“闪崩” 之后,日元后续怎么走?

野村和花旗一致認為短期日元將繼續下跌,野村認為自民黨單獨執政則可能引發” 高市交易” 逆轉,導致日股下跌以及日元進一步貶值。花旗認為” 早苗經濟學” 並非安倍經濟學 2.0,短期內美元/日元不排除會上升至 154-155 的區間,但三角形頂部形態未變,頸線位於 140 附近。

“安倍繼承者” 高市早苗在自民黨總裁選舉中勝出,引發日元 “崩跌”,美元/日元匯率突破 153 關口,野村和花旗一致認為短期日元將繼續下跌,花旗預期美元/日元或升至 154-155 區間。

據追風交易台消息,野村證券在最新研報中表示,政治不確定性成為市場焦點。民主黨表示暫不加入自民黨 - 公明黨聯盟,據 NHK 最新報道日本公明黨計劃退出與自民黨的執政聯盟,日本執政聯盟預計將在週五解體。

野村表示,聯盟結果將直接影響日元走勢,自民黨單獨執政則可能引發"高市交易"逆轉,導致股市下跌、超長期國債被拋售以及日元進一步貶值。

花旗銀行分析顯示,短期內美元/日元匯率不排除會上升至 154-155 的區間。然而,花旗維持長期觀點,認為自去年夏天匯率從約 160 的高點大幅下跌以來,美元/日元一直在構建一個大型的三角形頂部形態,頸線位於 140 附近。

日元突破關鍵阻力位,當局保持沉默

美元兑日元在倫敦交易時段開盤後進一步上漲,突破 153 水平。儘管本週初以來日元貶值速度較快,但日本當局今日尚未進行口頭干預,市場似乎正在測試高市政府對日元弱勢的容忍度。

從利差交易角度來看,日元仍然是缺乏吸引力的貨幣。儘管日本政治不確定性加劇,但"高市交易"背後的動能依然存在,這使得美元兑日元短期內可能繼續上行。

花旗分析顯示,去年夏天美元兑日元從約 160 大幅下跌至約 140 標誌着日元長期下跌趨勢的轉折點。自此以來,該貨幣對一直在形成一個大型三角形頂部,頸線位於約 140,圍繞 350 日移動平均線展開。

執政聯盟談判決定日元命運

當前政治格局的核心在於自民黨 - 公明黨聯盟能否維持。民主黨黨首玉木雄一郎表示,該黨至少在臨時國會開始時不會立即加入自民黨 - 公明黨聯盟,同時拒絕在首相選舉中支持統一的反對黨候選人。

如果民主黨如報道所説暫時拒絕加入聯盟,而公明黨退出與自民黨的聯盟,自民黨將面臨以脆弱的立法地位單獨執政的局面。

野村證券分析指出,執政聯盟結果對日元影響截然不同:

