AI demand continues to drive growth! Taiwan Semiconductor's Q3 revenue exceeds expectations, with a year-on-year increase of 30%

More news, continuously updated

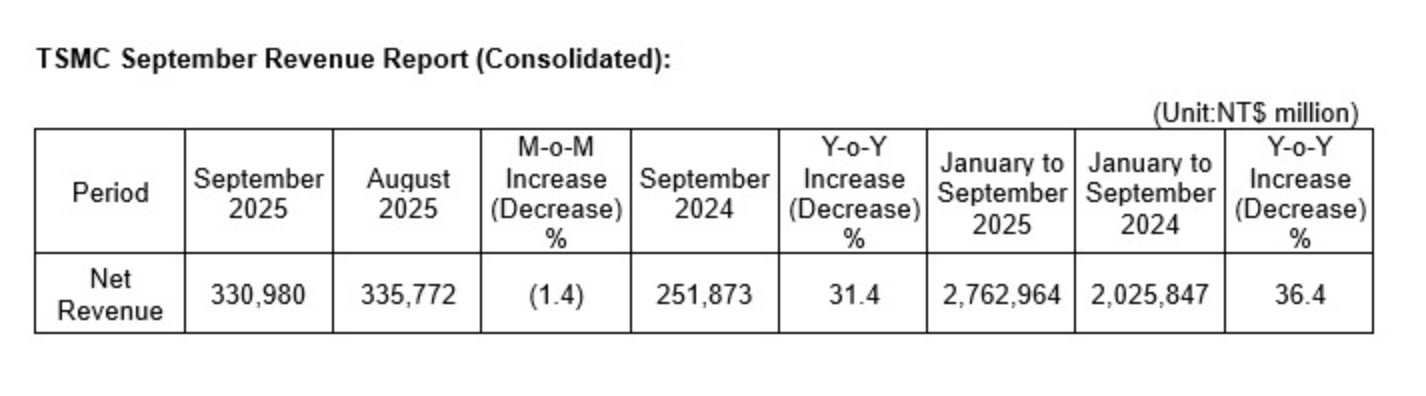

On October 9th, Thursday, Taiwan Semiconductor announced that the company's sales in September reached NT$ 330.98 billion, a year-on-year increase of 31.4% and a month-on-month decrease of 1.4%.

In the third quarter, Taiwan Semiconductor's revenue grew by 30% year-on-year, reaching NT$ 989.9 billion, exceeding analysts' average expectation of NT$ 962.8 billion; the cumulative sales for the first three quarters amounted to NT$ 2.76 trillion, a year-on-year increase of 36.4%.

Benefiting from the ongoing AI boom, Taiwan Semiconductor's stock price in the US has risen by over 50% this year. Both NVIDIA and OpenAI have invested billions of dollars in cloud computing capabilities, which Taiwan Semiconductor executives view as an important long-term growth driver.

Despite concerns in the market about a potential massive bubble forming from the recent "circular trading" among tech companies, Taiwan Semiconductor's latest sales data indicates that AI demand remains solid at present. The company will release its complete third-quarter earnings report on October 16th.

AI Chip Demand as a Core Driver

Taiwan Semiconductor is the preferred chip manufacturer for major AI accelerator designers such as NVIDIA, AMD, and Broadcom. As global tech giants continue to invest billions of dollars in the field of artificial intelligence, the demand for high-end chips provides strong performance support for Taiwan Semiconductor.

Executives at Taiwan Semiconductor believe that the large-scale spending by American tech companies on cloud computing capabilities will become an important long-term growth engine for the company, driving sustained demand for advanced process chips.

In addition to providing foundry services for AI chips, Taiwan Semiconductor also manufactures processors for Apple's iPhone and other devices. Although growth in the consumer electronics market has been limited recently, Taiwan Semiconductor's transition to more advanced processes has significantly improved the profitability of each sales unit.

Through technological upgrades and process optimization, the company has maintained strong profitability even amid a slowdown in traditional consumer electronics demand. This strategic transformation has helped Taiwan Semiconductor maintain a competitive edge in the market.

Although AI demand has driven Taiwan Semiconductor's performance beyond expectations, concerns about a bubble forming from "circular trading" among tech companies still exist. However, based on Taiwan Semiconductor's latest sales data, AI-related demand currently remains solid. The company will announce detailed third-quarter financial results on October 16th, at which time more information regarding the performance of various business segments and future outlook will be provided. Investors will closely monitor the company's assessment of the sustainability of the AI market and future order situation