Which U.S. stock sector has risen the most this year? It's not AI, nor Bitcoin concept stocks, but gold mines!

金價飆升至每盎司 4000 美元,點燃金礦股史詩級行情。標普全球金礦指數年內暴漲 129%,遠超科技與加密板塊,Newmont、Barrick 等巨頭股價翻倍。金價上漲帶來的利潤槓桿效應使礦企現金充裕,但投資者警惕 2011 年泡沫重演。

在一眾科技巨頭與加密貨幣的光環之下,今年美股市場的最大贏家悄然來自一個 “備受冷落” 的傳統行業——金礦開採。

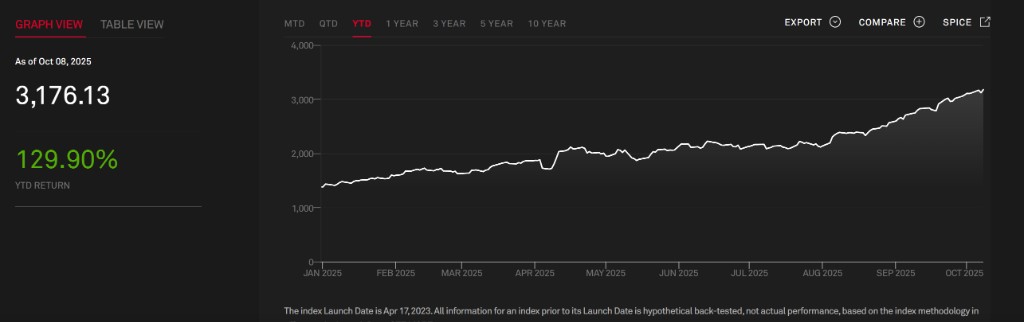

隨着金價自 1 月以來飆升 52%,並在本週突破每盎司 4000 美元大關,金礦公司的股價迎來了更猛烈的漲勢。標普全球金礦指數(S&P Global Gold Mining index)今年已飆升 129%,成為標普行業指數中表現最佳的板塊。美國政府停擺的風險、各國央行的持續買入以及對主權債務膨脹的擔憂,共同點燃了這輪貴金屬牛市。

對於 Agnico Eagle、Barrick Mining 和 Newmont 等行業巨頭而言,金價的上漲意味着即將到來的豐厚利潤。由於礦企的日常生產成本在很大程度上是固定的,金價上漲所帶來的額外收入幾乎可以轉化為純利潤。投資公司 VanEck 的投資組合經理 Imaru Casanova 直言:

“對金礦股來説,這是非常棒的一年。他們手握的現金多到不知如何處理。”

