Caution! The thing the Federal Reserve fears the most is happening: the risk of inflation expectations spiraling out of control is surging

波士頓聯儲報告指出,當前通脹預期急劇上升,給美聯儲控制物價帶來更大風險。與以往不同,家庭對一年期通脹預期的上調並非主要受食品和能源價格驅動,增加了通脹持續高於 2% 目標的風險。研究顯示,通脹預期的飆升可能表明風險已顯著上升,但目前仍在可控範圍內。美聯儲官員將密歇根大學調查結果視為 “異常值”,其他指標仍與目標相符。

智通財經 APP 獲悉,波士頓聯儲近期發佈的一份報告指出,與以往相比,當前通脹預期的急劇上升,對美聯儲控制物價的能力構成了更大風險。

與疫情期間情況不同,當前家庭對一年期通脹預期的上調並非主要受食品和能源價格驅動。這種特徵增加了通脹預期持續高於美聯儲 2% 政策目標的風險。

研究人員 Philippe Andrade 與 Michael Wicklein 通過分析密歇根大學消費者調查數據發現,類似的情況曾在 20 世紀 70 年代末出現:當時通脹率飆升,美聯儲通過一輪激進的加息週期予以應對。

今年以來,隨着美國家庭逐步消化特朗普政府激進的貿易政策,併為進口商品價格上漲做準備,消費者對通脹的預期持續走高。美聯儲官員也在密切關注這些政策舉措,以評估關税政策究竟會引發一次性的價格衝擊,還是導致通脹更持久地飆升。

研究指出:“我們發現,20 世紀 70 年代初以及疫情期間的通脹預期飆升,在很大程度上可由當時能源與食品價格的急劇上漲,以及貫穿那些時期的普遍性通脹來解釋。然而,我們的估算顯示,20 世紀 70 年代末的通脹預期飆升與物價上漲的關聯性並不緊密,2025 年春季開始的這輪通脹預期上升同樣如此。”

研究人員補充道,這種無法用物價上漲解釋的通脹預期飆升 “可能表明,通脹預期像 20 世紀 70 年代末那樣 ‘脱錨’ 的風險已顯著上升”。不過研究人員也指出,“目前來看,這些風險仍處於可控範圍”。

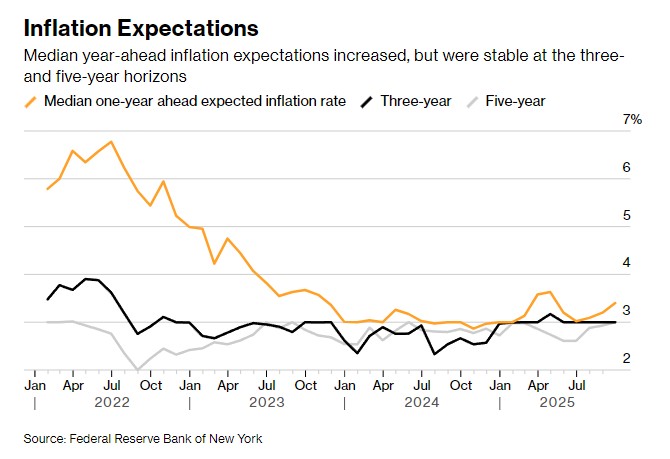

對於密歇根大學調查中顯示的通脹預期居高不下的結果,美聯儲官員曾多次將其定性為 “異常值”,並表示其他通脹預期指標仍與 2% 的目標相符。但在紐約聯儲一項備受關注的調查中,9 月消費者對未來一年的通脹預期同樣攀升至 3.4%;同期對三年和五年的通脹預期,更是比美聯儲 2% 的目標高出整整 1 個百分點。