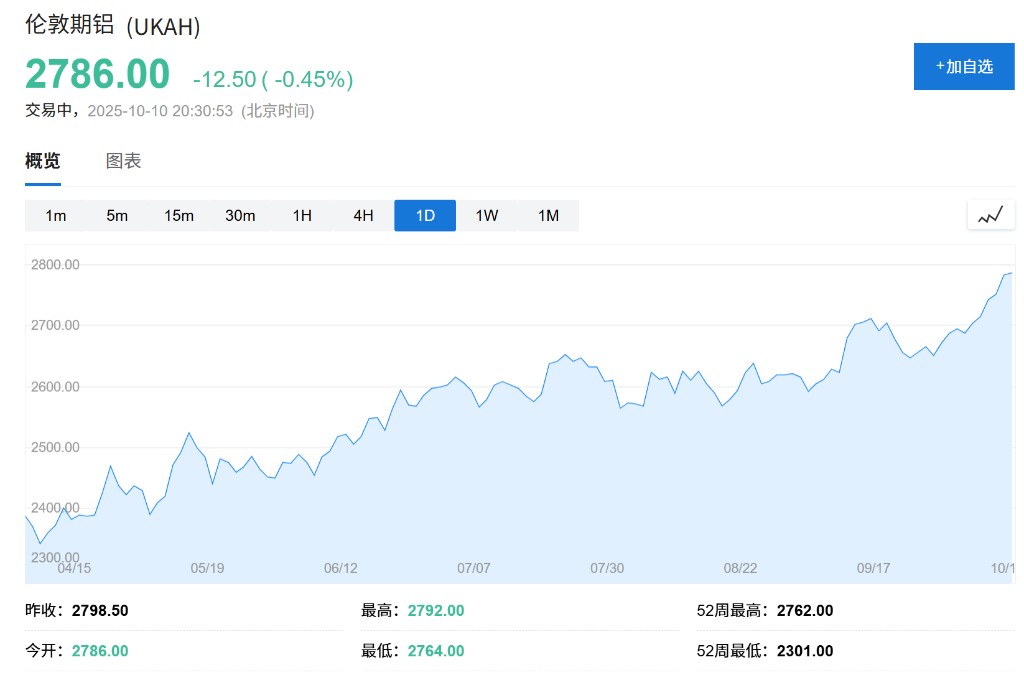

市場估值顯示鋁仍被低估。WisdomTree 的鋁 ETF 管理資產不足 4000 萬美元,而其銅產品管理資產超過 10 億美元。Alcoa 等鋁業公司股價僅為未來 12 個月預期收益的 13 倍以下,遠低於 Glencore 等銅業公司近 30 倍的估值水平。

供需格局迎來歷史性拐點

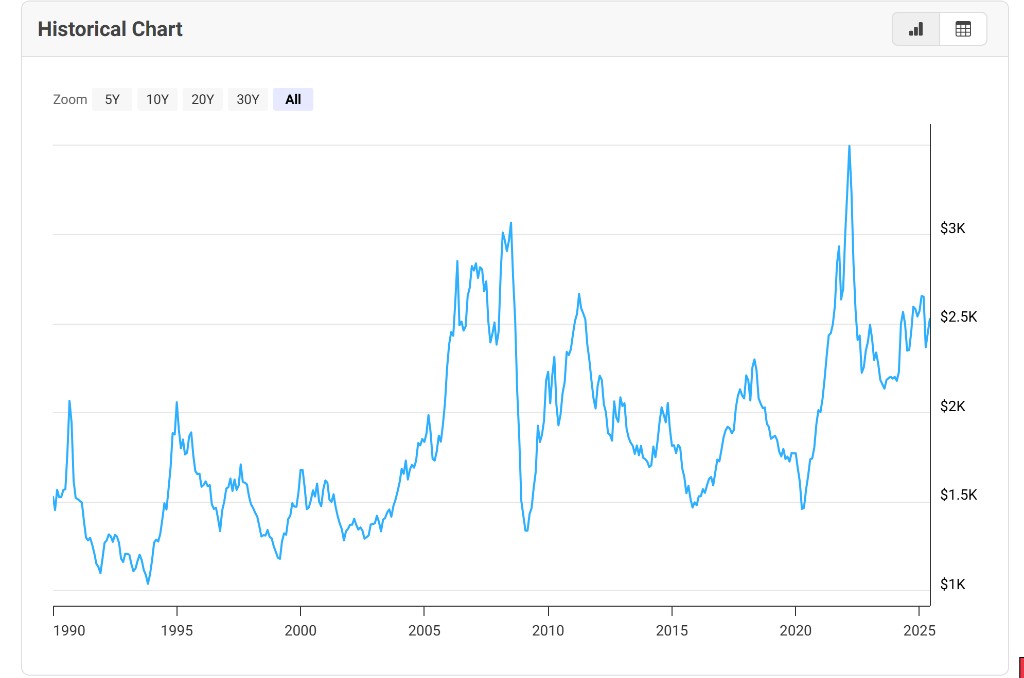

鋁市場正經歷根本性轉變。過去二十年來,鋁價累計上漲約 44%,遠遜於銅價超過 160% 的漲幅。

但這一格局即將改變。花旗分析師預計,全球原鋁供應過剩將在 2026 年快速收窄,2027 年起出現約 140 萬噸缺口。Wood Mackenzie 預期供應短缺將從 2028 年開始,持續約五年。而中國作為全球最大的鋁生產和消費國,正接近年產能上限 4500 萬噸。

