Lock in profits after a big surge, gold hits sentiment, emerging markets "everything is falling"

本月新興市場資產開局不穩,貨幣在區間內波動,美元意外走強挑戰市場預期,金價下跌則加劇了市場的 “一切都在跌” 氛圍。週五 MSCI 新興市場貨幣指數下跌 0.2%,周線或實現下跌,股票指數則下跌 0.5%。

投資者開始獲利了結並降低風險敞口,週五新興市場資產全線下跌,金價回落和美國政府停擺持續,進一步打擊市場情緒,亞洲市場呈現廣泛的去風險模式。

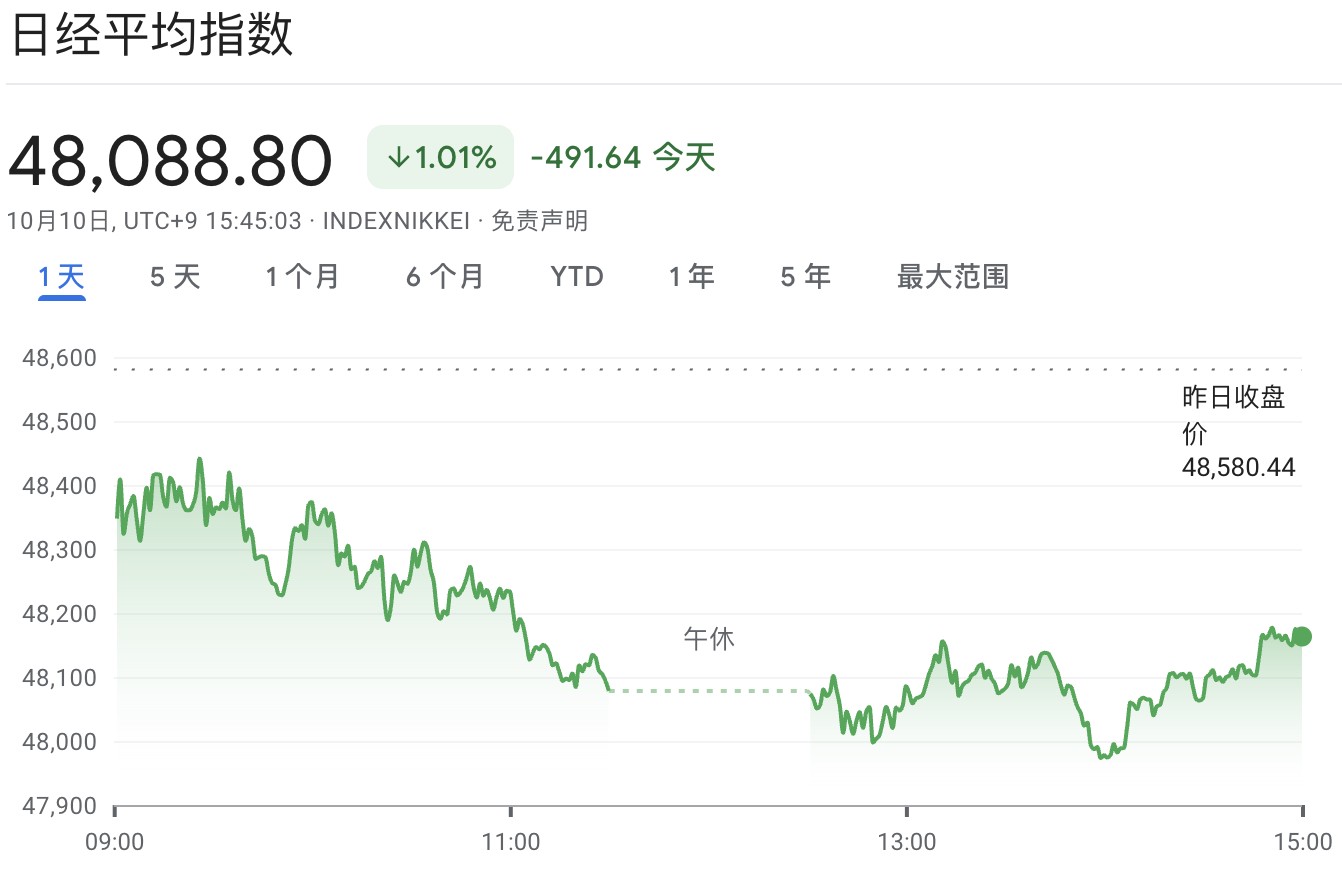

週五,MSCI 新興市場貨幣指數下跌 0.2%,有望錄得周線跌幅,股票指數則下跌 0.5%。除韓國綜合股價指數(因週四休市)外,幾乎所有亞洲股指均下跌,其中日股收跌 1%。

Saxo Markets 首席投資策略師 Charu Chanana 表示:

