Is this time really different?

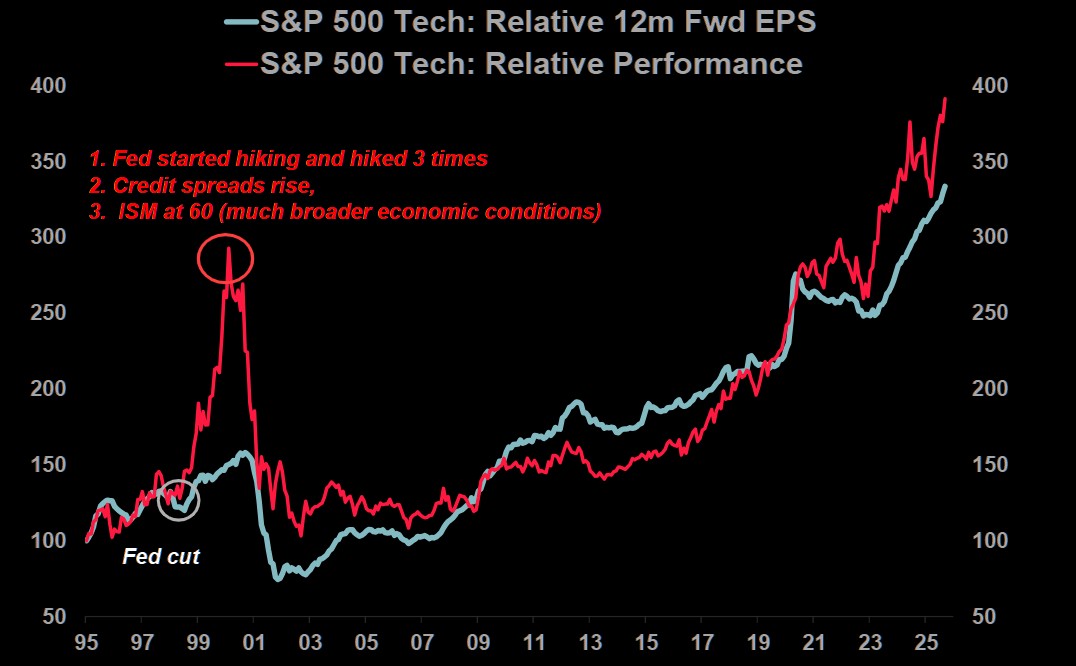

The biggest difference between this round of "AI frenzy" and the "Internet frenzy" of 2000 is: this time, American tech stocks have performance. As shown in the figure: the performance of the S&P 500 technology sector (the gray line represents dynamic EPS) rises in sync with the stock price (the red line), which is different from 1999-2001. Société Générale believes that the conditions for ending the tech stock bull market are the following three: - The Federal Reserve starts raising interest rates, and raises rates more than three times; - Credit spreads begin to widen; - The U.S. ISM Manufacturing Index reaches 60 (indicating a broader economic recovery)

The biggest difference between this round of "AI frenzy" and the "Internet frenzy" of 2000 is that this time, U.S. tech stocks have performance.

As shown in the figure: the performance of the S&P 500 technology sector (the gray line represents dynamic EPS) rises in sync with the stock price (the red line), which is different from 1999-2001.

Société Générale believes that the conditions for ending the tech stock bull market are the following three:

-

The Federal Reserve starts raising interest rates, and raises rates more than three times;

-

Credit spreads begin to widen;

-

The U.S. ISM Manufacturing Index reaches 60 (indicating a broader economic recovery)