Not just the hottest stock market concept, AI has already become a major story in the U.S. bond market

AI 相關公司債務規模已超越了傳統的銀行業,成為投資級債券指數中的最大板塊。分析師警告,若 AI 範式轉變,AI 信貸泡沫破裂將比股市崩盤衝擊更甚。

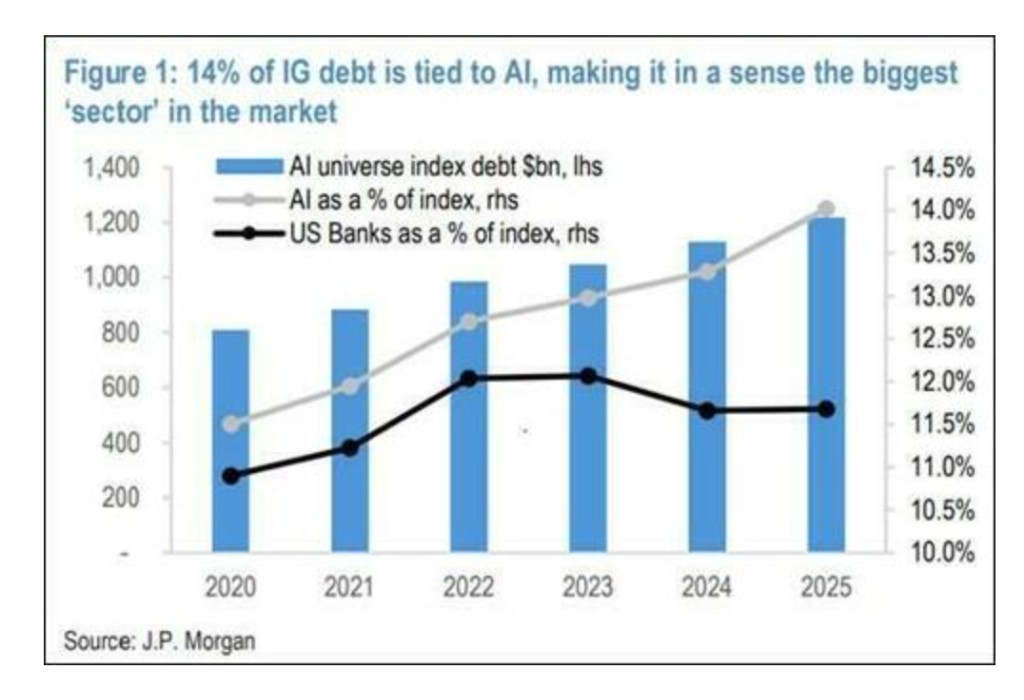

人工智能熱潮正從股市蔓延至債市,AI 相關公司債務規模已超越了傳統的銀行業,成為投資級債券指數中的最大板塊。

據摩根大通最新報告數據,AI 相關公司當前佔投資級債券指數的 14%,負債總額達 1.2 萬億美元。隨着 AI 基礎設施建設需求激增,相關公司正在大舉借債以支撐每年高額的資本支出需求。

甲骨文模式引發債務軍備競賽

甲骨文打破了 AI 基礎設施建設此前主要依靠現金流自籌資金的模式,公司願意承擔高達數千億美元的槓桿來搶佔市場份額,倒逼亞馬遜、微軟、谷歌等巨頭跟進,進一步推高整個行業的債務水平。

此前,OpenAI 承諾每年向甲骨文支付 600 億美元用於未建成的雲計算設施。消息推動 甲骨文股價漲 25%,但同時甲骨文的借款也增加了,公司債務權益比飆升至 500%,遠超亞馬遜(50%)、微軟(30%)及 Meta、谷歌。

摩根大通的 Michael Cembalest 指出,甲骨文承諾的 600 億美元年度支出,公司根本無法用現金流支付這筆費用,必須通過股權或債務融資來實現。這種模式正將 AI 行業原本紀律嚴明、由現金流融資的競賽,轉變為一場由債務驅動的軍備競賽。

泡沫破裂風險引發擔憂

貝恩諮詢的研究顯示,滿足 AI 需求所需的數據中心建設每年需要約 5000 億美元資本投資,貝恩對雲服務提供商可持續資本支出與收入比率的分析表明,5000 億美元的年度資本支出相當於 2 萬億美元的年度收入。

即使企業將所有本地 IT 預算轉向雲服務,並將在銷售、營銷、客户支持和研發領域應用人工智能所節省的資金(估計約佔這些預算的 20%)再投資於新數據中心的資本支出,也仍將比支付全部投資所需的收入少 8000 億美元。

分析師警告,一旦 AI 範式發生轉變,無論是市場突然要求 AI 投資產生實際回報,還是出現技術顛覆,AI 信貸泡沫的破裂將比股市崩盤造成更嚴重的經濟後果。這些以未來現金流擔保的債務一旦違約,將衝擊整個經濟體系。