黃金股表現碾壓科技巨頭

金礦股之所以能跑贏黃金本身,核心在於其運營模式的利潤槓桿效應。更高的金價可以直接增厚利潤率,從而對股價產生放大作用。

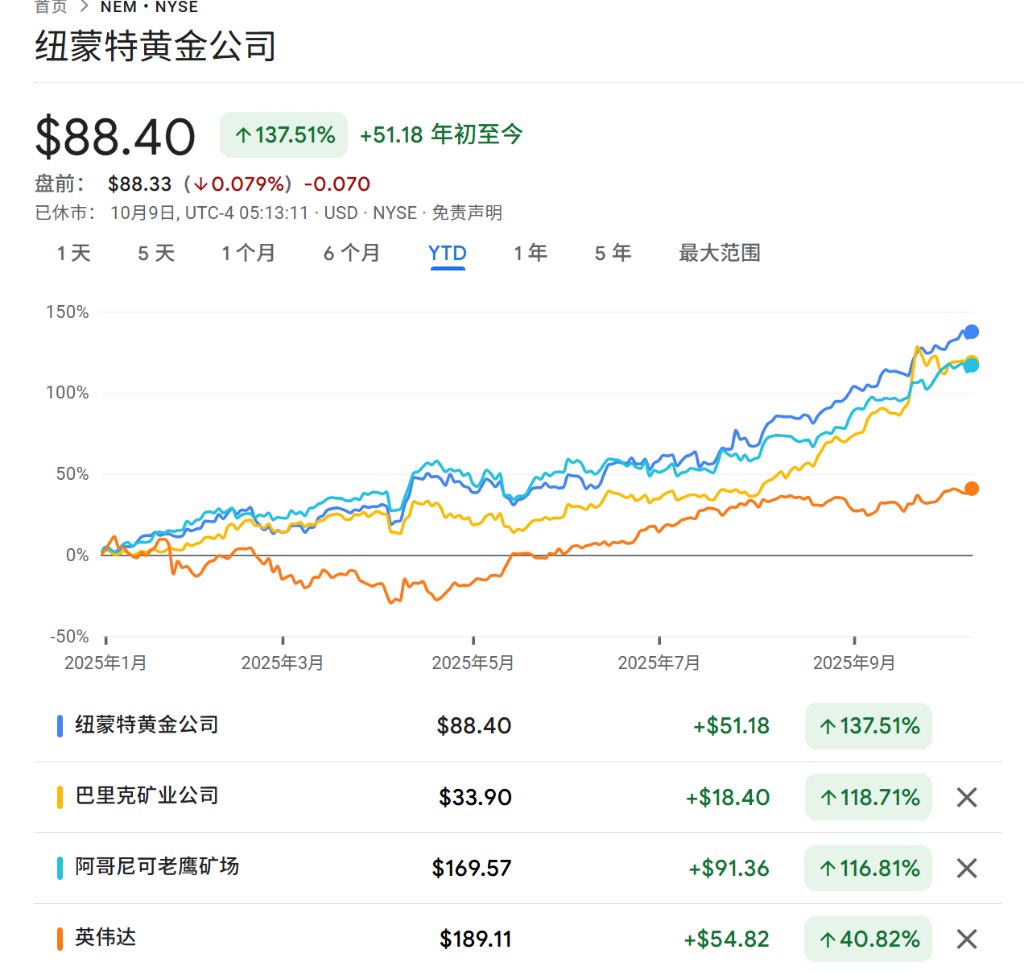

數據顯示,今年以來,Newmont 股價上漲了 137%,Barrick 上漲 118%,Agnico Eagle 則上漲 116%。就連於 9 月 30 日上市的紫金黃金國際,其股價也已翻倍,成為今年第二大首次公開募股。相比之下,AI 領域的明星公司英偉達上漲了 40%,甲骨文上漲 72%,谷歌母公司 Alphabet 上漲 30%,微軟則上漲 25%。

同期,比特幣的價格漲幅也僅為 31%。這使得曾一度被部分投資者視為 “價值毀滅者” 的金礦行業,重新回到了聚光燈下。

歷史的警鐘:投資者擔憂行業重蹈覆轍

儘管市場一片繁榮,但資深投資者仍對該行業過去的 “不良記錄” 記憶猶新。上一輪黃金牛市(2011 年見頂)期間,飆升的金價帶來了鉅額利潤,但也助長了大規模的企業併購、高管薪酬的急劇膨脹和生產成本的上升。

隨之而來的是殘酷的清算。從 2011 年的高點開始,金礦股在接下來的四年裏暴跌了 79%。VanEck 的 Imaru Casanova 指出:

“當時大量價值被摧毀。在投資者的腦海裏,這段記憶仍然很清晰。這些公司在上一週期犯下的錯誤,以及一些懷疑主義,會讓人們不禁要問,這些錯誤會再次發生嗎?”

資產管理公司 Ninety One 的黃金開採基金投資組合經理 George Cheveley 也表示,這個長期 “不受待見” 的行業本質上是週期性的,往往 “在短時間內賺大錢”,也正因如此,“它確實會變得過度”。

資本配置成關鍵挑戰

面對預期中的資金流入,黃金礦業公司的管理層正面臨如何最佳配置資本的難題。BMO 資本市場預測,該板塊明年的自由現金流將達到 600 億美元。

董事會層面的變化也反映了改善回報的壓力。Newmont 和 Barrick 上週都宣佈了新的首席執行官任命。BMO 資本市場分析師 Matthew Murphy 表示,Barrick 意外更換 CEO Mark Bristow 可能"與股價相對同行表現不佳有關"。

貝萊德主題與板塊投資主管 Evy Hambro 表示:

“貝萊德預期金礦公司將檢視資本配置計劃,期望管理層能夠大幅提高派息,讓股東最終能從金價上升中受惠。”

然而,併購交易的誘惑可能難以抗拒。由於新金礦的稀缺性,生產商可能會尋求通過併購來補充因開採而持續減少的儲量。分析師認為,類似 Anglo American 和 Teck Resources 最近全股票合併交易的模式可能成為未來併購的範本。

另一個股東擔憂是高管薪酬問題。黃金礦業公司 CEO 的薪酬已經高於其他礦業公司高管,投資者擔心他們可能會像過去一樣試圖攫取更多現金。

Paulson & Co 合夥人、金礦商 Perpetua Resources 董事長 Marcelo Kim 承認這次情況有所改善,但仍警告避免過度行為:

"我希望沒有人僅僅因為金價上漲就獲得瘋狂的薪酬包,因為他們與此毫無關係。"