"Boiling" precious metals: Gold breaks 4000, silver approaches 50, palladium surges 10%

Against the backdrop of intertwined global geopolitical and economic risks, investors are flocking to precious metals for safe-haven assets, pushing gold to a historic high of $4,000 and igniting a strong rally in silver and palladium. Among them, silver, due to its industrial properties, has performed particularly well, with a year-to-date increase of 67%, even surpassing gold. Analysts believe that supported by safe-haven sentiment and continued central bank gold purchases, this round of the precious metals bull market is unlikely to peak in the short term, and the upward trend may continue until 2026

A global wave of risk aversion is pushing the precious metals market to a "boiling" peak.

Amid multiple global risk factors, the price of gold has surpassed the historic threshold of $4,000 per ounce, with an increase of 54% this year.

The market's "boiling" is not limited to gold. Silver has surged even more rapidly, with an increase of over 67% this year, outpacing gold, and its price is approaching $50.

At the same time, the price of palladium soared nearly 10% on Wednesday, rising above $1,482, marking the largest single-day increase since May 2023.

The surge in precious metals is driven by a combination of geopolitical tensions, concerns over the strength of the U.S. dollar, issues regarding the independence of the Federal Reserve, persistent inflation pressures, and sluggish economic growth in Europe. Analysts believe that there are currently almost no factors that can stop this rally, predicting that this metal bull market may continue until 2026.

Gold: Resonance of Risk Aversion and Central Bank Purchases

The core driving force behind this round of the gold bull market is the pervasive demand for safe-haven assets globally.

The market generally believes that from the trade tariff policies of the Trump administration to the Russia-Ukraine conflict, and concerns over inflation, almost all traditional gold-driving factors are simultaneously at play. David Wilson, an analyst at BNP Paribas, stated:

If you are an investor, where would you put your money? If you are worried about the U.S. economy and debt outlook, would you still want to buy traditional safe-haven assets like U.S. Treasury bonds? The answer is no.

In addition to the risk aversion demand from individual investors, the continuous buying by central banks has also provided solid support for gold prices. According to consulting firm Metals Focus, since 2022, global central bank purchases of gold have exceeded 1,000 tons annually, with an expected purchase of 900 tons this year, which is double the average level from 2016 to 2021.

With strong fundamental support, market expectations for gold prices continue to rise. Goldman Sachs has raised its gold price forecast for December 2026 to $4,900 per ounce. Analysts at consulting firm SP Angel described this round of market movement as "a once-in-a-generation trend."

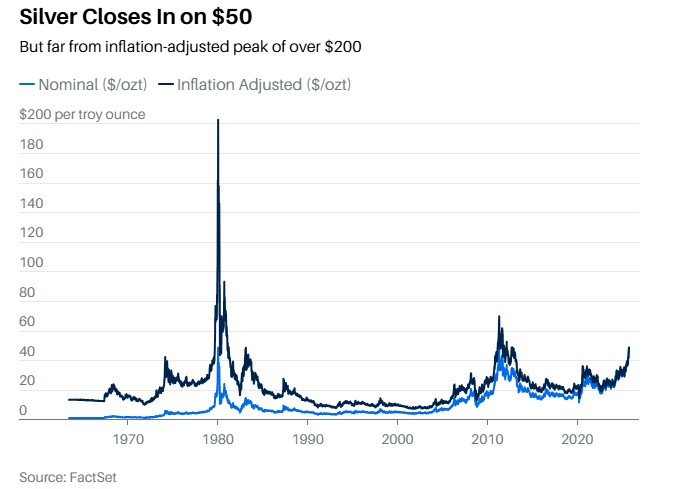

Silver: Driven by Industrial and Investment Demand

In this round of precious metal price increases, silver's performance has been even more impressive than gold. Currently, silver has not only achieved its largest year-to-date increase since 1979, but its outstanding performance relative to gold is also the best in 15 years

This Wednesday, the most active silver price closed at a historic high of $48.994, briefly breaking through $49 during the session, the last time it surpassed this level was 14 years ago. Compared to the gold price that broke $4,000, the silver price seems insignificant, but so far this year, silver has risen by 67.55%, which is 13.42% higher than gold's increase of 54.13%.

The strength of silver is driven by its dual industrial and investment attributes. On one hand, the booming development in areas such as solar panels and AI-related semiconductors has led to strong industrial demand. On the other hand, some investors who believe that gold trading has become too crowded are turning their attention to silver as an alternative safe-haven tool.

Moreover, the scale of the silver market is much smaller than that of gold, which means that fluctuations in the value of the dollar have a greater impact on its price. Louis-Vincent Gave, founding partner of Gavekal Research, wrote in a report that unless the Federal Reserve turns hawkish or the dollar strengthens significantly, it will be difficult for the bull market in precious metals to stop, and currently, these scenarios seem unlikely to occur.

Paul Wong, market strategist at Sprott Asset Management, believes that if silver prices can continue to trade above $50, it may indicate that "the market is reassessing its economic value and store of value function."

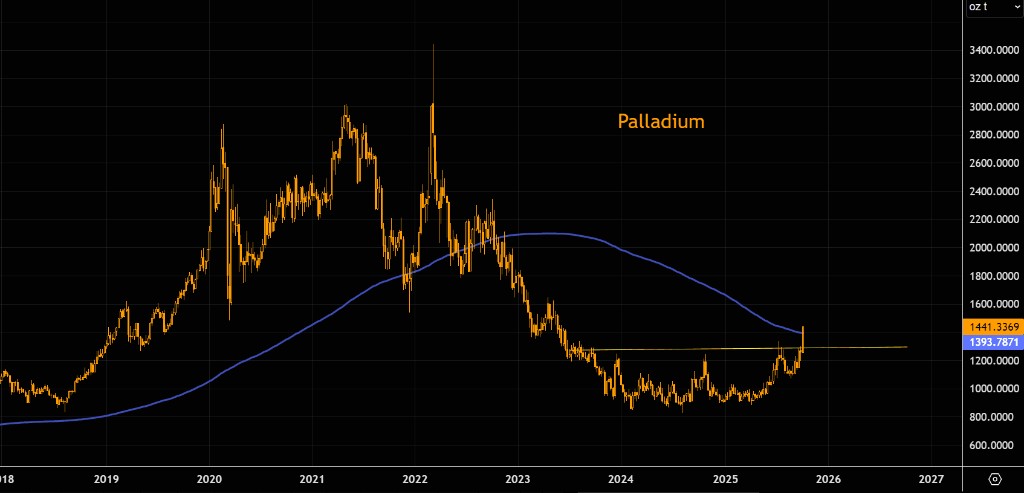

Palladium: Following the Trend to Reach a Two-Year High

The strong momentum of gold and silver has also transmitted to the platinum group metals. Palladium, primarily used in automotive exhaust purification catalysts, surged nearly 10% this Wednesday and rose for the third consecutive day, reaching over $1,482 per ounce, the highest level since May 2023.

In the past month, palladium prices have risen by more than 20%, outpacing gold's 11% and silver's nearly 17% increases. Although the current price is still less than half of its historical high of $3,400, its nearly 49% increase this year is almost on par with gold's performance.

The rise in palladium is mainly driven by the investment momentum across the entire precious metals sector. During times of heightened political and economic uncertainty, investor demand for safe-haven metals is spreading from gold and silver to other precious metal varieties