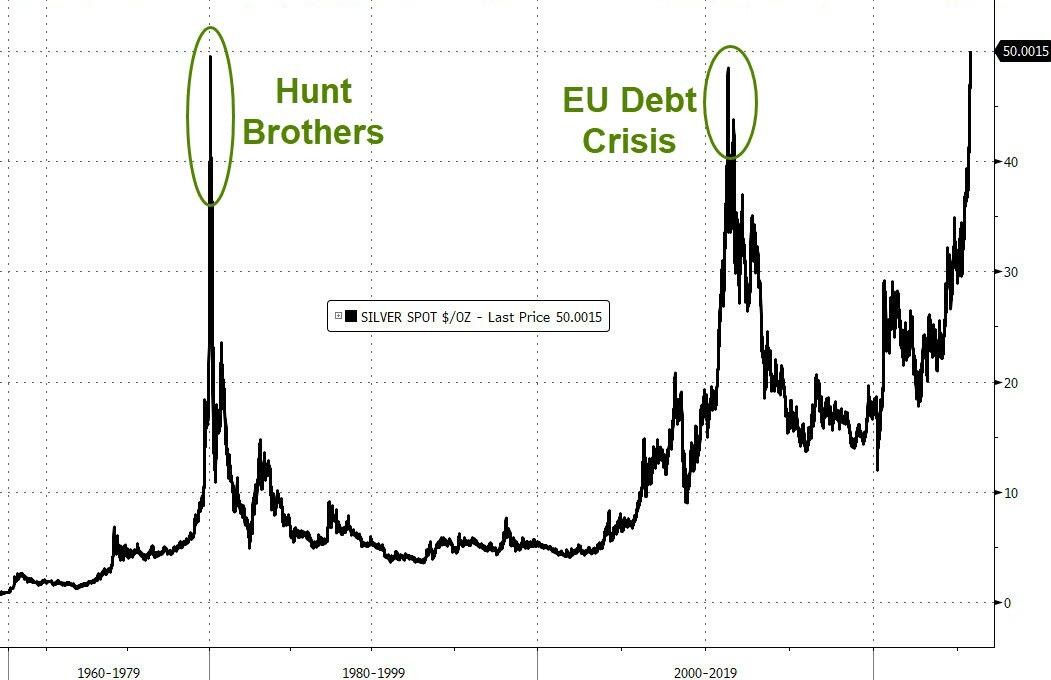

Silver prices have surpassed $51, setting a record high since the Hunt brothers' short squeeze!

Concerns over U.S. fiscal risks, an overheated stock market, and threats to the independence of the Federal Reserve have triggered a demand for safe-haven investments. At the same time, there is a severe supply shortage in the London silver market, with borrowing costs skyrocketing, further supporting price increases. Silver has risen over 70% this year, outperforming gold, which has been hitting record highs

The spot silver price has broken through the $50 mark, reaching its highest level since the Hunt brothers' short squeeze incident in the 1980s. The surge in demand for safe-haven assets and tight supply in the London precious metals market have jointly driven this historic breakthrough.

On Thursday, spot silver climbed above $51, hitting a new high with a daily increase of 4.5%. This price level is the highest in decades, second only to the historical record set during the Hunt brothers' short squeeze in January 1980.

This breakthrough marks a more than 70% increase in silver this year, outperforming even the record-high gold, making it the biggest winner in the precious metals market.

Concerns over U.S. fiscal risks, an overheated stock market, and threats to the independence of the Federal Reserve have prompted investors to seek safe-haven assets. At the same time, there is a severe supply shortage in the London silver market, with soaring borrowing costs further supporting price increases.

"Devaluation Trade" Boosts Precious Metals

Investors are flocking to safe assets such as Bitcoin, gold, and silver while pulling out of major currencies. This phenomenon, known as "devaluation trade," reflects market concerns that inflation and unsustainable fiscal deficits will erode the value of financial securities.

Silver and gold often fluctuate in sync, both showing a strong negative correlation with the U.S. dollar and Federal Reserve interest rates. However, silver is more volatile and has a fervent following among retail investors, who believe that silver prices are artificially suppressed by large banks and institutions.

This fervor has previously driven significant increases in silver prices in 2011 and 2020. In 2020, silver skyrocketed by 140% in less than five months, followed by Reddit users joining in, with the #silversqueeze topic rapidly spreading on social media.

Tight Supply in the London Market Drives Price Increases

The London silver market is experiencing unprecedented tension, with silver borrowing costs soaring to exorbitant levels. Concerns over potential U.S. tariffs on silver have triggered a rush to ship silver to the U.S. this year, depleting London's inventory and reducing the amount of silver available for borrowing.

On Thursday, New York silver futures prices were significantly lower than the London benchmark price, marking an unusual reversal of the typically positive price premium. In the New York Mercantile Exchange, silver futures remain below the historical high of $50.35 per ounce set in January 1980.

Strong Industrial Demand, Ongoing Supply-Demand Imbalance

Silver is not only an investment asset but is also widely used in industrial applications such as solar panels and wind turbines, which account for more than half of silver sales. Silver demand is expected to exceed supply for the fifth consecutive year by 2025.

According to Bloomberg data, the daily price auction in the London spot market on January 18, 1980, set a record high of $49.450. A spokesperson for the Chicago Mercantile Exchange stated that the historical high for Comex was also set on the same day.

Although silver has reached a nominal new high, its inflation-adjusted value is only about a quarter of the peak in 1980. Silver is one of the few markets where record highs set during the commodity boom of the 1970s and 1980s have yet to be surpassed Looking back at 1980, Texas oil billionaires and famous speculators the Hunt brothers attempted to monopolize the global silver market out of fear of inflation and a belief in silver's store of value function. They hoarded over 200 million ounces of silver, pushing the price above $50 per ounce, before it subsequently plummeted to below $11