-

利好情形:如果自民黨與公明黨的聯盟得以維持,或任命了一位政策立場不那麼鴿派的財務大臣,市場對日本國債供需的擔憂將緩解,從而對日元形成支撐。

-

利空情形:如果最終形成自民黨單獨執政的局面,政治不確定性將大幅上升,可能導致"高市交易"逆轉,引發股市下跌、超長期國債被拋售以及日元進一步貶值。

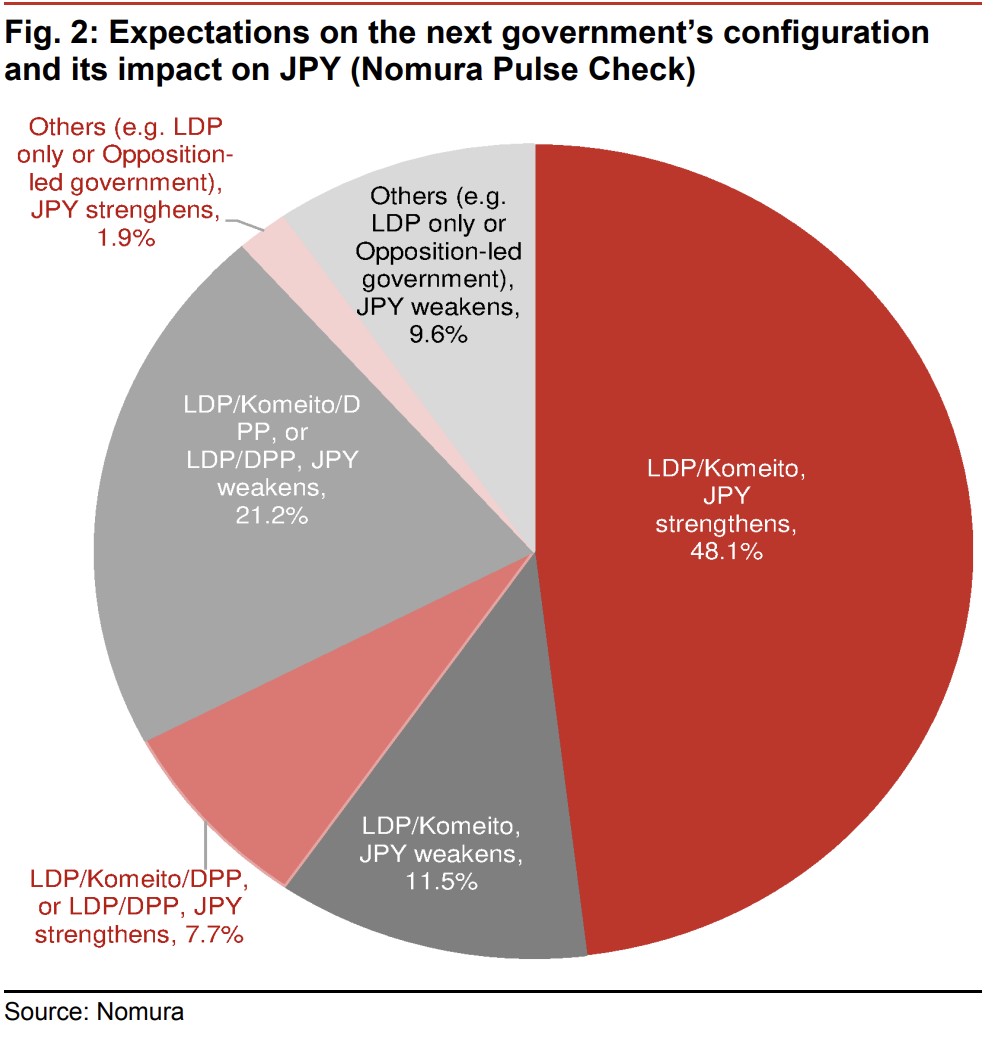

根據野村此前調查,59.6% 的受訪者預期自民黨與公明黨聯盟,28.9% 預期擴大聯盟或自民黨 - 民主黨聯盟,11.5% 預期其他情形。

"早苗經濟學"並非安倍經濟學 2.0,日元長期技術形態三角形頂部構建中

花旗銀行強調,高市早苗的經濟政策("早苗經濟學")不太可能是安倍經濟學 2.0 的簡單重現。這主要基於三個原因:

首先,自民黨內部政治格局發生變化。前首相麻生太郎在高市獲勝中發揮了關鍵作用,其本人擔任自民黨副總裁,其妹夫鈴木俊一擔任自民黨幹事長。兩人都根本反對過度擴張的財政政策。

其次,經濟環境已發生根本變化。十年前日本面臨通縮和日元升值問題,現在則面臨通脹和日元貶值挑戰。日經 225 指數從當時的約 10,000 點升至接近 50,000 點。

第三,美國財政部長貝森特等美國金融當局對日本擴張性財政政策表示擔憂,並公開要求日本央行政策正常化。

花旗銀行維持其長期觀點,認為自去年夏天匯率從約 160 的高點大幅下跌以來,美元/日元一直在構建一個大型的三角形頂部形態,頸線位於 140 附近。

該形態以 350 日移動均線(目前約 150)為中心,這條均線在 2023 年至 2024 年期間一直充當支撐線。儘管短期內美元/日元可能上升至 +1σ波帶,但三角形形態的構建過程仍將保持完整。

花旗認為,當匯率跌破長期頸線時,將出現長期趨勢的轉折點,但目前需要上調第四季度的下行目標。