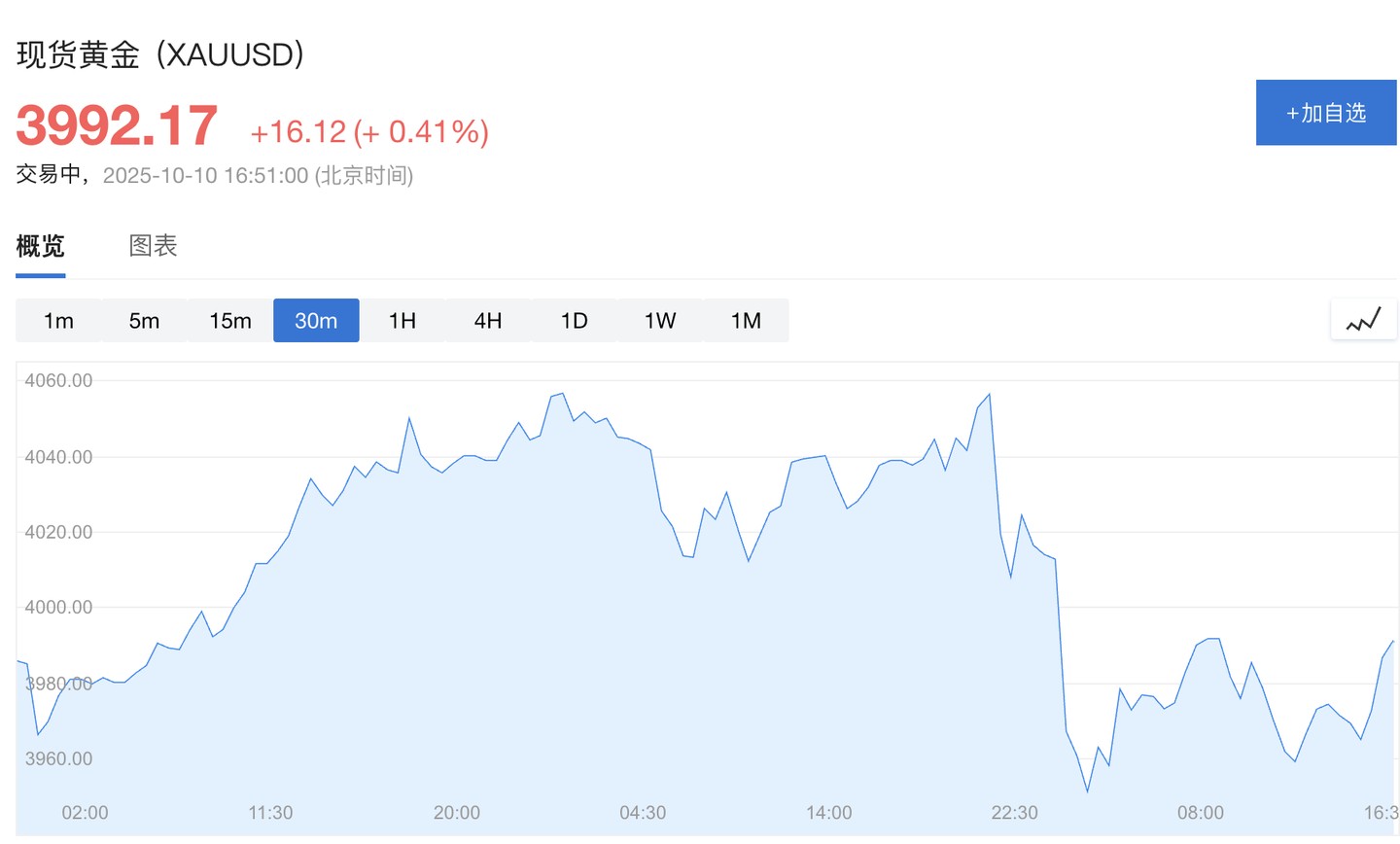

黃金下跌加劇了 “一切都在跌” 的氛圍,黃金觸及 4000 美元后的獲利回吐,部分源於停火消息傳出後地緣政治緊張局勢緩解。

本月新興市場資產開局不穩,貨幣在區間內波動,美元意外走強挑戰市場預期。儘管美國政府停擺持續,美元仍有望錄得 11 月以來最佳周表現,做空美元這一年內最主流交易策略開始出現裂痕。

黃金回落削弱避險情緒

黃金價格的回落成為拖累新興市場情緒的關鍵因素。Chanana 分析稱,黃金在觸及 4000 美元高位後出現獲利了結,同時停火消息緩解地緣政治緊張局勢,削弱了對避險資產的需求。

傳統的避險資產未能為新興市場提供緩衝,反而加劇了市場的 “一切都在跌” 氛圍。這種情況下,投資者更傾向於全面降低風險敞口。

美元強勢挑戰市場共識

儘管美國政府停擺持續,美元仍表現強勁,有望錄得 11 月以來最佳周表現。彭博美元即期指數週五小幅下跌 0.1%,但本週整體走勢依然堅挺。

J Stern & Co LLP 首席投資官 Christopher Rossbach 在彭博電視上表示:

消亡的傳言被大大誇大了,因為問題是還有什麼替代選擇?美國仍是世界最大經濟體,最具活力,增長率最高。

做空美元這一年內最主流的交易策略開始出現裂痕,新興市場貨幣因此承壓。MSCI 新興市場貨幣指數在美元走強背景下難以獲得支撐,在區間內波動。