U.S. Stock Market Outlook | Three major index futures mixed, airline stocks rise broadly in pre-market, multiple Federal Reserve officials to speak

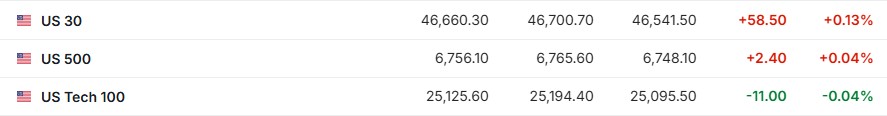

U.S. stock index futures were mixed, with airline stocks rising broadly in pre-market trading. Dow futures rose 0.13%, S&P 500 futures rose 0.04%, and Nasdaq futures fell 0.04%. Concerns over a bubble in U.S. stocks have intensified, as investors prepare for the upcoming earnings reports from tech giants. The global bond market is stagnant, with traders expecting a wave of economic data releases once the U.S. government shutdown ends, which could trigger market volatility

Pre-Market Market Trends

- As of October 9 (Thursday), U.S. stock index futures are mixed before the market opens. As of the time of writing, Dow futures are up 0.13%, S&P 500 futures are up 0.04%, and Nasdaq futures are down 0.04%.

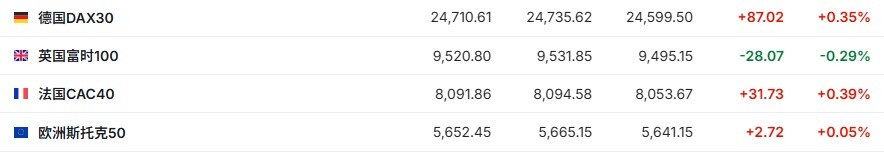

- As of the time of writing, the German DAX index is up 0.35%, the UK FTSE 100 index is down 0.29%, the French CAC 40 index is up 0.39%, and the Euro Stoxx 50 index is up 0.05%.

- As of the time of writing, WTI crude oil is down 0.34%, priced at $62.34 per barrel. Brent crude oil is down 0.30%, priced at $66.05 per barrel.

Market News

Concerns about U.S. stock market bubbles intensify, traders "buy insurance" to cool AI market ahead of tech giants' earnings reports. For investors in the U.S. stock market, it is easy to spot signs that the market may be in a bubble— the S&P 500 index has rebounded 36% since its April low, with valuations rising to levels comparable to previous "overexcited" periods. As individual stock correlations remain low, the VIX index has begun to rise slowly. A VIX index above 17 is seen by derivatives traders as a signal that institutional investors are worried that any misstep in the AI trades that have driven the market up this year could trigger an overall market correction. With several weeks to go before earnings reports from major tech companies like Apple, Alphabet, and Microsoft, derivatives traders are increasing protective positions in case any of these companies underperform.

Calm data hides undercurrents? Non-farm payrolls and CPI may simultaneously ignite the market! Traders rush to prepare. The world's largest bond market is stagnating, but traders are preparing for a "storm" as a significant amount of key economic data will "pour out" once the U.S. government shutdown ends. Once statistical data resumes publication, this $30 trillion market is bound to face a "bloodbath," and the government shutdown may complicate data collection. Options activity shows that traders are hedging risks against various scenarios that may arise from the Federal Reserve before the end of the year. The main question is which will pose a greater challenge when officials decide whether to ease policy again: overheating inflation or a cooling job market.

$130 billion slashed in two months! Are global central banks accelerating their exit from U.S. Treasuries? As gold prices hit new highs, the New York Fed, representing central banks around the world, has seen the scale of U.S. Treasury holdings drop to its lowest level in over a decade, raising further questions about foreign investors' willingness to hold U.S. sovereign debt and other dollar-denominated assets However, recent data, including the U.S. Department of the Treasury's International Capital Flow Report (TIC) and the International Monetary Fund's (IMF) "Composition of Official Foreign Exchange Reserves" (Cofer) report, indicate that overseas demand for U.S. Treasury bonds and dollar assets remains strong. Although these two sets of data are considered the "gold standard" for measuring U.S. capital flows and global foreign exchange reserves, their release is subject to a significant lag.

Is the global safe-haven cornerstone shaking? Canadian pension official warns of U.S. debt's precarious status. The Canada Pension Plan Investment Board (CPPIB) has warned that if U.S. fiscal pressures continue to escalate, U.S. Treasury bonds may face the risk of losing their status as a safe-haven asset. Manulife's Chief Investment Officer, who oversees the total fund management of the pension plan, stated in an interview: "We are concerned that if the fiscal situation continues to deteriorate for a while," the U.S. debt market may no longer possess safe-haven attributes. This statement comes as the U.S. government faces a shutdown stalemate due to fiscal spending disputes, with increasing warnings from market participants regarding the outlook for the dollar.

