A record for four consecutive years! Uniqlo's parent company expects a 13% increase in operating profit for fiscal year 2025 and raises the profit guidance for fiscal year 2026

迅銷公司連續第四年創下利潤紀錄,2025 財年營業利潤達 5642.7 億日元,同比增長 13%,超出市場預期。國際業務成為主要增長引擎,其中中國市場貢獻最大。公司上調 2026 財年預期至 6100 億日元。預計弱勢日元顯著提振海外收入並帶動國內免税消費。

優衣庫母公司迅銷公司(Fast Retailing)連續第四年創下利潤紀錄,儘管面臨美國關税壓力,但憑藉弱勢日元和全球擴張戰略推動業績增長。

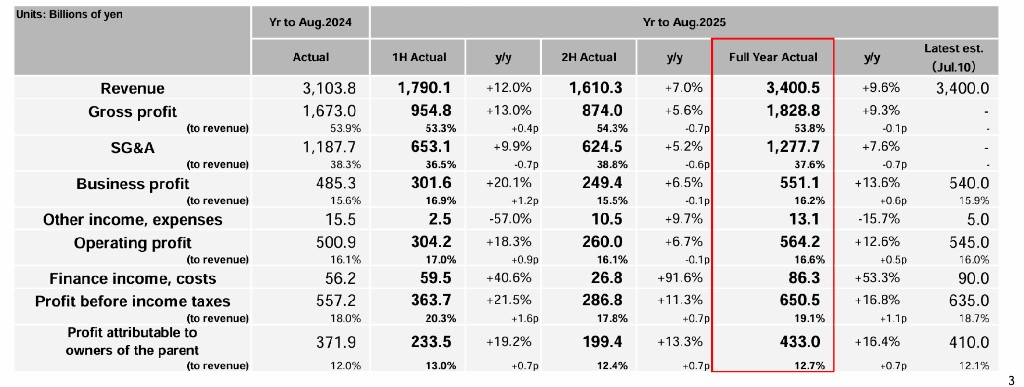

最新公佈的 2025 財年業績顯示,迅銷營業利潤達 5642.7 億日元,同比增長約 13%,超出公司此前預期的 5450 億日元以及分析師平均預期的 5460 億日元,連續第四年創下歷史新高。優衣庫國際業務營業利潤達 3093.2 億日元,成為集團最大利潤貢獻來源。

公司同時預測,截至 2026 年 8 月的新財年營業利潤將達 6100 億日元,高於分析師平均預期的 5880 億日元。這一預測反映出迅銷對其全球擴張戰略和市場前景的信心。

弱勢日元為公司業績提供了顯著支撐,目前日元兑美元匯率處於 2 月以來最低水平,兑歐元更是創下歷史新低,這有利於公司海外收入轉換和吸引國內免税購物需求。

2026 財年預期全面超預期

迅銷公司對 2026 財年的業績指引全面超出市場預期。公司預計營業利潤將達 6100 億日元,高於分析師平均預期的 5883 億日元,連續第四年創下歷史新高。淨利潤預期為 4350 億日元,超出預期的 4253.9 億日元。

銷售收入方面,公司預計 2026 財年淨銷售額將達 3.75 萬億日元,顯著高於市場預期的 3.66 萬億日元。這一預期增長率體現了管理層對全球市場需求復甦的信心。公司預計派發每股 520 日元股息,遠超分析師預期的 482.65 日元,顯示出對現金流和盈利能力的充分信心。

迅銷創始人柳井正作為日本首富,長期以來一直致力於將公司打造成全球最大的時尚零售商。柳井正的最終目標是實現年銷售額 10 萬億日元,將迅銷轉型為全球性服裝製造商。在這一征途中,公司需要與 Zara 母公司 Inditex 和 H&M 等全球時尚零售巨頭競爭。

國際業務成增長引擎,日本本土業務保持穩定

2025 財年業績數據顯示,公司國際業務已成為集團最重要的增長動力。國際業務收入達 1.91 萬億日元,略超市場預期的 1.9 萬億日元,佔集團總收入的 56%。

中國市場表現尤為突出,收入達 6502.3 億日元,成為公司最大的單一海外市場。韓國、東南亞、印度和大洋洲地區收入達 6194.2 億日元。北美和歐洲市場雖然規模相對較小,但分別實現 2711.3 億日元和 3695.1 億日元收入。

日本業務繼續為集團提供穩定的現金流和利潤貢獻。日本市場收入達 1.03 萬億日元,略高於市場預期的 1.02 萬億日元。日本業務營業利潤達 1844.5 億日元,超出分析師預期的 1784.3 億日元。

分析認為,弱勢日元成為迅銷業績的重要推動力。在國內市場,日本旅遊熱潮帶動了國內門店免税購物的激增。在海外市場,公司來自西方市場的收入在轉換為日元時獲得額外提升。

其他品牌面臨挑戰

除優衣庫外,迅銷旗下其他品牌表現不一。GU 品牌收入為 3307 億日元,略低於市場預期的 3327.8 億日元,營業利潤 305.1 億日元也未達到 314 億日元的預期。

Global Brands 業務面臨更大挑戰,出現 9.5 億日元營業虧損,而市場此前預期該業務能實現 8.551 億日元利潤。這一表現顯示了迅銷在多品牌戰略執行中遇到的困難。

庫存管理方面,公司庫存降至 5109.6 億日元,低於市場預期的 5474.8 億日元,反映出較為健康的運營狀況和需求預測能力。