Coreweave CEO refutes "AI closed loop": Big companies are investing in infrastructure, where is the loop coming from? This is all demand

CoreWeave 首席執行官 Michael Intrator 稱,Meta、微軟、亞馬遜、谷歌等科技巨頭正在大舉採購基礎設施服務客户,這是真實需求驅動的” 根本性基礎設施建設”。在如此大規模的基礎設施建設過程中,” 看到合作伙伴關係並不罕見,因為人們試圖為消費者提供基礎設施服務”,這種動態在其他市場也會出現。

AI 雲基礎設施供應商 CoreWeave 首席執行官 Michael Intrator 強烈反駁了華爾街對科技巨頭間"循環投資"的擔憂,稱這種説法"根本有缺陷"。

10 月 9 日,據 CNBC 報道,在週三接受採訪時,CoreWeave 首席執行官 Michael Intrator 表示,科技行業正經歷"根本性的基礎設施建設",當前的合作伙伴關係模式在其他市場的大規模基礎設施建設中並不罕見。

他強調,Meta、微軟、亞馬遜、谷歌等全球最大科技公司正在大舉採購基礎設施以服務客户,這是真實需求驅動的基礎設施建設。他認為關於循環投資的質疑只是暫時的,因為市場的根本驅動力"巨大"。

該公司最近與 OpenAI、Meta、英偉達簽署了總價值超過 430 億美元的重大合同,進一步鞏固了其在 AI 基礎設施市場的地位。

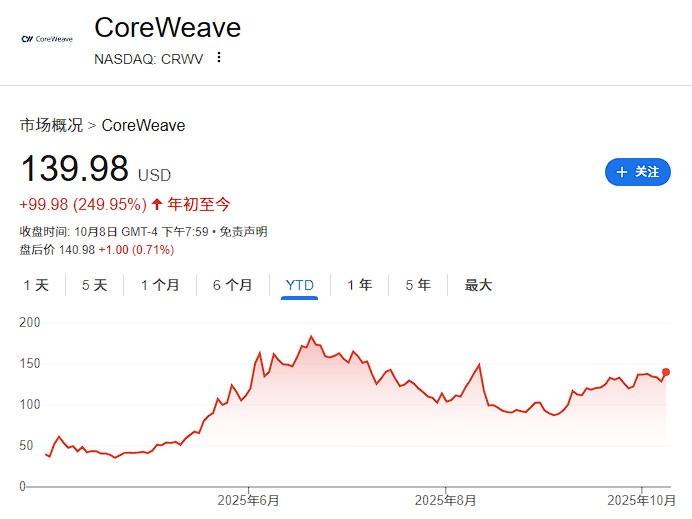

CoreWeave 於今年 3 月上市,成為 2021 年以來美國最大的科技 IPO,成功募資 15 億美元。隨着投資者對 AI 和數據中心需求的持續增長,該公司股價自華爾街首秀以來已飆升超過 200%。

鉅額合同引發循環投資質疑

CoreWeave 近期簽署的一系列重磅合同引起了華爾街對"循環投資"的擔憂。

上月底,該公司宣佈與 OpenAI 擴大合作協議 65 億美元,使與這家 ChatGPT 製造商的合同總額達到 224 億美元。幾天後,CoreWeave 又與 Meta 簽署了 142 億美元的協議。

9 月初,CoreWeave 還披露了與芯片製造商英偉達價值至少 63 億美元的訂單。英偉達是 CoreWeave 的重要支持者,根據最新協議,英偉達"有義務購買剩餘未售產能",合約期至 2032 年 4 月。

報道稱,這些交易以及大科技公司間的其他類似協議讓一些華爾街分析師擔心,資金在公司間來回流轉,形成了過度循環的投資模式。

CEO 力辯真實需求驅動基礎設施建設

面對質疑,Intrator 在接受 CNBC 主持人 Jim Cramer 採訪時明確回應稱:

"現實情況是,真正大型、真正重要的科技公司正在購買基礎設施以交付給客户——Meta、微軟、亞馬遜、谷歌。全球最大的科技公司購買這些基礎設施是因為他們有需求,這沒什麼循環的。"

他強調,當前的交易代表着"根本性的基礎設施建設"。在如此大規模的基礎設施建設過程中,"看到合作伙伴關係並不罕見,因為人們試圖為消費者提供基礎設施服務",這種動態在其他市場也會出現。

Intrator 表示:

"關於循環投資的説法——這只是當下的論調,但會過去的,因為市場的根本驅動力是巨大的。"