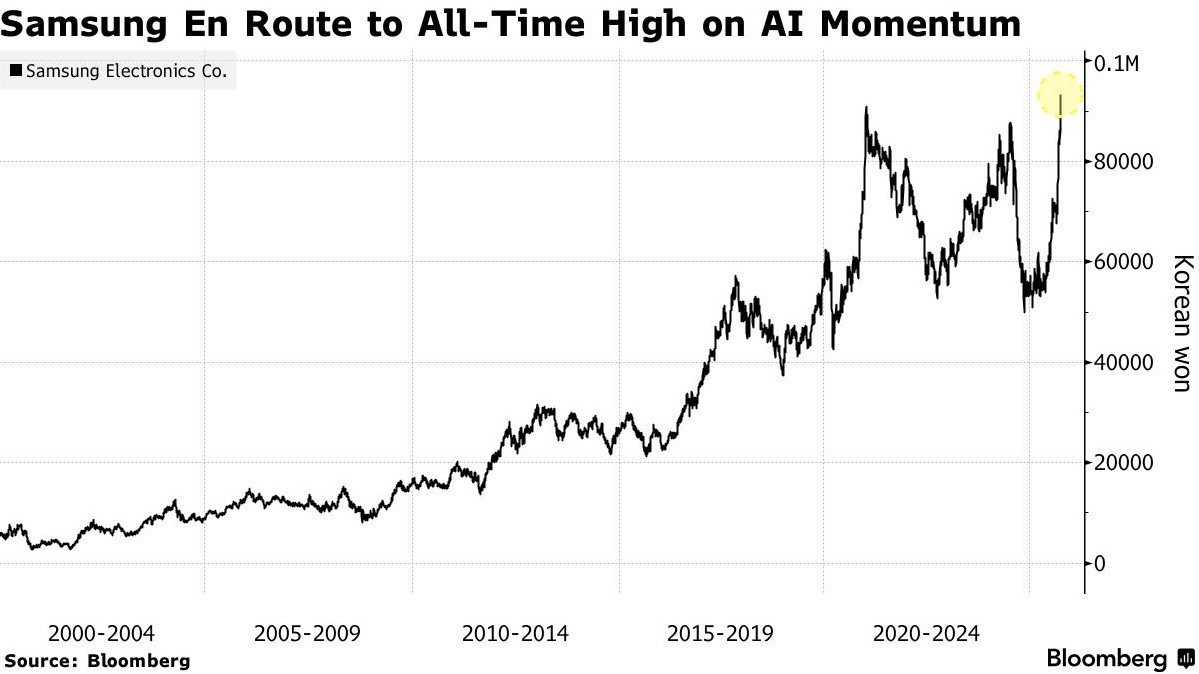

OpenAI's investment in AMD ignites the industry chain, with Samsung and SK Hynix stock prices soaring to all-time highs

韓國芯片製造商 SK 海力士和三星電子的股價創下歷史新高,受益於 OpenAI 與 AMD 的交易。SK 海力士股價上漲 10%,三星電子上漲近 6%。AMD 股價本週漲幅超過 40%。市場對三星在高帶寬內存領域的追趕態勢持樂觀態度,預計將從 OpenAI 的 AI 芯片訂單中獲益。

智通財經 APP 獲悉,在幾乎長達一週的假期結束後,韓國芯片製造商 SK 海力士和三星電子的股價於週五雙雙創下歷史新高,受到一系列人工智能交易 (合作) 的提振。FactSet 數據顯示,SK 海力士股價跳漲 10%,三星電子上漲近 6%,均刷新紀錄。這兩家公司有望從 OpenAI 與 AMD(AMD.US) 的一項交易中獲益,該交易可能使 Sam Altman 的公司獲得 AMD 10% 的股份。這意味着今後 OpenAI 的 AI 訓練/推理芯片訂單會大量流向 AMD,而 AMD 的 HBM(高帶寬內存) 主力供應商正是 SK 海力士和三星電子。

消息公佈後,AMD 股價大漲,本週迄今漲幅已超過 40%。同時,英偉達股價本週亦上漲 2.6%,此前 CEO 黃仁勳表示,近幾個月需求有所上升。黃仁勳還證實了英偉達參與資助埃隆·馬斯克的 AI 初創公司 xAI,並稱他 “對他們正在進行的融資機會感到超級興奮”。

值得一提的是,隨着首爾股市結束一週假期恢復交易,三星電子的股價年內累計漲幅已達 76%,市值突破 3900 億美元。

市場普遍看好三星在人工智能應用所需高帶寬內存 (HBM) 領域的追趕態勢。此前,規模較小的競爭對手 SK 海力士在該領域佔據先機,但越來越多的資金押注三星能夠縮小與 SK 海力士的差距。

據 NH Investment & Securities Co.股票交易員 Shawn Oh 透露,三星與英偉達 (NVDA.US) 就高帶寬內存供應量、價格及時間表的談判已進入最後階段,其估值折價問題正逐步解決。與此同時,三星與 OpenAI 達成的重大供應協議,為兩家韓國企業帶來額外利好。

在傳統內存芯片市場,三星主導的 DRAM 和 NAND 業務也迎來強勁週期。受供應短缺推動,產品價格前景持續向好,市場預計將出現 “超級週期”。

摩根士丹利分析師在休市期間將三星目標價上調 14% 至 111,000 韓元,並指出第四季度內存芯片價格將大幅上漲,且強勁需求週期預計將持續至 2026 年,為後續股價 “大幅上漲” 奠定基礎。

值得注意的是,此次三星股價突破與 2021 年疫情期間散户狂熱推動的峯值不同,本輪上漲主要由外國投資者主導,標誌着其在今年早些時候錯過全球人工智能浪潮後,於 9 月創下 2020 年以來最佳月度表現。

三星電子與 SK 海力士的顯著上漲 (後者年內漲幅達 145%) 共同助力韓國成為今年表現最好的股市之一,基準韓國綜合股價指數 (Kospi) 年內累計漲幅已達 50%。