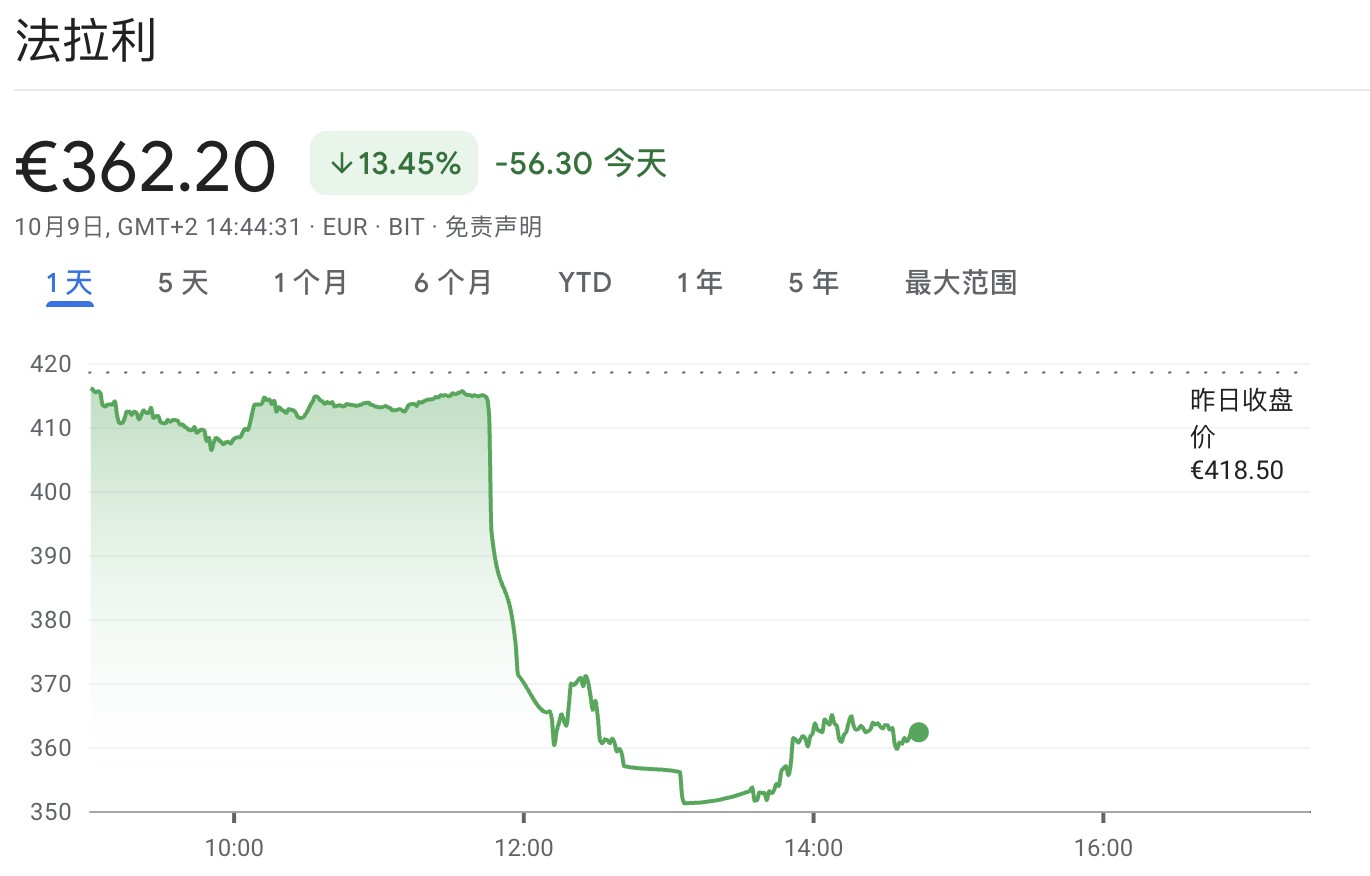

"Disappointing" earnings outlook triggers sell-off, Ferrari's stock price plummets 16%, marking the largest decline since 2016

Ferrari's stock price plummeted 16% on Thursday, marking the largest single-day drop since its listing in 2016, due to its 2030 performance guidance falling short of Wall Street expectations and a downgrade of its electrification transformation goals. The company raised its 2025 net income forecast to at least €7.1 billion, but analysts believe the long-term guidance is overly conservative and carries risks. Meanwhile, the target for electric vehicle sales proportion was lowered from 40% to 20%

Ferrari's stock price plummeted 16% on Thursday, marking the largest single-day drop since the company went public on the Milan Stock Exchange in 2016. This sharp decline was due to its 2030 performance guidance falling short of Wall Street expectations, while the company also lowered its electrification transformation targets.