Options trading volume surges threefold! Hedge funds aggressively buy call options betting on a stronger dollar by year-end. Hedge funds are showing a preference for the dollar in the options market, betting that the rebound of the dollar against most major currencies will continue until the end of the year. According to traders, based on expectations that currencies like the euro and yen will weaken against the dollar, fund companies have increased their options trading activity this week. Data from the Chicago Mercantile Exchange Group shows that during Wednesday's trading session, the trading volume of euro put options against the dollar set to expire in December reached three times that of call options—these options will gain value when the currency pair declines. The increasing bullish bets on the dollar in the options market may indicate that the phase of currency weakness triggered by the U.S. government shutdown may have ended.

Individual Stock News

Delta Air Lines (DAL.US) Q3 earnings exceed expectations, raises full-year guidance. The financial report shows that Delta Air Lines' Q3 adjusted revenue increased by 4.1% year-on-year to $15.2 billion, better than the market expectation of $15.08 billion; the adjusted earnings per share were $1.71, exceeding the market expectation of $1.53 and higher than the $1.50 from the same period last year. For 2025, the company expects adjusted earnings per share of $6, better than the market expectation of $5.80 and close to the previous guidance of $5.25 to $6.25; it expects full-year revenue growth of 2% to 4%, while the previous guidance was for growth of 0% to 4%. As of the time of publication, Delta Air Lines' stock rose over 5% in pre-market trading on Thursday. Additionally, U.S. airline stocks saw broad gains in pre-market trading. American Airlines (AAL.US) and United Airlines (UAL.US) rose nearly 4%, JetBlue Airways (JBLU.US) and Alaska Airlines (ALK.US) rose over 2%, and Southwest Airlines (LUV.US) rose nearly 2%.

PepsiCo (PEP.US) Q3 earnings exceed expectations, reaffirms full-year guidance. The financial report shows that PepsiCo's Q3 revenue increased by 2.7% year-on-year to $23.94 billion, better than the market expectation of $23.83 billion; core earnings per share were $2.29, exceeding the market expectation of $2.26 but lower than the $2.31 from the same period last year. The company's CEO, Ramon Laguarta, stated that the revenue growth reflects the resilience of its international business and the improving momentum of its North American beverage sector And the measures taken by PepsiCo to reshape its product portfolio. For the full year, PepsiCo still expects organic revenue to grow in the low single digits, while earnings on a constant currency basis will be roughly flat compared to last year. Additionally, the company announced that the current Chief Financial Officer will retire on November 10, and Steve Schmitt will succeed him.

The AI boom continues, TSMC (TSM.US) Q3 revenue exceeds expectations with a 30% increase. Driven by the continued investment of large U.S. technology companies in the field of artificial intelligence (AI) with billions of dollars, TSMC's sales in the third quarter increased by 30% year-on-year. According to TSMC's monthly sales data, for the three months ending September, the company's total revenue reached NT$989.9 billion (approximately USD 32.5 billion), exceeding the average market analyst expectation of NT$962.8 billion. Benefiting from the long-term optimistic sentiment towards AI, the company's stock price, the highest market capitalization in Asia, has risen over 30% this year.

UK regulators launch compensation scheme for mis-sold car loans, Lloyds Banking Group (LYG.US) warns: may need to increase provisions. Lloyds Banking Group stated on Thursday that following the launch of a compensation scheme for mis-sold car loans by UK financial regulators, the bank is likely to need to increase provisions to compensate customers who were misled into purchasing car loans. Lloyds noted in a document that this amount could have a "material impact." Currently, the bank has set aside £1.15 billion (approximately USD 1.54 billion) to cover costs related to refunds. As of the time of publication, Lloyds' stock fell over 2% in pre-market trading on Thursday.

Important Economic Data and Event Forecasts

Beijing time 20:30 Initial jobless claims in the U.S. for the week ending October 4

Beijing time 20:30 Federal Reserve Chairman Powell delivers opening remarks at a community banking conference hosted by the Federal Reserve Board

Beijing time 20:45 Federal Reserve Governor Bowman speaks

Beijing time the next day 00:45 Federal Reserve Governor Barr speaks on the economic outlook

Beijing time the next day 01:00 Federal Reserve Governor Barr and 2026 FOMC voting member, Minneapolis Fed President Kashkari speak at an event

Beijing time the next day 01:00 2025 FOMC voting member, St. Louis Fed President Bullard speaks on the U.S. economy and monetary policy

Earnings Forecast

Friday morning: Applied Digital (APLD.US)