電力約束成為供應瓶頸

電力供應緊張正成為制約鋁產能擴張的關鍵因素。鋁冶煉過程需要通過電解將氧化鋁中的鋁氧強鍵斷開,耗電量極大。據美國鋁業協會數據,一座新鋁冶煉廠的年耗電量相當於波士頓或田納西州納什維爾市的總用電量。

在潛在的新興生產國如印度尼西亞,電力同樣是限制因素。新冶煉廠可能需要配套建設燃煤電廠,但西方銀行對此類項目融資意願不強。

美國的人工智能發展雄心也使其難以重振昔日冶煉輝煌。Alcoa 運營着美國仍在運行的四座冶煉廠中的兩座,該公司在 9 月的行業會議上表示,必須與亞馬遜和微軟等科技巨頭競爭電力合同。科技公司願意為電力支付每兆瓦時超過 100 美元的價格,而 Alcoa 要維持冶煉廠的經濟性運營,電價需要控制在每兆瓦時 30 美元左右。

能源轉型催生結構性需求

鋁在多個快速增長的行業中發揮關鍵作用。據彭博 NEF 研究,鋁與銅、鋰、鋼並列為能源轉型所需的四大關鍵金屬。

電動汽車是推動鋁需求增長的最大動力。據 CRU Group 報告,電動汽車平均比內燃機汽車多使用約 150 磅鋁材,主要得益於鋁的高強度重量比特性,有助減輕車重並延長續航里程。

太陽能發電領域,鋁是僅次於鋼的第二大金屬投入。在電力傳輸中,由於價格更低、重量更輕且導電性能適宜,鋁正成為銅的替代選擇。數據中心建設中,鋁被廣泛用於散熱器、冷卻系統和結構框架。

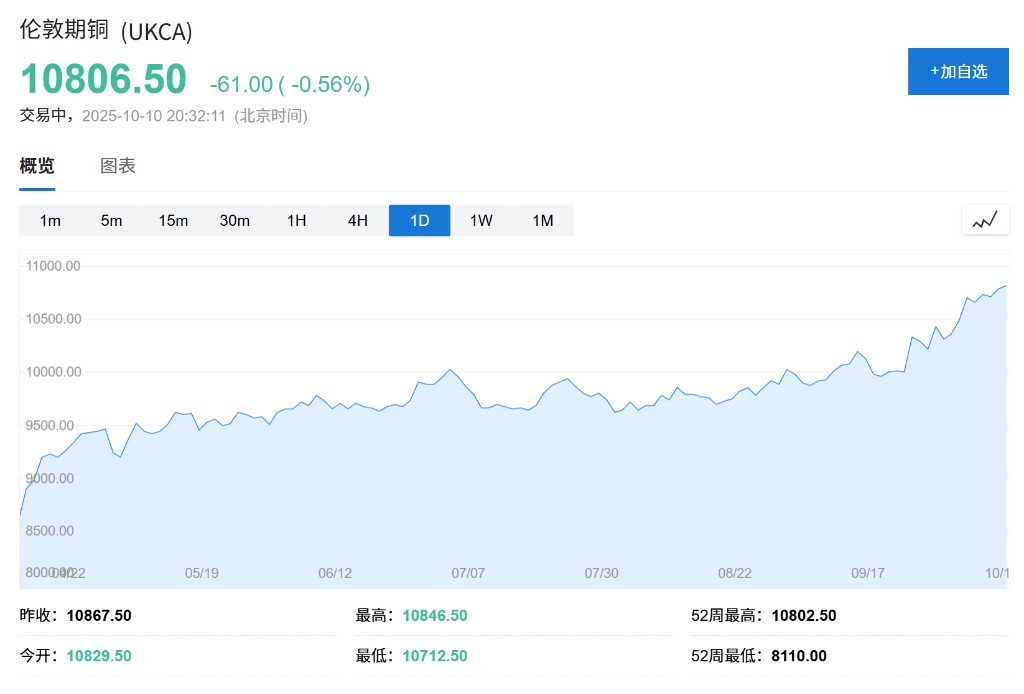

銅價今年上漲超過 20%,進一步推動了對鋁的替代需求。礦業巨頭 BHP 表示,當銅鋁價格比達到 3.5-4 倍時,市場會更多地用鋁替代銅。該比值過去十年平均為 3.5 倍,目前銅價約為鋁價的 3.9 倍。

儘管廢鋁回收可以提供部分供應,但無法根本解決供需矛盾。在許多應用中,廢鋁必須與原鋁混合使用以滿足質量標準。Wood Mackenzie 的 Patel 指出,雜質會影響電力傳輸效率。

今年紐約一家鋁軋製廠發生火災,該廠生產美國汽車工業約 40% 的鋁材,導致福特股價暴跌。Wood Mackenzie 分析師 Shashank Sriram 表示,這一事件反映了更深層的結構性脆弱性——美國冶煉業在高能源成本下萎縮,軋製、擠壓和精加工領域長期投資不足。

在新一輪商品牛市週期中,從汽水罐到鋁箔等各個領域的完美風暴正在形成,鋁有望成為下一個市場熱點。

風險提示及免責條款

市場有風險,投資需謹慎。本文不構成個人投資建議,也未考慮到個別用户特殊的投資目標、財務狀況或需要。用户應考慮本文中的任何意見、觀點或結論是否符合其特定狀況。據此投資,責任自負。