HSBC is optimistic about Chinese gold mining stocks: For every 1% change in gold prices, the profits of gold producers will change by approximately 2%

Against the backdrop of gold prices recently breaking through the historical high of USD 4,000 per ounce, HSBC believes that the rise in gold prices will bring significant profit elasticity to Chinese gold producers. For pure gold producers, a 1% increase in gold prices will correspondingly increase their profit levels by approximately 2%

Against the backdrop of gold prices reaching a historic high and breaking through $4,000 per ounce on the 9th, HSBC believes that the rise in gold prices will bring significant profit elasticity to Chinese gold producers.

According to the trading desk, HSBC stated in a research report on the 8th that for every 1% change in gold prices, the earnings of pure gold mining stocks will change by approximately 2%. This multiplier effect means that in a gold bull market, the potential price increase of gold producers' stocks will significantly exceed the increase in gold prices themselves. Based on this expectation, HSBC has raised the target prices for Zijin Mining, SD-GOLD, and Zhaojin Mining.

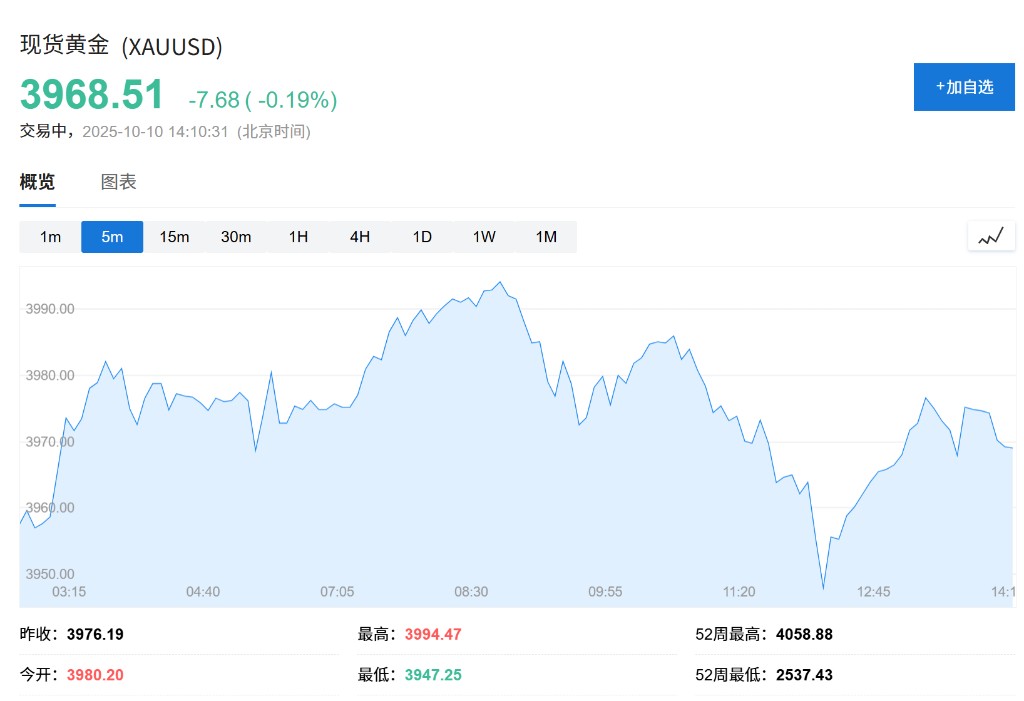

HSBC expects gold prices to remain in a wide fluctuation range of $3,700 to $4,050 per ounce for the remainder of 2025, and to expand to $3,600 to $4,400 per ounce in 2026, with a peak expected in the first half of 2026. As of the time of writing, the spot gold price has retreated to $3,968 per ounce.

Gold Price Outlook: Multiple Positive Supports, Short-term Target of $4,000

Amid multiple global risk factors, gold prices have broken through the historic threshold of $4,000 per ounce, with a year-to-date increase of 54%.

HSBC's chief precious metals analyst pointed out that geopolitical risks, economic policy uncertainty, concerns about the independence of the Federal Reserve, and a weakening dollar are the core driving forces behind the rise in gold prices. Notably, the U.S. government shutdown crisis and doubts about the independence of the Federal Reserve have further heightened risk aversion.

Global gold ETFs recorded the largest single-month inflow in history in September, with cumulative inflows in the third quarter reaching a record high. Over-the-counter trading and physical demand remain strong, and speculative long positions on the Chicago Mercantile Exchange are also at high levels. More importantly, the People's Bank of China has increased its gold reserves for the 11th consecutive month, although the pace of increase has slowed, China's gold reserves account for only 7.7%, far below the global average of 15%, indicating significant room for growth in the future.

Based on the above factors, HSBC expects the trading range for gold prices for the remainder of 2025 to be $3,700 to $4,050 per ounce, and the trading range for 2026 to expand to $3,600 to $4,400 per ounce, with prices potentially peaking in the first half of 2026