On Thursday, Ferrari raised its 2025 net income forecast from the previous "over €7 billion" to "at least €7.1 billion," and set a 2030 net income target of approximately €9 billion. However, analysts generally believe this long-term guidance is overly conservative.

Citigroup analysts stated in their report that Ferrari's guidance "is below our 'low growth scenario' estimates in the capital markets day preview, reflecting management's conservative attitude." They added that while the guidance is conservative, it implies limited operational leverage in future cycles, "we believe there are certain risks to recent consensus earnings per share and valuation multiples."

At the same time, Ferrari announced an adjustment to its electrification strategy, lowering the target for electric vehicle sales to account for 20% of total sales by 2030, down from 40%. The company also showcased the technical details of its first all-electric vehicle, "elettrica," which is scheduled for delivery by the end of 2026.

Slight Increase in 2025 Guidance, Slower Growth in 2030 Targets

In terms of performance guidance, specifically:

- Adjusted EBITDA for 2025 is expected to be at least €2.72 billion, with the actual figure being €2.68 billion, and an estimate of €2.73 billion;

- Revenue for 2025 is expected to be at least €7.1 billion, with an estimate of revenue exceeding €7 billion, and an estimated revenue of €7.09 billion;

- The 2030 net income is expected to be approximately €9 billion, with an expected adjusted EBITDA of at least €3.6 billion for 2030;

- The adjusted EBIT for 2030 is expected to be at least €2.75 billion, with an adjusted earnings per share target of at least €11.50;

Investors were disappointed with the long-term target for 2030, as the RBC Capital Markets analyst Tom Narayan's team indicated that Ferrari's updated 2030 guidance is below consensus expectations. UBS analyst Narayan pointed out that the management's forecast of €9 billion in revenue and €3.6 billion in EBITDA for 2030 implies a compound annual growth rate far below the 10% growth trajectory predicted in 2022.

Additionally, the company announced that starting in 2025, it will increase its dividend payout ratio to 40% of net profit and stated that it will exceed the profit targets of its 2026 business plan by one year

Electrification Strategy Adjustment: Lowering EV Sales Targets

Ferrari announced an adjustment to its 2030 product line composition target: 40% internal combustion engine vehicles, 40% hybrid vehicles, and 20% pure electric vehicles, significantly down from the previous target of 40% electric vehicle sales.

The company stated that this revised target is based on an "customer-centric approach, the current environment, and its expected evolution." This shift comes as several global automakers have recently lowered their electric vehicle sales targets due to reasons including a lack of affordable models, slower-than-expected progress in charging station construction, and fierce competition from China.

Ferrari showcased the production chassis and power system of its first pure electric vehicle "elettrica" at a technology innovation seminar, with deliveries set to begin at the end of 2026, and the complete model expected to make its global debut next year.

Ferrari's Executive Chairman John Elkann stated in a statement: "With the all-new Ferrari elettrica, we reaffirm our commitment to advancing development through a combination of technical discipline, design creativity, and manufacturing craftsmanship."

Diverging Analyst Opinions: Bulls Optimistic About Long-term Execution

Despite a significant drop in stock price, JP Morgan analysts remain optimistic about Ferrari's 2030 strategic plan announcement. In their report on Thursday, they stated: "Given the ample evidence that current demand far exceeds supply, we have great confidence in management's ability to execute long-term plans."

JP Morgan also estimates that the company benefits from CEO Benedetto Vigna's leadership style, "which challenges the company to leverage collaboration to accelerate the embrace of innovation. The upcoming supercar may also contribute to significant profit growth."

Ferrari indicated that its current active customer base has grown to 90,000, a 20% increase from 2022. The company also plans to launch an average of four new cars each year from 2026 to 2030.

However, UBS warned last week that weak consumer demand in the U.S. has spread from low-income groups to middle-income buyers, adding uncertainty to the luxury market outlook.

Risk Warning and Disclaimer

The market carries risks, and investments should be made cautiously. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investing based on this is at one's own risk